Different Ways to Use Gaps in Forex

Gaps have long been viewed as part of the technical analysis toolkit to be used when trading, and when it comes to the Forex market, they are even more important. This is because of the nature of the Forex market and the fact that it is open 24/5. Because the Forex market is an extremely liquid place, with buyers and sellers changing hands aggressively, the only possibility for a gap to form is over the weekend. It means that on Monday, due to unforeseen events that happen over the weekend, prices open with a different price when compared with the previous Friday’s closing.

| Broker | Bonus | More |

|---|

What is a Gap?

The very definition of a gap is the distance between the Friday’s closing and the Monday’s opening. The bigger this difference is, the bigger the gap is. A gap is therefore a pattern that forms due to changing conditions over the weekend. The treatment of a gap on the Forex market is different from that of gaps in other markets. For example, the stock market opens with a gap on a daily basis, because the market closes every day. Because of this, the significance of these gaps is lost, and they are not even considered important for the stock market. However, due to the nature of the Forex market, gaps provide a lot of information and trading opportunities by the time they are formed. Before moving on to interpreting a gap, we need to first consider the reasons why gaps form.

Reasons for Gap Appearances

One hundred percent of the time a gap appears on the Forex market it is due to fundamental reasons. Either an economic news item over the weekend (usually Chinese data is released on Sunday, and if the actual differs a great deal from the forecasted value, a gap is most likely to be seen in the Australian Dollar pairs – more than 30% of Australian goods go to China, so what happens in China strongly affects the Aussie dollar), or a political event (elections, referendums, etc.,) may be the cause of the gap at Monday’s opening. As a matter of fact, from a trader’s point of view, the reason why the gap has formed is irrelevant. What is crucial is to know what to do after its appearance, and how to trade that market moving forward.

The Western Approach

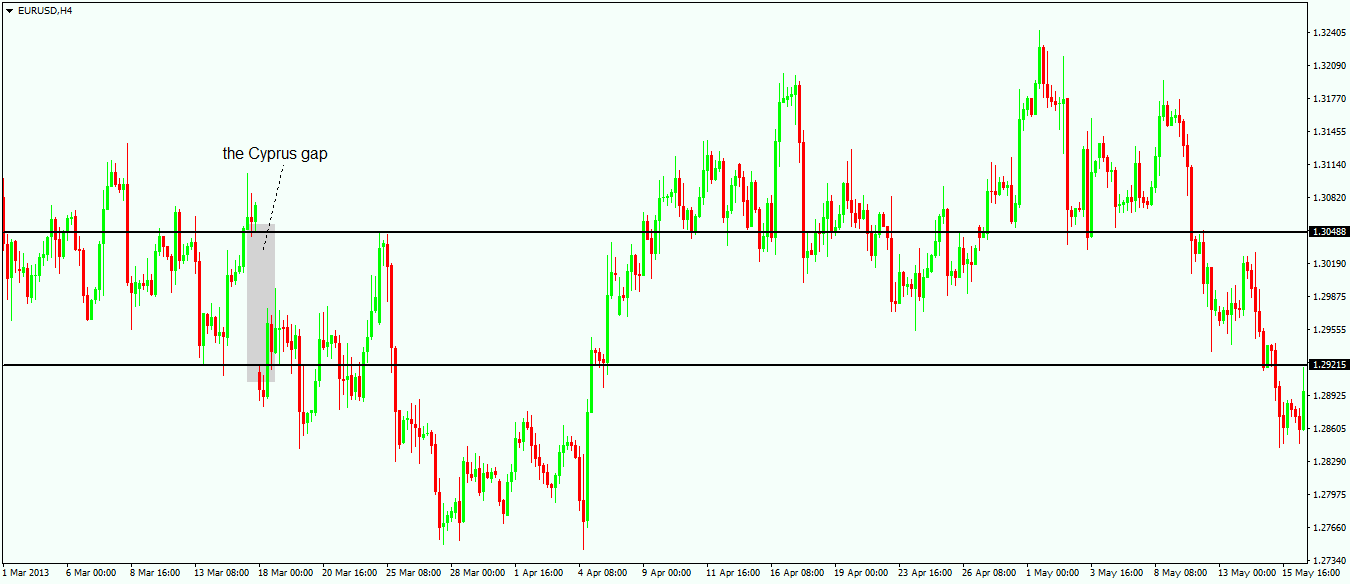

The Western world is considered to be the one that laid down the basis of technical analysis and, under this approach, it is mandatory for a gap to be filled/closed. Even though some people say that gaps should be closed on the Monday that they appear, or at the latest during that week, it is not possible to put an accurate time perspective on the closing of a gap. To put it simply, gaps must mandatorily be filled and there are many traders who use gaps as trading opportunities, using them to trade the other way around by the time the market is open. The chart below shows the so-called “Cyprus Gap” that formed on the EUR/USD pair when over the weekend the decision to use part of the people’s money to bail out banks in Cyprus was taken.

