How to Use Corrective Elliot Waves in FX Trading

This part of the overall Elliott Waves theory is the one that is most of the time totally misunderstood. Corrective waves are so important, though, in the overall interpretation of the moves the market makes that they are vital to any correct Elliott labelling.

Before starting a discussion about corrective waves and what the main things are to consider, Forex traders should know that they are much more common than impulsive waves. This means that corrective waves forming more often, and therefore labelling should be done mostly with letters.

The previous article here on our Forex Trading Academy discussed what makes an impulsive wave – and if that seemed confusing, then corrective waves will give you an even harder time. Elliott discovered many corrective waves, with variations ranging from the place they appear, their interpretation, their construction, etc. There are so many things to consider that the best approach is to start with the very basic things and then slowly but surely build on the whole theory.

| Broker | Bonus | More |

|---|

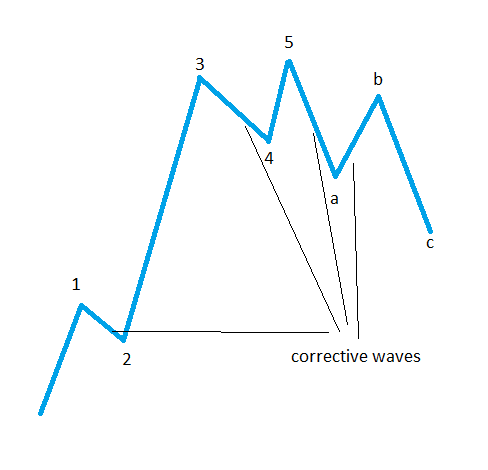

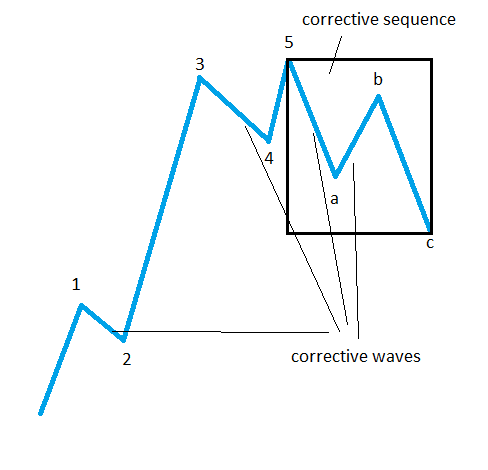

According to Elliott, a five-wave structure (1-2-3-4-5) is followed by a third-wave correction (a-b-c). This sequence represents a cycle, and all the waves in this cycle are of the same degree. Such a cycle can be the first and the second wave of an impulsive wave, or the third and the fourth wave, as explained in the previous article where impulsive waves were defined. Out of the whole 1-2-3-4-5 and a-b-c sequence that defines a cycle, the second and the fourth waves, together with waves a and b, are corrective in nature.

This is a very powerful statement as, from this moment on, any discussion involving impulsive waves refers only to the first, third, fifth and c-waves, while the corrective waves are the second, fourth, a-waves and b-waves. Already the overall analytical process of Elliott Waves thinking is better structured when compared to the beginning of this part of our overall project.

Corrective Waves Generalities

Moving forward with this article, the focus will be on the second and fourth waves as well as on the a-wave and b-wave, as they are the corrective waves in an Elliott cycle. Despite the fact that they are all in the same category, they are very different, and their interpretation is subject to different considerations.

To divide things even further, it is time to mention that Elliott found two types of corrective waves that can form: simple and complex corrections. Both of them are important, and by the time a trader decides that a move is a corrective one, the next thing to do is to establish whether the correction is a simple or a complex one.

Second Wave Characteristics

Any second wave in a five-wave structure is a corrective wave, and it can be either a simple or a complex correction. Most of the time, this wave is a complex correction that retraces deeply into the territory of the first wave.

