Contracting And Expanding Triangles in Elliot Waves Theory

Despite the general belief, Forex markets spend most of the time in consolidation, as trends scarcity is the rule of the game. After all, central banks’ mandate of price stability translates through prices keeping more or less the same levels over an extended period of time. Having said that, the most popular way for a market to consolidate is in a triangle. There are many types of triangular formations, with different applications and implications for the patterns that are about to form, but the main two categories are contracting and expanding triangles.

Types of Triangles

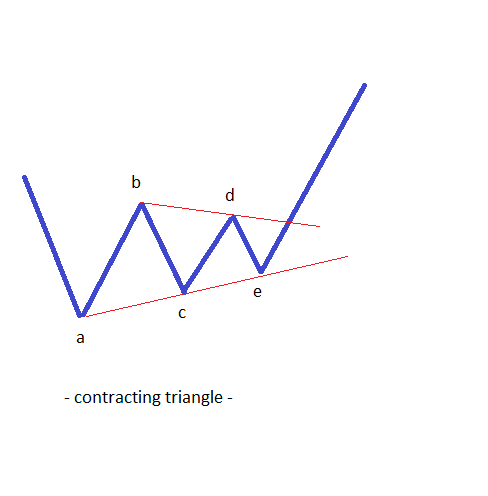

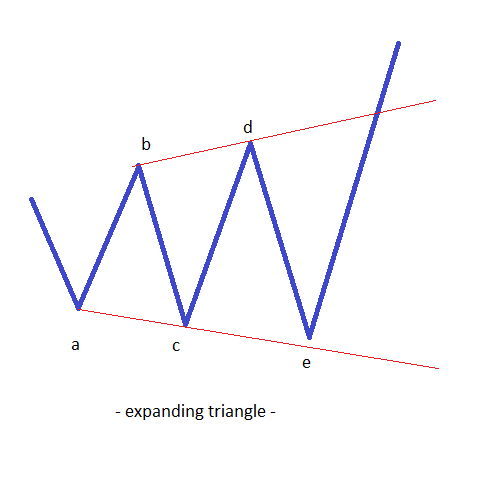

A triangle is a three-wave structure, even though it actually has five different legs. All the legs of a triangle are labelled with letters, namely a-b-c-d-e, and they are corrective. Because of the fact that all of them are corrective, it is said that a triangle is a three-wave structure, as these structures are always corrective. How do we define a triangular formation? The first thing to look for is a series of three higher-highs, lower-lows, or lower-highs, higher-lows. Depending on the time frame they are forming over, triangles can have tremendous implications for the overall Elliott Waves count. In order to represent a triangle or to make it visible, two trendlines need to be drawn: the a-c and b-d trendlines. These trendlines are mandatory to connect the end of the a-wave with the end of the c-wave, and respectively the end of the b-wave with the end of the c-wave. It is the nature of these two trend lines that differentiate between triangles. A contracting triangle is therefore a triangle that has the a-c and b-d trend lines moving towards a common point in the future, while an expanding triangle, as the name suggests, has the a-c and b-d trend lines moving in opposite directions. Of the two categories, contracting triangles appear most frequently, even though in the Forex market expanding triangles appear more often than when trading other financial instruments, such as the stock market, for example.

Contracting Triangles

Such a triangle is characterised by all the legs of it being smaller than the previous one. This is what gives the contracting nature, as the market is forming smaller and smaller moves, until eventually the triangle breaks higher or lower. A contracting triangle can be either a simple correction (in this case it can be either the fourth wave in an impulsive move or the b-wave in a zigzag), or a complex correction. As simple corrections, contracting triangles do not form that often, but they do appear extremely frequently in complex corrections. As a rule of thumb, a complex correction never starts with a triangle, no matter what its nature, and so we immediately eliminate a possible place for triangular formation appearance. It means that in a complex correction, a triangle can be either the x-wave or the second or third corrective wave of that respective complex correction. The biggest advantage of contracting triangles, and perhaps the main reason why they are so popular among Forex traders, is the fact that they are readily visible. This means that by the time the a-c and b-d trendlines are drawn, all traders have to do is to wait for the triangle to be completed. This happens when the b-d trendline is broken. Talking of the b-d trendline, this is by far the most important one of the two trendlines in a triangle, and all eyes are on the moment it is going to be broken. Contracting triangles are consolidation areas, areas when the price is not able to break a specific level and needs to consume time until eventually the area is cleared. These kind of triangles mostly form ahead of important economic releases, and then when the release comes, the b-d trendline is broken. Such a trendline is usually retested, even though such a thing is not really mandatory on all types of triangles. Nevertheless, a good entry point when trading a contracting triangle is to wait for the b-d trendline to be retested before taking a trade.

Expanding Triangles

The same is valid for the e-wave, and by the time the triangle is actually breaking, in a totally opposite direction from that of the e-wave, both bulls and bears have already lost their track, and no one really knows where they are with the Elliott count. When the triangle becomes obvious, it is usually too late for taking a new position. In an expanding triangle, the e-wave is by far the most complex structure, and the most vicious one, as it is the longest out of all the legs. It is so powerful that it will give you the impression that the market will never turn back. Of course this is only an illusion, but this is the general feeling given by the e-wave.

Expanding triangles do not form as often as contracting ones, but this statement is valid for classical expanding triangles. We’re going to cover here at our Forex Trading Academy some special types of expanding triangles that form in the Forex market on a regular basis. In conclusion, knowing the types of triangles a market can form is a great way of understanding corrective waves, both simple and complex. The fact that they appear so often is another incentive for taking the time to get to know how to trade such patterns.

Other educational materials

- What is Elliott Waves Theory?

- Defining Impulsive Waves

- Defining Corrective Waves

- Use the Fibonacci Extension Tool in Elliott Waves Theory

- Different Fibonacci Levels Important When Trading with Elliott

- Trading Different Types of Extended Waves

Recommended further readings

- “Economic integration and the evolution of trade: a geometric interpretation of trade measures.” Azhar, Abdul KM, and Robert JR Elliott. Journal of Economic Integration (2004): 651-666.

- Mastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice Exercises Brown, C. (2012). A Summary with Study Flash Cards for Patterns, Rules, and Guidelines. , 77-103.