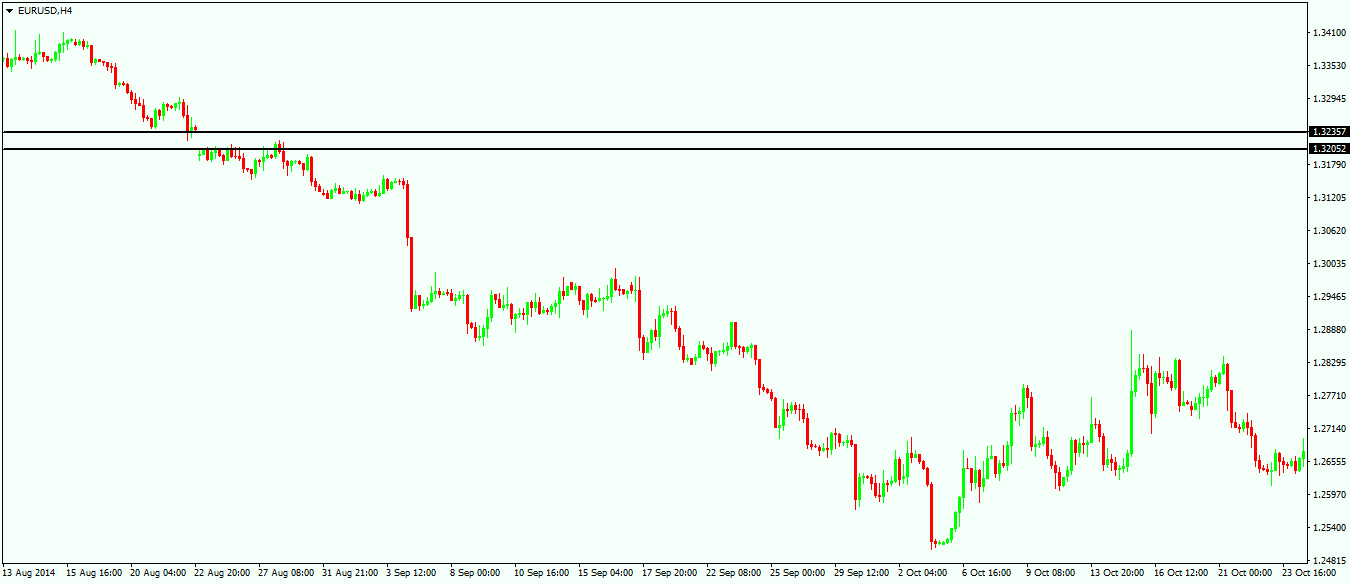

Consequently, the market opened with a gap, and in the case of the EUR/USD pair, the gap was almost 200 pips wide. This is an important gap due to its size. Nevertheless, 30 candles later, the gap was filled in the sense that traders bought the EUR/USD pair on the premise that all gaps must mandatorily be filled. While this was correct in this case, it is not mandatory for the market to close the gaps. The gap shown below is still on the 4-hour EUR/USD chart, and it formed when the pair traded at the 1.32 level.

With the EUR/USD now trading around the 1.10 value, with the current low in place being around 1.05, the gap shown above is still not closed. Treating gaps as mandatory-to-fill patterns is not consistent with a profitable approach because, as can be seen in this case, such an approach may result in terrible losses, if not wiping out of the trading account. Fading this move lower, as it was in the case of the Cyprus gap, would result in great losses for the trading account. This is therefore the proof that it is not mandatory to fill gaps. However, it doesn’t mean that in the end, this gap will not end up being closed. What it means is that trading the gap this way does not always work.

The Japanese Approach

The Japanese approach to gaps is a bit different, in the sense that such areas are called “windows”. This is the term given by the Japanese technical analysis branch to gaps. Moreover, not only are these windows not supposed to be closed, but they represent a continuation pattern. Such a pattern is a sign that the trend is powerful enough to continue in the same direction. Using the example above, the window formed around the 1.32 level was a nice continuation pattern, as sellers dominated the EUR/USD market before the gap and after it. This is the perfect example of how gaps are interpreted in the Japanese technical analysis approach, and it is completely different from the approach we see in the Western world. The proper way to treat gaps, though, should be a combination of the two. As we know by now, moves can be either corrective or impulsive, and if the gap is part of a corrective wave, then it most probably will be closed quite soon. On the other hand, if a gap is part of an impulsive move, chances are slim for it being closed and it will rather represent a continuation pattern. Such a continuation pattern in an impulsive move will form most of the time in the extended wave, and Elliott Waves traders associate such gaps with a living proof that the third wave in an impulsive wave is under way. Again, as was the case in the previous article as well, combining concepts will always lead to more successful trading.

Other educational materials

- How to Use Parabolic SAR to Buy Dips or Sell Spikes

- Use the Head and Shoulders Pattern to Spot Reversals

- Trading with the Cloud – Use Ichimoku Cloud to Spot Reversals

- Forex Market Terminology

- Profit from Forex Trading Using Different Trading Styles

- Trading with the Apex of a Contracting Triangle

Recommended further readings

- “Optimal monetary policy in a currency area.” Benigno, Pierpaolo. Journal of international economics 63, no. 2 (2004): 293-320.

- “Liquidity and market structure.” Grossman, Sanford J., and Merton H. Miller. the Journal of Finance 43, no. 3 (1988): 617-633.