The impact of running corrections on the Forex market

A running correction is a powerful structure that forms before the market breaks heavily in a new direction. So powerful are running corrections that people will have a tough time recognizing them when they are forming. Having said that, it means that they can be interpreted after the fact if they are only seen after their formation. This is not a problem for the Elliott Waves trader, as even after the fact, they still provide nice opportunities for taking a trade. There are multiple running corrections that the market can form, and we have so far covered the commonest ones, the double and triple three running. However, there are a few others, such as double and triple running flats, running triangles, etc., but their interpretation should be the same. For the overall interpretation of a count, the nature of a running correction is very important. Indeed, it is as important as the place where it forms.

| Broker | Bonus | More |

|---|

Types of Running Corrections

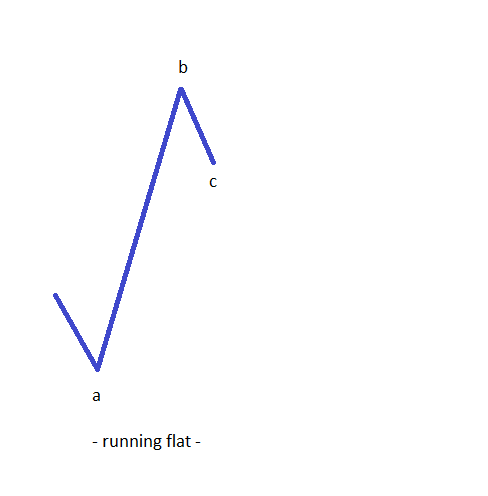

Running corrections have some variations, and they can be simple or complex ones. As a matter of fact, there are only two types of simple running correction, and the rest of them are all complex. The ones that are complex obviously have a large x-wave. For further tips about how to trade a correction with a large x-wave, please refer to the article dedicated to the subject here on our Forex Trading Academy.

Simple Running Corrections

Complex Running Corrections

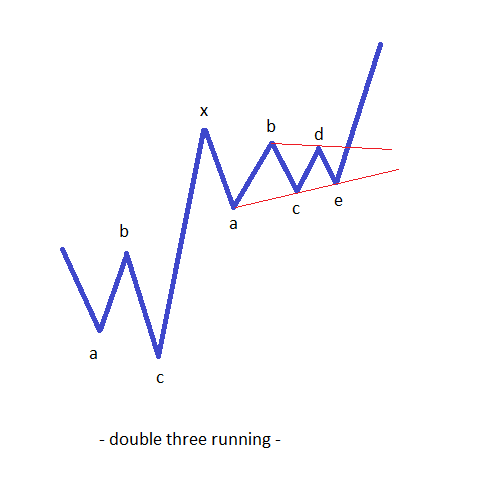

A complex running correction involves at least one large x-wave, and the more complex it is, the more powerful the move to follow is. Elliott discovered the following running complex corrections:

- Double three running – As the name suggests, we’re talking about two corrective waves connected by a large x-wave, which is the most common form of a running correction. It appears mostly as the second wave in an impulsive wave of a bigger degree.

- Triple three running – In this case, there are no less than three corrective waves connected by two large x-waves, and this pattern can go really nasty. It almost always ends with a triangle.

- Double and triple running flats – This running correction is made up of two or three running flats (like the ones mentioned in the “simple running corrections” paragraph) and the x-waves here have the tendency to be even more aggressive than the b-waves in those flats. The move that follows such a pattern is one of the most aggressive ones that can be expected.

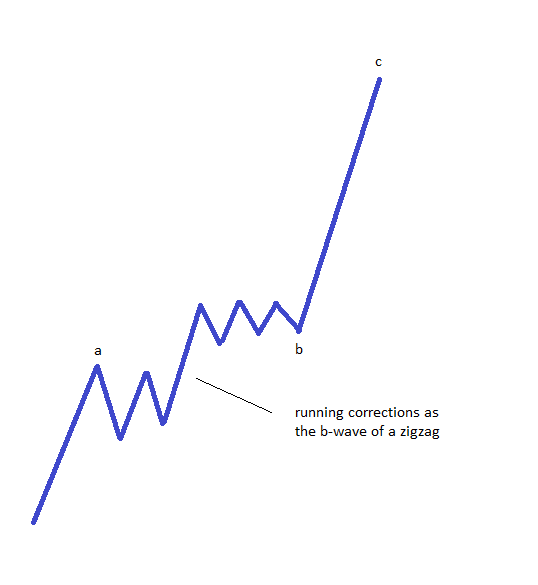

One thing to consider is that, at least in the case of a double- or triple-three running pattern, a triangle is most likely to be expected at the end of the pattern. The triangle, on the other hand, can be either a contracting or an expanding one, but chance favours greatly that it is going to be a contracting one. Therefore, if you ever experience a running correction as the second wave in an impulsive move or the b-wave in a zigzag, just wait until a triangle forms and then try to correctly interpret the triangle. (For this, please refer to the articles dedicated to contracting triangles here on our Forex Trading Academy.)

