Learn how to Trade Complex Corrections

The previous article on our Forex Trading Academy dealt with simple corrections and how to actually trade them based on the b-wave retracement level and the break of the b-d trend line. However, simple corrections appear really rarely as individual corrections of a bigger degree, so traders should be ready to deal with complex corrections. A complex correction is formed out of simple ones (zigzags, flats, triangles) that are connected by a maximum of two x-waves, or intervening x-waves. The key to correctly labelling a complex correction comes from this connecting x-wave and its retracement level.

| Broker | Bonus | More |

|---|

Types of Complex Corrections

There are many types of complex corrections that Elliott identified, and the way to start is to split them into two categories. These categories are determined by how much the first x-wave in a complex correction is retracing into the territory of the previous correction. It means that one should effectively measure the first a-b-c structure, from its beginning to its end, and then look where the end of the x-wave falls. If its x-wave ends above the 61.8% level of the whole first correction, it is said that the complex correction to form is one with a large x-wave. On the other hand, an x-wave that ends below the 61.8% retracement level is part of a complex correction with a small x-wave. As a rule of thumb, it is not possible for a complex correction to start with a triangle, so the only two options available are a zigzag and a flat pattern.

Complex Corrections with a Small X-Wave

The patterns that fall into this category have an x-wave that retraces less than 61.8% of the previous a-b-c structure (that can either be a zigzag or a flat). Such patterns are far commoner than corrections with large x-waves, and it is therefore mandatory for a trader to master them.

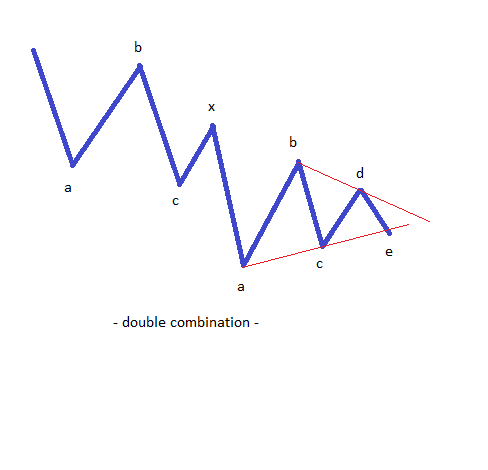

Double Combinations

Like the name suggests, a double combination is, in fact, a “combination” of two simple corrective waves, connected by a small x-wave. Considering the fact that a complex correction cannot start with a triangle, the only possibilities we have are the following:

- Zigzag – x wave – triangle. This is a double combination that ends with a triangle, a very common one, and by the time the triangle is completed, the whole pattern is considered to be completed. It has the following structure, of a lower degree: a-b-c – x wave – a-b-c-d-e. All the rules of a zigzag and of a triangle must be respected.

- Flat – x wave – triangle. Another double combination that ends with a triangle, a very common one as well, with the following structure: a-b-c – x wave – a-b-c-d-e. The only difference between this double combination and the previous one comes from the fact that the first a-wave is a corrective wave, and the first b-wave retraces more than 61.8% of the a-wave.

- Zigzag – x wave – flat. This is a rare double combination, and has an a-b-c – x-wave – a-b-c structure.

- Flat – x wave – zigzag. The last possibility of a double combination, still a rare one, with the same structure as the one above.

A double combination almost always ends with a triangle, so the other ones should be interpreted as being quite rare. Quite rare doesn’t mean they never form, however, as they are to be found on the Forex market on a regular basis.

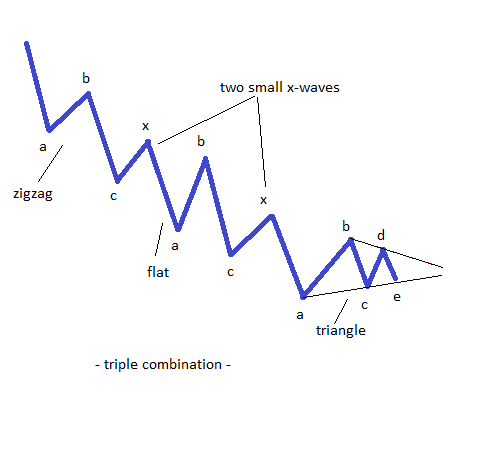

Triple combinations

By now it should be obvious that a triple combination should have just one more correction to follow after the double combination is completed. However, this should not come before another x-wave, an intervening one, is forming. There are multiple types of triple combination, and I’m not going to list them all here. All you have to do is to start with either a flat or a zigzag and then to combine the simple corrections in order to find out all the possibilities. You should consider though that, as was the case with double combinations, a triple combination almost always ends with a triangle. A typical triple combination looks like the image below.

