B Wave Retracement Explained for FX Traders

Forex traders should be aware that the market spends most of the time in consolidation or ranging, and when it comes to Elliott Waves theory, this means it is more common for the market to form corrections rather than impulsive waves. This is how currency pairs move, and a Forex trader should adapt to it. Such consolidations are caused by various factors. Lack of demand caused by the end of a trading session is a very plausible reason for the market to suddenly lose direction and start ranging. This happens, and can be visible after the end of the London session when activity drops significantly. The same is even more obvious after the North American session ends and the Asian session is about to start. Asian sessions are by definition very slow, and this means that corrective waves are forming. Interpreting a corrective wave is a tricky thing, though. The fact that the market is forming a corrective wave doesn’t mean that there is any impulsive activity. In reality, a corrective wave can be even more vicious than a single impulsive wave. The classical example, in this case, is a triple zigzag. Such a complex correction, despite the fact that it is indeed a complex correction, is actually formed from six different impulsive waves of a lower degree. In other words, such a move will be characterised by the market moving aggressively in a specific direction, even though the whole move is corrective.

It follows from the above that trading corrective waves doesn’t necessary mean that the market is not moving. In order to know what kind of a correction the market is forming, it all comes down to the b-wave. This is a crucial wave, and its retracement tells us the possible pattern that may be going to form.

| Broker | Bonus | More |

|---|

Golden Ratio Makes the Difference Again.

Before going into more detail regarding the b-wave of any corrective wave, it is worth mentioning that such a wave is always a corrective one in its own right. In other words, it makes no sense to look for an impulsive wave when an a-wave has already been completed. The b-wave is the one that makes the difference between the type of correction that the market is going to form, and based on its retracement, a trader knows the structure of the previous move the market made. This is crucial in correctly forecasting future prices, and offers a huge competitive advantage when trading with Elliott Waves. After all, this is what trading is: interpreting previous price action in order to forecast future moves.

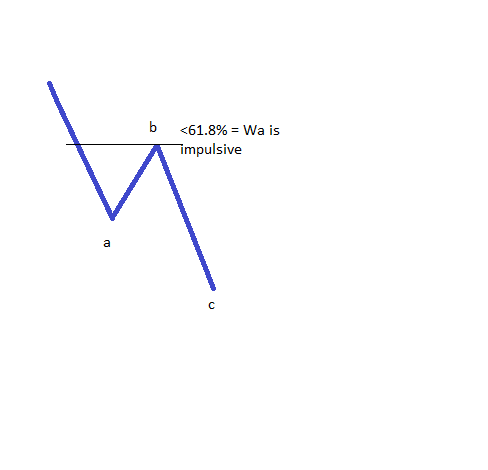

B-Waves in Zigzags

By now, you should know that a correction is always labelled with letters, and is represented like this: a–b–c. This is a three-wave structure, and can be the a-wave of a bigger degree, for example. Nevertheless, it is a three-wave structure as a corrective wave. In this three-wave structure, as mentioned above, the b-wave is always a corrective wave. Its structure is very important, but even more important is the retracement level into the territory of the previous a-wave. It all comes down to the 61.8%, or the golden ratio. The b-wave in a zigzag should not end anywhere beyond the 61.8% retracement when compared with the previous a-wave. Careful here, as this is a tricky statement, like many others in Elliott Waves theory! The retracement refers to the end of the b-wave, not the actual high/low point parts of it might travel. Therefore, assuming we have a five-wave structure followed by an a-wave, and then a counter-trend move, that counter-trend move must be a b-wave. At this moment in time, all eyes should be on how much this counter-trend move is going to retrace. If it retraces less than 61.8%, the market is forming a zigzag pattern for the whole a–b–c. Any zigzag must have the 5–3–5 structure for its a–b–c; or, impulsive wave–corrective wave–impulsive wave. This means that if the b-wave retraces less than 61.8% into the territory of the previous a-wave, the a-wave must be an impulsive wave (the first five-wave structure), and the c-wave to follow must be an impulsive wave in its own right.

In this way, we identified the nature of the previous pattern, only for that to give us the nature of the pattern that is about to form: the c wave of a zigzag, which must be an impulsive wave. And all these are given by the fact that the b-wave does not retrace more than 61.8% of the a-wave. This is just a simple example of the power the Elliott Waves theory has when forecasting future price movements.

