Important Fibonacci Levels in Forex

Fibonacci levels are extremely important for a correct Elliott count, and the patterns Elliott identified are strongly related to these levels. Regardless of whether an impulsive wave or a corrective one forms, Fibonacci levels are the decisive factor for correctly counting waves.

Elliott identified many types of patterns that evolve around Fibonacci levels, and there are both internal and external Fibonacci considerations when counting waves with the Elliott Waves theory. External considerations refer to the overall place of the pattern in the whole structure, while internal Fibonacci projections refer to either retracement or expansion levels that need to happen in a pattern.

Just to give you an idea, in a contracting triangle – one of the commonest patterns defined by Elliott – at least three waves need to retrace a minimum of 50% of the previous wave. Such a rule is an internal one, and it defines the overall pattern. If there are no three waves to fulfil this rule, then it is not a contracting triangle. As simple as that.

As you can see, Fibonacci levels are the pillars of the Elliott Waves theory, and the purpose of this article is to list the most important ones, together with the implications that arise from their interpretation.

| Broker | Bonus | More |

|---|

Fibonacci Levels to Consider

Fibonacci retracement and expansion levels are both equally important, even though traders tend to focus more on the retracement ones. This happens because of the constant search for the third wave in an impulsive move, as this is considered to be the one that is most of the time the extended wave, and hence the most profitable one to trade.

When talking about Fibonacci levels, it is important to make a clear distinction between retracement and expansion levels. Both categories are used in the correct interpretation and count with Elliott Waves theory, but their application is a bit different.

The Most Important Retracement Levels

As retracement levels are more popular, it is only normal to start with them. Using retracement levels when trading is also extremely useful from a money management perspective, in the sense that traders place pending orders on specific retracement levels, and if those levels are not reached, it means that the corrective wave is not completed, hence no new trade is taken.

In this way overtrading is avoided, and discipline takes control over the trading account. Usually, the combination of the two results in the trading account growing.

The Golden Ratio

By far the most important Fibonacci retracement level is the 61.8%, or the so-called “golden ratio”. Fibonacci defined this as the crucial level for almost everything that surrounds us, and it is no wonder it is finds such an important use in the technical analysis field as well.

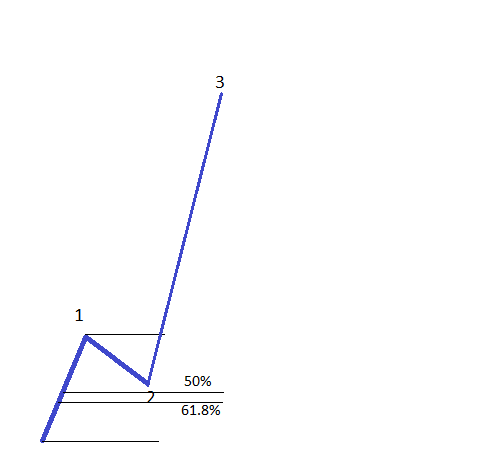

The 61.8% level is used in both impulsive and corrective waves, but the interpretation is quite different. In impulsive waves, its main use is to find the entry before the third wave, as the standard interpretation is that the second wave will retrace 61.8% of the previous first wave.

While the retracement level is alright, in the sense that one should indeed take a trade if the second wave retraces that much into the first wave territory, it is unlikely that the end of the second wave will be close to the 61.8% level. It is most likely that only part of the second wave, probably the a-wave, will end around the 61.8% level, and the rest of the second wave will follow.

This is one of the biggest mistakes traders who use Elliott as a trading tool make. However, for whatever the reason, this interpretation, even though most likely to be wrong in almost all cases, is extremely popular.

The golden ratio level is used in corrective waves as well; as a matter of fact, it defines corrective waves. As you’re about to find out in our future articles, corrective waves are all about 61.8% retracement.