By the time the b–d trendline of that triangle is broken, it means that the second wave in the impulsive move is completed as well. That is the moment from where the third wave, or the impulsive wave that needs to be extended, starts, and this is why an explosion in price and overall market activity should be expected. Future articles will discuss the running concept of these complex corrections in more detail, as they are really important to the overall Elliott Waves theory. It is not possible to have a proper Elliott Waves count if running corrections are not part of it.

Places Where Running Corrections Appear

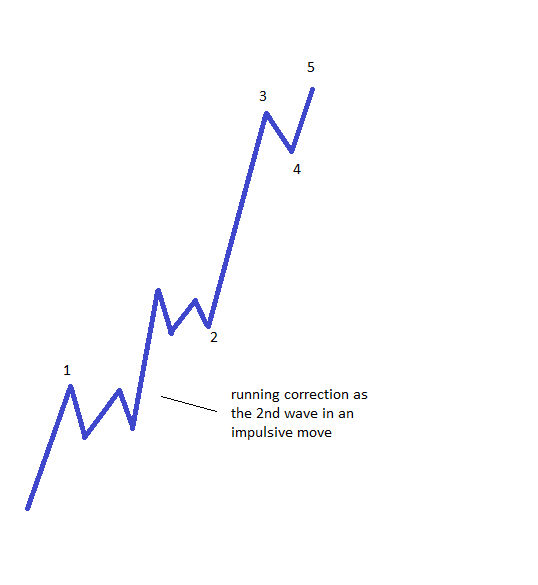

There are three possibilities for where a running correction may form, and they all take into account the fact that a powerful move should come in the direction of the previous wave that formed prior to the running correction. Keep in mind that an impulsive wave needs to have at least one extended wave, and extensions usually come after a running correction ends. As a rule of thumb, a running correction always forms after a five-wave structure. This means that the move that formed before the running correction must be an impulsive wave. Based on the nature of that impulsive wave and its structure, there are three places to consider where running corrections may form.

The Second Wave in an Impulsive Move

The B-Wave of a Zigzag

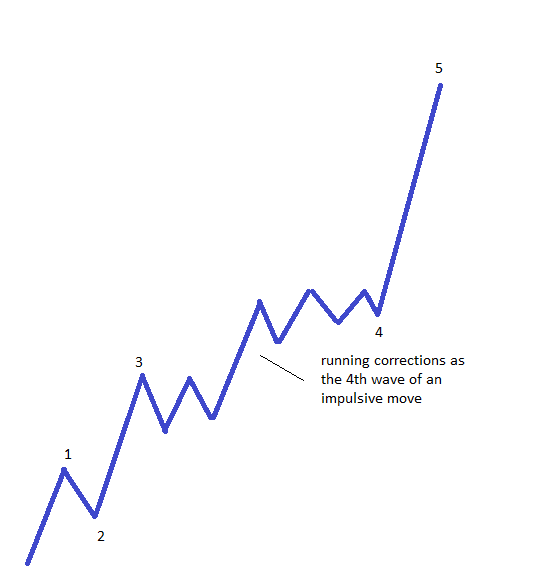

The Fourth Wave in an Impulsive Move

The last possibility for a running correction to appear is the fourth wave in an impulsive move. In this case, the previous third wave is the five-wave structure that needs to form prior to the running correction. In order for the fourth wave to be a running correction, it means that the fifth wave will be the one that is going to be extended.

Out of all the running corrections that can possibly form, in the case that the fourth wave is a running triangle, the price action to follow after the triangle breaks higher should be limited in both price and time. We covered this topic earlier in one of our articles here on the Forex Trading Academy. These three possibilities are places where running corrections appear in the Elliott Waves theory, and they should limit the possibilities a trader has when counting.

This means that one cannot label a running correction as the a-wave of any move, or some other wave, as it simply means the count is wrong. Understanding that running corrections are really common on the Forex market is a step forward in the analytical process of counting waves with the Elliott theory. When doing a top-down analysis of any currency pair, running corrections are to be identified on each and every timeframe. A proper top-down analysis starts from the monthly chart and comes down to the weekly, daily, and even shorter timeframes. The idea is to start from the bigger picture and then slowly but surely move on to the shorter timeframes, counting waves of lower degree, until a tradable timeframe is reached. In doing that, you’ll find out that running corrections are really common!

Other educational materials

- Placing Pending Orders When Trading with Elliott

- How to Trade 2nd and 4th Waves

- The All-Important B Wave Retracement

- What Are Corrective Waves?

- Trade Forex with Simple Corrections

- Complex Corrections in Elliott Waves Theory

Recommended further readings

- Endogenous Financial Networks: Efficient Modularity and Why Shareholders Prevent it. Hazell, J. and Elliott, M., 2016. In 2016 Meeting Papers (No. 235). Society for Economic Dynamics.

- The Elliott’s Wave Theory: Is It True During the Financial Crisis Magazzino, C., Mele, M., & Prisco, G. (2012). The Elliott’s Wave Theory: Is it True During the Financial Crisis?. Magazzino, C., Mele, M., Prisco, G.,(2012), , 100-108.