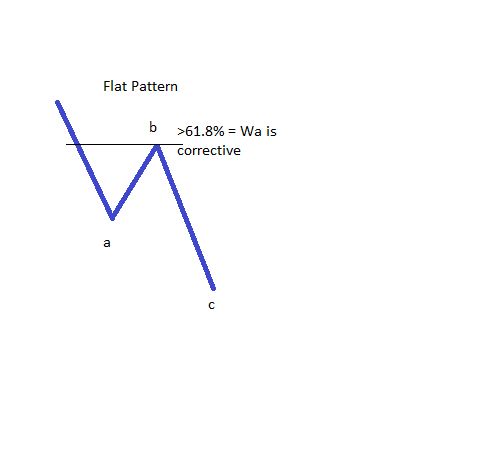

B-Waves in Flats

The previous example showed the b-wave being decisive in the structure of a zigzag, but the Elliott Waves logical process does not end there. The next question a trader should ask is the following: What if the b-wave retraces more than 61.8% of the previous a-wave? Such a retracement totally invalidates the zigzag scenario, only to open a new one: The market forms a flat pattern. In a flat pattern, it is mandatory for the b-wave to retrace a minimum of 61.8% of the previous a-wave, and the overall a–b–c structure must be a 3–3–5, or a corrective wave–corrective wave–impulsive wave. And just like that, the b-wave again tells us the nature of the previous wave, as well as the nature of the wave to follow. This means that profits can be made, as we know that the previous a-wave must be a corrective wave (either a flat or a zigzag or a complex correction of a lower degree), and the future c-wave must be an impulsive wave.

The next thing to do in order to correctly position for trading the c-wave based on the b-wave retracement is to go back and look at the types of impulsive waves that may possibly form. A third-wave extension is the most popular impulsive wave, and just like that, the trader knows the most likely scenario for the pattern about to form. This can translate by correctly positioning for the next move, and this means making profits from Forex trading. Again, it has all been given by the b-wave retracement level.

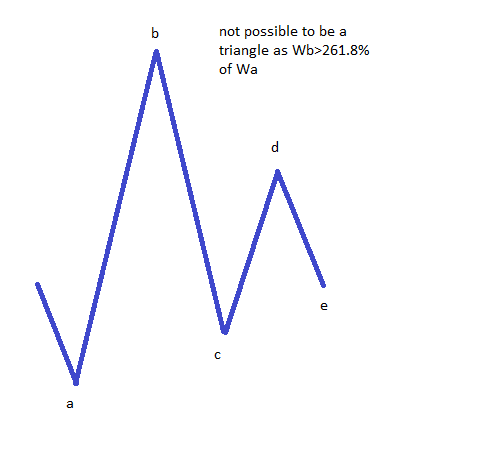

B-Waves in Triangles

This part is very easy to explain as there are simply no limitations when it comes to the retracement level the b-wave is allowed to travel in a triangle. Actually, there is one limitation, and it calls for the b-wave not to retrace more than 261.8% more than the a-wave. In such a case the pattern that forms is not a triangle, but is most likely the b-wave of a running flat, or part of an impulsive wave. No other limitations can be applied for the b-wave in a triangle. These three situations for the b-wave retracement level are the cornerstone of starting to label corrective waves. It all comes down to the b-wave in order to move forward with the logical process, and see whether the corrective wave is a simple or a complex one. More about this in future articles here on our Forex Trading Academy.

Other educational materials

- What Are Corrective Waves?

- Trade Forex with Simple Corrections

- Trading with the Apex of a Contracting Triangle

- Types of Contracting Triangles

- The Concept of a Running Correction

- Double Three Running Patterns

Recommended further readings

- “METHODOLOGY FOR ELLIOTT WAVES PATTERN RECOGNITION.” Kotyrba, Martin, Eva Volna, Michal Janosek, Hashim Habiballa, and David Brazina. ratio 34, no. 55 (2013): 0-618.

- “How to use Fibonacci retracement to predict forex market.” Gaucan, Violeta. Journal of Knowledge Management, Economics and Information Technology 1, no. 2 (2011).