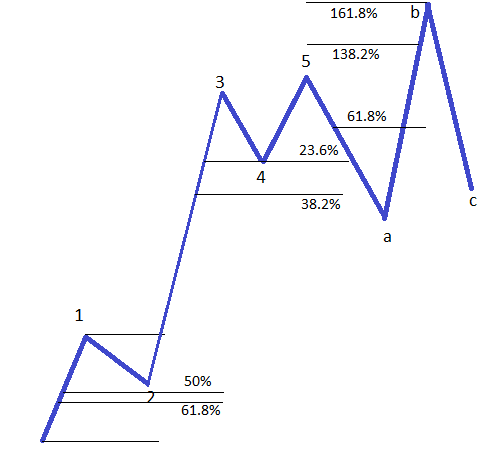

In order to correctly interpret a three-wave structure as either a zigzag or a flat pattern, all eyes should be on the b-wave retracement level. Whether this one retraces more or less than 61.8% when compared with the previous a-wave is the most important factor in deciding whether the three-wave structure is a flat or a zigzag.

Moreover, the golden ratio has implications in deciding whether a correction is a simple or a complex one. If the move that follows a simple correction does not confirm the correction, it means that market is forming an intervening wave or a corrective wave. This is the very first sign that a complex correction is about to unfold. Complex corrections are of multiple types, though, and these types are given by the retracement level the intervening wave reaches.

In other words, the 61.8% level is decisive for the analytical thinking that should be used with Elliott Waves theory. To answer all those questions related to the nature of a move, its type and interpretation, one will have to use the golden ratio in the process.

The 50% Retracement Level

The common wisdom when trading with Elliott Waves calls for the second wave to retrace anywhere between 50% and 61.8% into the first wave’s territory, and this makes the 50% retracement level an extremely important one. It is by far the most important use of it, and the next most important is to interpret the Fibonacci retracement inside a contracting triangle, as mentioned earlier in this article.

The 38.2% and 23.6% Retracement Levels

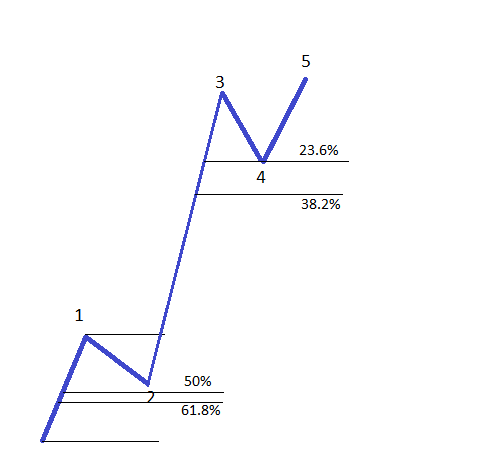

These two are not that popular, but they do have important application when looking to find the end of the fourth wave in an impulsive wave, or the b-wave in a zigzag. If the second wave in an impulsive wave is a complex correction, chances favour greatly that the fourth wave will be a simple one, and it will retrace just a bit. A good opportunity to trade the fifth wave therefore arises, and traders enter on 23.6% first, and then more aggressively on the 38.2% levels.

The b-wave of a zigzag cannot retrace more than 61.8% of the previous a-wave, and that makes the 23.6% and 38.2% levels good entries for traders who want to ride the c-wave. In a zigzag, the c-wave is always an impulsive wave, and this makes it a wave many traders want to be in.

Expansion Levels to Consider

In order of their importance, the following are the expansion levels to be considered when trading with Elliott Waves theory:

- The 161.8% level – This is the defining level that gives the extension in an impulsive wave, but it has applications in corrective waves as well. Just to give an example, if the b-wave in a flat retraces more than 161.8% of the a-wave, then it is not possible for the c-wave to break the end of the a-wave.

- The 138.2% level – This is one level that helps differentiate types of flats, as flats are the most-divided simple corrections.

- The 123.6% level – Such a level is calculated again, to make a difference between two types of flat patterns.

Other educational materials

- What is Elliott Waves Theory?

- Defining Impulsive Waves

- Defining Corrective Waves

- Use the Fibonacci Extension Tool in Elliott Waves Theory

- Trading Different Types of Extended Waves

- Bill Williams – How to Use Williams Indicators When Trading Forex

Recommended further readings

- Elliott wave principle: key to market behavior, AJ Frost, RR Prechter – 2005

- Magic of Fibonacci Sequence in Prediction

of Stock Behavior , Rajesh Kumar