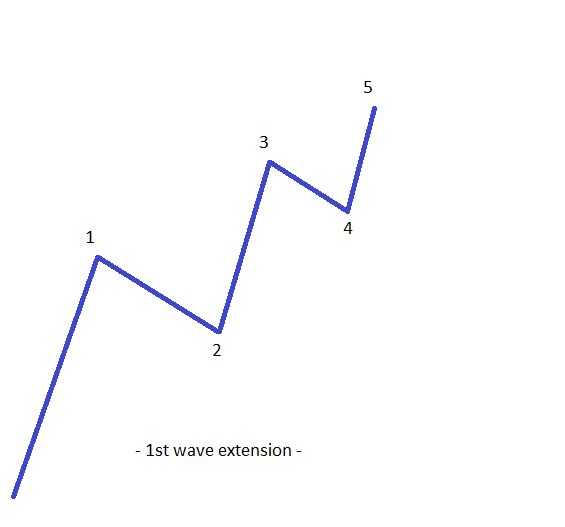

Trade First Wave Extensions in Forex

First-wave extensions are patterns that often form when trading Forex markets, and they are characterised by a strong and powerful move, followed by a prolonged consolidation, only for the price to break again in the same direction as the previous move. As defined by Elliott, being an impulsive wave, all rules need to be respected. We have covered here articles dedicated to impulsive waves and the basics of each type of impulsive wave, and now it is time to go into specifics. While the general rules of an impulsive wave are known and must be respected in a first-wave extension, there are some other things to consider as well – things that are valid only for this type of extension. Before going into more detail, let’s look at the rules that make up an impulsive wave:

– In a five-waves structure, the first, third and fifth waves are impulsive waves on their own;

– The second and the fourth waves are corrective;

– At least one wave is extended;

– The third wave cannot be the shortest one when compared with the first and the fifth.

These four things are the pillars of any impulsive wave, and what we need to do is to add to this rule based on which wave is going to extend. This way, traders have more details to consider to allow them to properly count an impulsive wave.

| Broker | Bonus | More |

|---|

Things to Consider in a First-Wave Extension

A first-wave extension impulsive move can be simply defined as a five-waves structure that has the first wave as the longest wave in the whole move. It is by far the one that stands out in the crowd, and this move needs to respect all the rules of an impulsive wave as they are listed above. Things like time and price play an important role in this type of an extended wave, and this way Elliott brings something new to each type of impulsive wave. It should be no wonder, as details make the difference between a correct count and an incorrect one.

Interpreting the Second Wave

– The retracement level into the territory of the first wave cannot be much more than 38.2%. “Much more” is a relative term, as the whole Elliott Waves theory is a relative one. However, if you see the second wave retracing more than 38.2%, then the 50% retracement should be the line in the sand for invalidating the pattern. In reality, first-wave extensions have only a small retracement for the second wave, with 23.6%, or even less, being most likely to be seen.

– The time taken for the second wave plays an important role. By the time, Elliott means the consolidation time, or the time it takes for the second wave to correct. As a rule of thumb, in a first-wave extension impulsive move, the second wave is the most time-consuming pattern out of all of the five waves. In other words, when, while doing a top-down analysis, a five-waves structure seems to be forming, if the first wave is the one that is the longest, then the time taken for the second wave to consolidate is key for correctly interpreting the whole move.

Alternating Between the Third and the Fifth Waves

Analysing markets with Elliott Waves theory is a logical process destined to end with the right count. This can be no truer than this situation: If the third wave is not supposed to be the shortest wave, but the first wave is the longest – as it is the extended wave – it means that the fifth wave in such a pattern must be the shortest one. In other words, a trader can anticipate the end of the impulsive wave, and can trade a first-wave extension based on the following logical thinking:

- When the market suddenly makes a strong move in one direction or another, chances are that a first-wave extension is forming;

- – Measure the time taken for the first wave and project it onto the right side by the time the first wave has ended;

- Wait for time to expire, as that implies that the second wave consolidation took more time than the first wave;

- Take a Fibonacci retracement tool and find out the 23.6% and 38.2% levels;

- If the first wave is a bullish one, go long on the 23.6% and 38.2%, with stop loss at 50% retracement;

- Take the 61.8% measurement of the first wave and project it from the end of the second wave. The third wave should end below that 61.8% measured level, and it should be the take-profit level for the earlier long trade.

- Look for a simple correction for the fourth wave, a correction that should NOT overlap with the second wave. Remember – in an impulsive wave, overlapping is not allowed.

- Measure the length of the previous third wave and project it from the end of the fourth wave. This is the maximum length of the fifth wave. (Remember, the fifth wave is the shortest one in this pattern.)

- Go short by the time the high in the third wave is exceeded, with the stop loss at the maximum point of the fifth wave.

Following the above plan, we traded a bullish impulsive move both to the upside and to the downside, based on generalities as well as specific things to consider in a first-wave extension. Depending on the timeframe the first-wave extension is forming in, such a trading plan can be extremely profitable, as the length of the moves will be considerable. The next article will deal with a similar trading plan for the most popular impulsive wave: the third-wave extension. “Most popular” means that it is the one that appears most often, so it is vital for any Elliott Waves trader to understand how to trade it.

Other educational materials

- S&P 500

- Composite Index

- Toronto Stock Exchange (TSX)

- The Importance of Press Conferences

- Forex Trading When Central Bankers Hold Speeches

- Risk-off vs. Risk-on Trading

Recommended further readings

- “Using wave theory to maximize retail investor media communications.” Martin Jr, Ernest F. International Journal of Strategic Communication 1, no. 3 (2007): 191-206.

- Multi-classifier based on Elliott wave’s recognition. Volna, E., Kotyrba, M. and Jarusek, R., 2013. Computers & Mathematics with Applications, 66(2), pp.213-225.