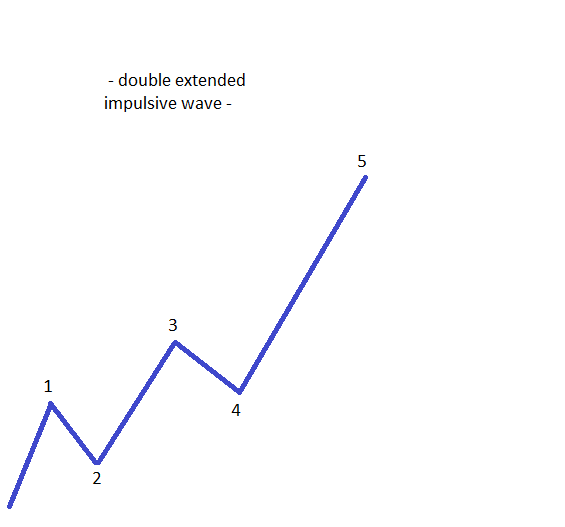

How to Trade Double Extended Impulsive Waves

Elliott defines an impulsive wave as a five-wave structure that should have at least one extended wave. The very first impression is a confusing one, as only three possibilities for an extended wave are listed: third-wave extension, first-wave extension, or fifth-wave extension. What is the reason for mentioning “at least one extended wave”? The answer is quite simple: There are impulsive waves that have two extended waves, and these are called double extended impulsive waves. As the name suggests, a double extended impulsive wave has two extended waves. The extension applies to the same motive waves: the third, first, or the fifth. The only possibility for a double extended impulsive wave to form is for the third wave to be extended, and then the fifth wave to extend as well. As a quick reminder, the extension means the wave is bigger than 161.8% when compared with the length of the previous wave. This is the minimum distance to be travelled by an extended wave, but in the case of a double extended wave, the price cannot travel much more than that extension.

| Broker | Bonus | More |

|---|

Steps for Trading a Double Extended Impulsive Waves

The most common wave to be subject to an extension is the third wave, and this makes a third-wave extension impulsive move the most popular one. It is so popular among traders that almost everyone looks to trade the third wave to catch the longest wave. In a double extended impulsive wave, the third wave will end up looking like peanuts when compared with the fifth wave, as this last one will be bigger than 161.8% when compared with the length of the third wave! But the third wave was already bigger than 161.8% when compared with the length of the first wave; so, you can imagine the strength of the trend that makes up a double extended impulsive wave! To trade such an impulsive wave, one stop loss needs to be hit. However, this is only a normal step, as the loss should be recovered, and some profits made on top of that. How is that done?

Trading a Third-Wave Extension

The way to trade a double extended impulsive move is to treat it as a third-wave extension. Remember that at the start of an impulsive wave, we don’t know what kind of an impulsive wave it is going to be. All we know is that the most common set-up is for the third wave to extend, and it is normal for this to be the scenario to be traded first. The reason why I said that a stop loss should be hit is that traders will look for the end of the impulsive wave by the time the third-wave extension is reached. Therefore, it is normal for the fifth wave to be faded, meaning that traders should look to trade in the opposite direction of the overall impulsive move by the time the fifth wave starts. For this, there’s a stop loss to be placed, and this can be 61.8% of the length of the third wave, placed from the end of the fourth wave. In a third-wave extension impulsive wave, it is not possible for the fifth wave to move beyond that level! If the stop loss is hit, it means that the whole move cannot be a third-wave extension. A fifth-wave extension is out of the question, and this leaves room for only one plausible explanation: A double extended impulsive move is going to form.

Reverse the Trade and Go Aggressively for 161.8%

If, and only if, the stop loss is hit, the thing to do is to reverse the original trade. This can be done either with the same volume or with a bigger volume, as the move that started will be another impulsive wave that will be way bigger than the previous third wave. To be more exact, the fifth wave should be around 161.8% of the third wave, so, to calculate the level, the Fibonacci Expansion tool should be used. It should be dragged from the top to the bottom of the third wave, and then the 161.8% measurement should be taken. This measurement should then be attached to the end of the fourth wave, and this is how the fifth wavelength is deducted. Moreover, this represents the take profit of the previous trade mentioned above, and because the fifth wave is the longest one in the whole five-wave structure, the loss will be more than recovered. A double extended impulsive move is common on the foreign exchange market when currency pairs are moving a lot due to changes in monetary policy, or due to support or resistance levels being broken. However, they are not so common in other markets such as the stock market, for example.

With this double extended impulsive wave, we have so far covered all the possibilities for an impulsive wave: a third-wave extension, a first wave, a fifth wave, and a double extended impulsive move. The next articles here on our Forex Trading Academy will deal with generalities, or things to consider in impulsive waves, on each type of extension except the one treated here. The reason for that is because Elliott found internal Fibonacci relations on different types of extended waves, and if they are not respected, the move is not the impulsive wave one expected it to be. Just to give you an example, in a first-wave extension impulsive move, the second wave cannot retrace much more than 38.2% of the previous first wave. If you do see a retracement of more than 38.2%, then most likely the move you thought was a first wave extension is not, and the whole count should be revised. This is how Elliott Waves theory works: putting things together to find the right set-up.

Other educational materials

- FTSE AIM All-Share Index

- FTSE All-Share Index

- Japanese Exchange Group (JPX)

- Forex Market Terminology

- Profit from Forex Trading Using Different Trading Styles

- How to Set Up an Expert Advisor

Recommended further readings

- Neural pattern recognition with self-organizing maps for efficient processing of Forex market data streams. Ciskowski, P., & Zaton, M. (2010, June). In International Conference on Artificial Intelligence and Soft Computing (pp. 307-314). Springer Berlin Heidelberg.