Price and Time – The Holy Grail in Forex Trading

Trading the Forex markets implies choosing a currency pair and then buying or selling it in the expectation that the market is going to move higher or lower. If the direction the market is moving in is the right one, a profit is made based on the different between the entry and the exit price (in the case of a short trade) or the exit and the entry price (in the case of a long trade). In other words, traders are speculating that a currency pair is going to move and, based on either technical or fundamental analysis, or both, they buy or sell a currency pair. The art of speculation is not complete, though, unless the last ingredient is considered: the time element. Trading without a time horizon for the trade to happen is like driving a car without knowing what the destination is.

Time should be part of any trading plan, and, most of the time, it is even more important than the price itself. Let me give you an example: Let’s say that, according to your analysis or beliefs, the EUR/USD rate is expected to move to 1.40 from the current 1.07 at the moment this article is being written. Such a target may be derived from technical or fundamental analysis, but if you don’t put a time horizon on it, it may be worthless, even though the price in the end will move to 1.40. If this is only going to happen 20 years from now, then I’m not interested in trading that currency pair, as in the meantime the opportunity cost associated with blocking the margin for such a long period is not worth the risk. Therefore, time is more important than price.

| Broker | Bonus | More |

|---|

The Holy Grail

Knowing when the price is supposed to make a specific move, or when the price is supposed to reach a take profit, is what traders have been looking for from the beginning of trading. There are some trading theories that incorporate the time element, the most famous one being the Gann trading method. We’ve covered the basics of the Gann trading method here in one of the articles in the Forex Trading Academy, and I would like to reinforce here that Gann believed that each financial instrument (in our case, each currency pair) has its own angle that defines the way the currency pair moves. This angle is called the 1×1 angle, and the moves the market makes are supposed to be related to this angle. On top of this, the Gann Square method allows the time element to be incorporated. However, there are no strict rules to be used with the Gann theory, and therefore the whole concept is a shallow one. There is one theory out there, however, that considers time to be even more important than price: the Elliott Waves theory.

Time with Elliott Waves Theory

We have dedicated numerous articles to the Elliott Waves theory here on the Forex Trading Academy, and this has been done on purpose. According to Elliott, the market moves in steps that are either impulsive or corrective. Based on that judgment, traders can count the waves, starting with historical prices on the longer timeframes, and ending with shorter timeframes that can be used for taking a trade. The patterns discovered by Elliott have one thing in common: They consider the time element. It is true that not all of them consider the time element, but the most important ones do. Regardless of whether the move is impulsive or corrective, the price should follow a specific path in a specific amount of time. If this does not happen, the count is not good and is not validated, and the trade should be closed. It may be that when the time invalidates the count the trade is in profit, but closing that trade was not something that was done due to price considerations, but to time considerations. Time can therefore be seen to be more important than price, as it gives entry and exit levels no matter where the price is. The holy grail in trading is never closer than when trading with the Elliott Waves theory.

Patterns that Consider the Time Element

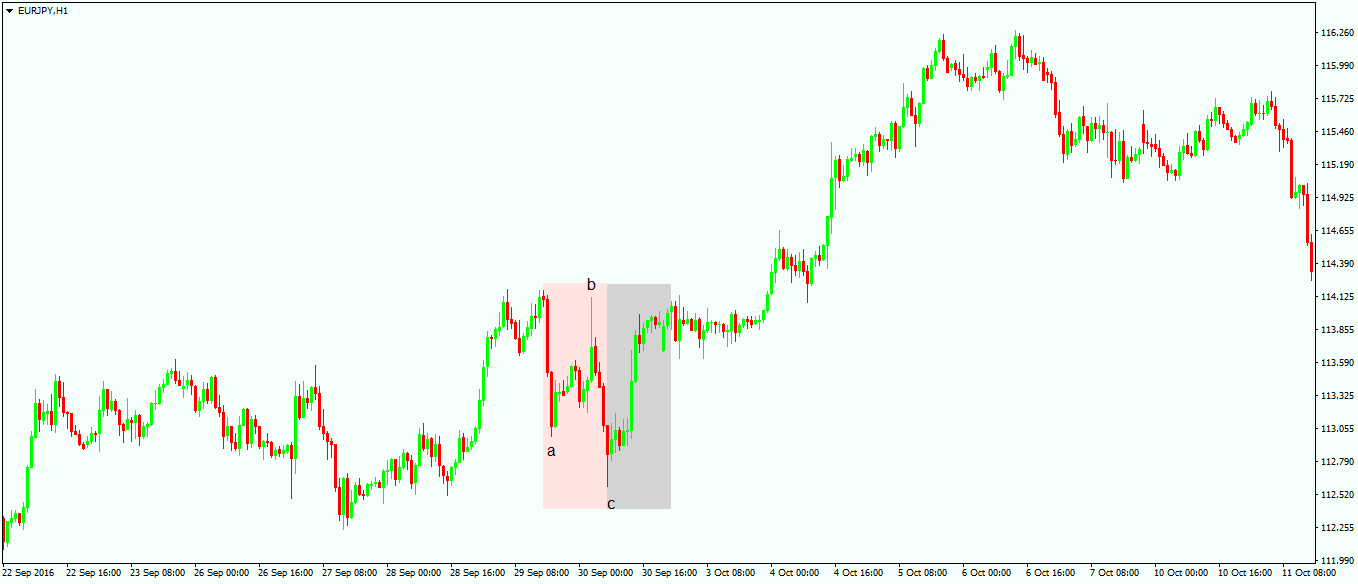

One of Elliott’s great discoveries was the fact that corrective waves can be either simple or complex ones. The difference between the two, or the element that allows a trader to make a distinction between the two, is time. For a corrective wave to be considered a simple one, it must be confirmed by future price action, and this confirmation has some time constraints. The price must make a specific move in a specific period of time for the whole correction to be a simple one. If this does not happen, or if the time element is not confirmed, the implications are that the corrective wave is a complex rather than a simple one. From this moment on, the trader’s focus will shift towards complex corrections types, and the element that was the base for this decision was time.

Other educational materials

- Bollinger Bands – Profit from One of the Best Trend Indicators

- Trading with the Cloud – Use Ichimoku Cloud to Spot Reversals

- How to Use the Apex of an Expanding Triangle

- Trading with the Apex of a Contracting Triangle

- Types of Contracting Triangles

- Special Types of Triangles

Recommended further readings

- Trading volume and price reactions to public announcements. Kim, O. and Verrecchia, R.E., 1991. Journal of accounting research, pp.302-321.

- “The relation between price changes and trading volume: A survey.” Karpoff, Jonathan M. Journal of Financial and quantitative Analysis 22, no. 01 (1987): 109-126.