The general belief is that the second wave should retrace between 50% and 61.8% of the first wave, and traders will trade aggressively on such a retracement as the third wave in an impulsive wave (the one that it is usually the extended wave) is about to start. Such a belief is not correct as, if price really retraces to the 61.8% level, it is only part of the second wave and not the end of it.

It is mandatory for the second wave to retrace into the territory of the first wave, but not mandatory for it to end in that territory. If it ends higher or lower, depending on the type of the impulsive wave, it is said that the second wave is a running correction.

Fourth Wave Characteristics

The fourth wave in any five-wave structure must be corrective in nature, and can be a simple or a complex correction. It is not possible for the fourth wave to completely retrace the third wave, nor for it to enter the territory of the second wave. A typical retracement for the fourth wave would be anywhere between 38.2% and 50% retracement into the territory of the third wave. In fact, if the price retraces more than 50% into the territory of the third wave, this retracement should be viewed as only part of the fourth wave, and not the end of it.

“Wave a” Characteristics

If we’re discussing an a-wave, then this implies that a five-wave structure is already completed. The a-wave is part of the overall move that corrects the initial five-wave structure, and therefore its interpretation is crucial.

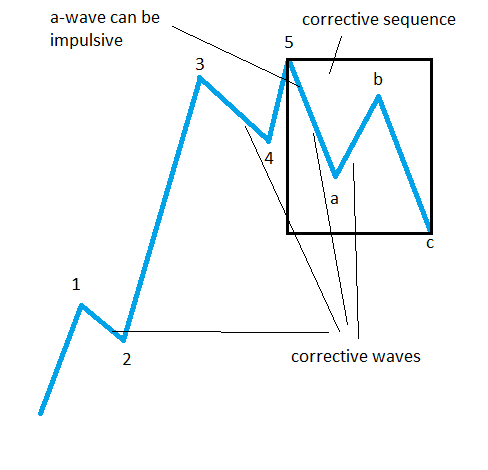

At this very moment, the Elliott Waves theory divides even further. As mentioned above, the a-wave is listed in the corrective waves category – which is very much true, with one exception: if it is the first part of a zigzag. (A zigzag is a simple corrective wave that will be covered later in our project.)

Having said that, after an impulsive wave to the upside, for example, or a bullish five-wave sequence, the a-wave is the first bearish reaction to that impulsive wave. It can be an impulsive wave of a lower degree, hence respecting the rules of an impulsive wave, or a corrective wave of a lower degree.

If it turns out to be a corrective wave, then it can be a simple or a complex correction as well. As a rule of thumb, if the a-wave that follows an impulsive wave is an impulsive wave, it will be retraced less than 61.8%. On the other hand, if it is a corrective wave, then the move to follow is mandatory to retrace beyond the all-important 61.8% level.

“Wave b” Characteristics

It is mandatory for the b-wave in any type of Elliott Waves structure to be a corrective wave. As was the case with the previous corrective waves mentioned here, it can be a simple or a complex correction on its own.

This is one of the most difficult waves to be found and interpret, but the whole count depends on it. Such a wave can retrace completely the previous a-wave and can give the impression that the overall correction ended.

All in all, corrective waves are more common than impulsive structures, and the characteristics listed in this article are only meant to define their structure. Bear in mind, though, that these are only generalities, as complex corrections from the types listed above can form on each and every corrective wave.

Other educational materials

- What is Elliott Waves Theory?

- Defining Impulsive Waves

- Use the Fibonacci Extension Tool in Elliott Waves Theory

- Different Fibonacci Levels Important When Trading with Elliott

- Trading Different Types of Extended Waves

- Bill Williams – How to Use Williams Indicators When Trading Forex

Recommended further readings

- Theories and reasons for wave patterns in economic development and their implications, BM Ndlovu – The International Financial Crisis

- Methodology for Elliott waves pattern recognition, M Kotyrba, E Volna, M Janosek, H Habiballa, D Brazina – ratio, 2013 – scs-europe.net