How to Trade Double and Triple ZigZags

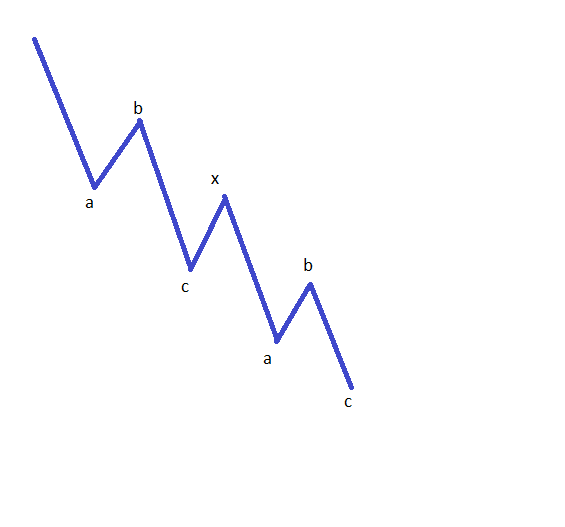

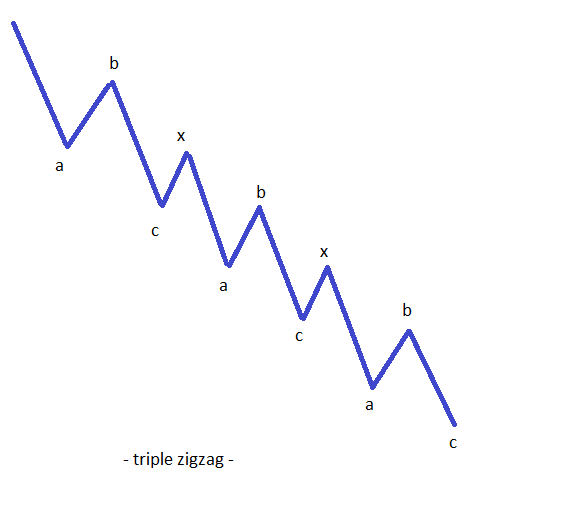

Elliott Waves theory is based on in impulsive wave, or a five-wave structure that is corrected by a three-wave one. That impulsive wave is far more aggressive than the corrective one, in the sense that the price travels more in the case of an impulsive wave than in a corrective wave. This holds true for most of the patterns, with some exceptions: a double or a triple zigzag. These two patterns are the most vicious ones when it comes to the price travelling in one direction or another. They are so violent that they leave traders little or no room to exit if they are on the wrong side of the market. Such patterns are so aggressive because the double zigzag is formed out of four impulsive waves, while a triple one is formed from no less than six different impulsive waves. All the rules of an impulsive wave are to be found in these types of impulsive waves, while retracement is almost non-existent.

| Broker | Bonus | More |

|---|

How to Trade Such Patterns

It is one thing to know the nature of a pattern, and a totally different thing to know how to trade it. There are different situations where these patterns appear as well, and this should be the starting point to any double or triple zigzag interpretation. The first thing to consider is that being such powerful patterns, it is not possible for them to be completely retraced by a wave of the same degree. This says much about the nature of the move to follow a double or a triple zigzag. The next thing to look for is the place where they might appear. The most common place is a leg or a segment of a triangle, but also the first or the third segment in a so-called terminal pattern that resembles a wedge formation.

Trading a Double Zigzag

Trading a Triple Zigzag

An aggressive trader will always try to pick a trade in the opposite direction of a triple zigzag by the time the last zigzag in the pattern is about to start. To do that, the thing to do is to measure the lengths of the previous two zigzags in the pattern, and project the length of the longest one from the end of the second x-wave. With this wave we have an educated notion about the maximum distance of the last zigzag in the pattern, and a trade in the opposite direction can be taken by the time half of that distance is covered, with a stop loss just beyond the end of the projected move for the last zigzag. As a target, look for the whole channel being broken, and then trail the stop loss order. Keep in mind the timeframe the triple zigzag appears on for setting the proper trail stop distance. Conservative traders will wait for the channel to be broken before taking a trade in the opposite direction, but in this case, the reward is not as big as it was in the previous one. No matter how you decide to trade a triple zigzag, expect the pattern to be a vicious one. This makes trading the triple zigzag a risky thing to do.

Other educational materials

- How to Use Parabolic SAR to Buy Dips or Sell Spikes

- Bollinger Bands – Profit from One of the Best Trend Indicators

- Risk-off vs. Risk-on Trading

- Macroeconomics in Forex Trading

- Profit from Forex Trading Using Different Trading Styles

- How to Set Up an Expert Advisor

Recommended further readings

- “A state space forecasting approach to commodity futures trading.” Marshall, Richard Carel. (1991).

- “A Survey of the Managed Futures Industry.” Jaffarian, Ernest. Efficient Capital Management, Naperville (2007).