Analyse Double and Triple Running Flats Correctly

According to Elliott, corrective waves should be split into two categories: simple and complex ones. Simple corrections must be confirmed by future price action, and such corrections are either triangles, zigzags, or flat patterns. Out of these three categories of simple corrections, flats are the most complex ones; not because they are difficult to understand or anything like that, but because there are so many types of flats that it is confusing to take them all into account. We covered the types of flats in previous articles here on our Forex Trading Academy project, and we know by now that flats are structured based on the b-wave retracement in the territory of the previous a-wave. It is mandatory for the b-wave to retrace a minimum of 61.8% in the territory of the a-wave. Depending on how much the b-wave retraces, we can identify the types of the flat patterns that might form. There are nine types of flats we’ve covered so far, three types for each of the following b-wave retracement levels: 61.8%–80%, 80%–100%, over 100%. However, on top of those nine type of flats that the market may form, there is one more, called a running flat. Such a pattern has a really strong b-wave that not only retraces 100% of the previous a-wave, but it is exceeding that level quite aggressively. Already having only one running flat, the implications are pretty bullish (if the overall trend is bullish), or bearish (if the previous trend is bearish). What if, instead of forming only one running flat, the market is actually developing two or even three flats?

| Broker | Bonus | More |

|---|

Double and Triple Running Flats

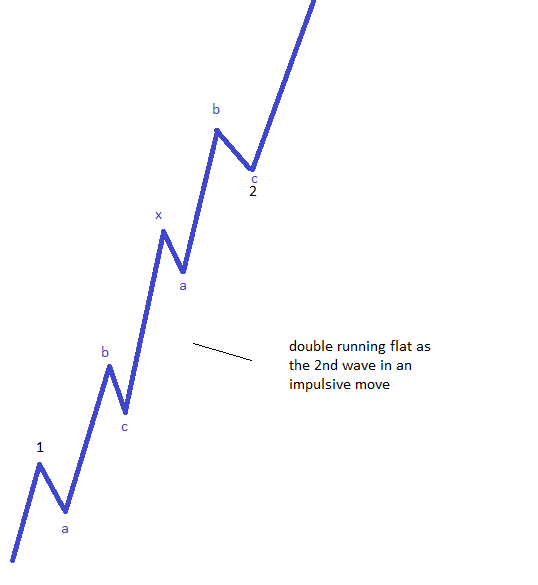

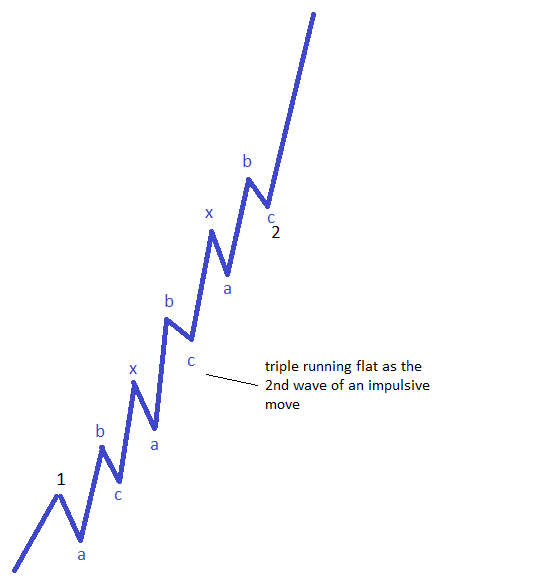

If the market is forms more than one running flat as a corrective wave, it means we have a complex correction. We know by now that a complex correction has at least one x-wave, and this x-wave can be either a small or a large one. The name of these patterns, double and triple running flats, tells us that the x-wave is a large one, as only large x-waves can possibly form in running corrections. In other words, by the time the first running flat is completed (which is already a powerful statement about the move to come!), a large x-wave should form. This large x-wave goes in the same direction as the b-wave of the running flat. Considering that the b-wave of the running flat is the longest and most aggressive one out of the overall a-b-c structure, it means that the x-wave will be at least as powerful as the b-wave.

Double Running Flat

Triple Running Flat

- Being a running correction, it will be followed by a minimum 161.8% extension when compared with the move prior to the running correction.

- The three running flats that make the pattern move almost in a vertical line, and there is no place for consolidation like there is in the case of a triple three running, for example. A triple three running almost always ends with a triangle, and there is therefore plenty of time for the triangle to form, so traders can see it and position accordingly. In a triple running flat, there is little or no consolidation as the only pullbacks will be the c-waves of the three running flats.

- On top of the two things mentioned above, the 161.8% extension comes after such an aggressive move that it will give traders the impression that the market will never stop. This is just a wrong impression, as well-prepared traders will know that a running pattern has actually just been completed.

All in all, double and triple running flat patterns do not form that often, but they do tend to appear on the Forex market. When they do, it is important not to fade such a move, as it will be an expensive move to be faded.

Other educational materials

- How to Trade 2nd and 4th Waves

- The All-Important B Wave Retracement

- What Are Corrective Waves?

- Trade Forex with Simple Corrections

- Complex Corrections in Elliott Waves Theory

- Types of Flat Patterns

- Types of Zigzag Patterns

- Contracting and Expanding Triangles

Recommended further readings

- Technical Analysis. In Exchange Rate Forecasting: Techniques and Applications Moosa, I.A., 2000. (pp. 173-230). Palgrave Macmillan UK.

- Neural networks for financial forecasting Loo, S.L., 1994. (Doctoral dissertation, University of London).