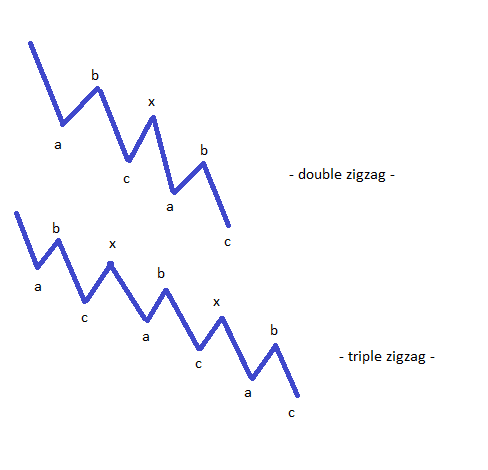

Double and Triple Zigzags

Like the name suggests, if there are two zigzags connected by a small x-wave, it is said that the market forms a double zigzag. A triple zigzag, moreover, has two x-waves and three zigzags, and this represents the most powerful corrective wave the market can form. Double and triple zigzags represent impulsive activity, as traders often interpret them in the wrong way. The fact that there is no alternation between corrective waves should be enough to tell us that the actual move is corrective and not impulsive.

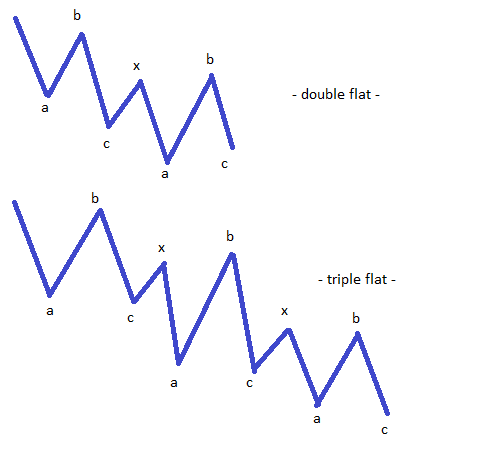

Double and Triple Flats

These patterns are rare ones, but they do form on the Forex market. We’re talking about two or three flat patterns connected by one or two small x-waves, a typical representation of which looks like the one below.

Complex Corrections with a Large X-Wave

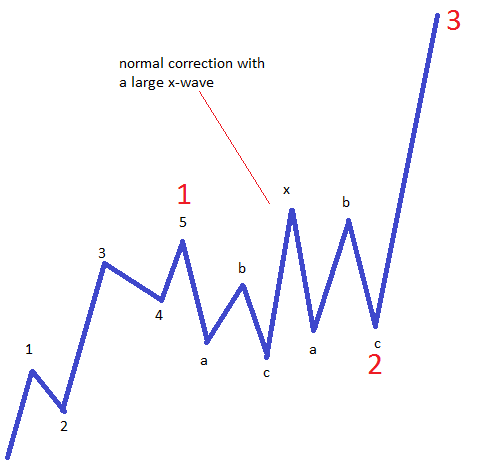

Such corrections are those that have the X-wave retracing more than 61.8% of the first a-b-c, and they are quite tricky. Elliott identified two sub-categories here: running corrections, and normal ones.

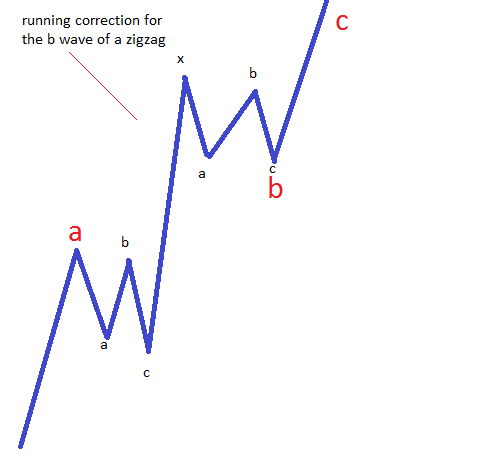

Running Corrections

The most common corrections with a large x-wave are the running type. The word running by itself implies that the correction will end above the end of the previous impulsive wave (in the case of a bullish trend), or below it (in the case of a bearish trend). Such corrections are most likely to appear as the second wave in an impulsive wave, or as a b-wave in a zigzag. A classical representation for a running correction as the second wave in an impulsive wave is shown below.

Normal Corrections

While the x-wave is a large one, in the sense that it is retracing more than 61.8% of the first a-b-c, the end of the whole correction will be into the territory of the first wave (if the correction is the second wave in an impulsive wave), or the a-wave (in the event that the correction is the b-wave of a zigzag). It is possible for such corrections to form as fourth waves in an impulsive wave, although such a situation should be considered rare. The reason for that comes from the fact that after corrections with large x-waves, the market usually explodes in the opposite direction, and this means that either an extended third wave in an impulsive wave, or a large c-wave in a zigzag, will follow.

This article only shows the possibilities for complex corrections, and in order to correctly use and trade them, a further analysis should follow. Such an analysis should consider each and every pattern listed here in order to go further into more detail as to how to properly trade it and interpret it.

Other educational materials

- Types of Zigzag Patterns

- Contracting and Expanding Triangles

- How to Use the Apex of an Expanding Triangle

- Trading with the Apex of a Contracting Triangle

- Types of Contracting Triangles

- Special Types of Triangles

Recommended further readings

- Large financial crashes. Sornette, D., & Johansen, A. (1997). Physica A: Statistical Mechanics and its Applications, 245(3), 411-422.

- Time Series Representation for Elliott Wave Identification in Stock Market Analysis. Phetking, C., Sap, M. N. M., & Selamat, A. (2008).