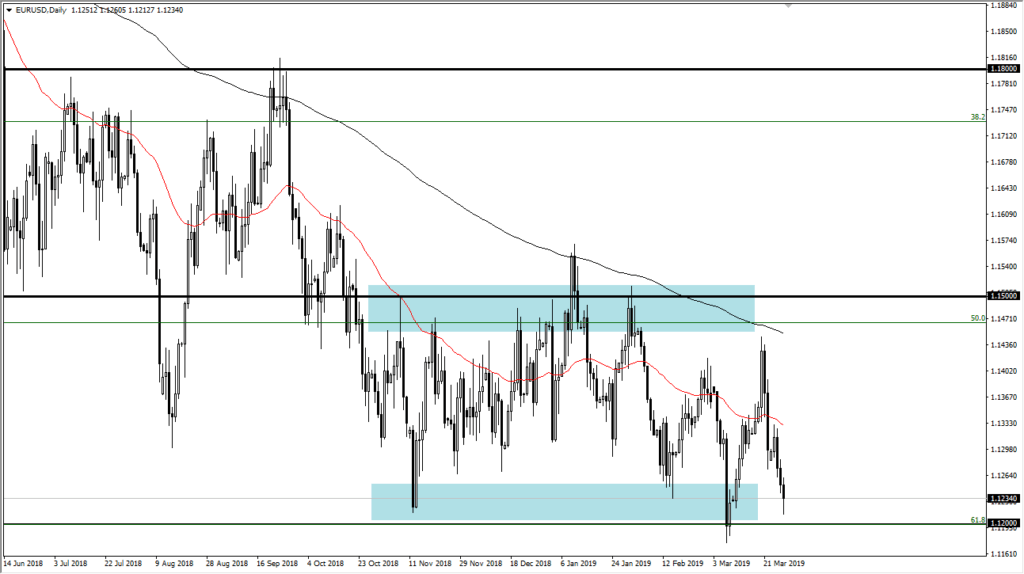

Euro tests major support against greenback

During the trading session on Thursday, we have seen the Euro breaking down rather significantly, reaching towards the vital 1.12 handle and what has been a rush to the greenback. We have seen a lot of bond buying in the United States, and that of course demands a lot of US dollars. That being said, it does look like this major level is trying to hold which of course is necessary to keep the Euro above water.

EUR/USD chart

The range

Currently, we have a range that has been somewhat reliable in the EUR/USD pair, with the 1.15 level above being massive resistance, and the 1.12 level underneath being massive support. As we approached the 1.12 level, a lot of value hunters would have been stepping in, as well as short-sellers taking profits. This range has been important for some time, especially at the 1.12 level as it is the 61.8% Fibonacci retracement level of the move from the absolute bottom, which of course will attract a lot of attention. But what I think is even more important is the fact that the level was previous resistance that took ages to break above. That means that this is an area crucial to the markets longer term health.

A leap of faith

Despite what people will tell you, sometimes in the markets you need to have a bit of a leap of faith. Some traders out there will be waiting for specific technical signals, candlesticks, an indicator doing a specific thing, or many other things. While this is not necessarily a bad thing to do, the reality is that most large firms tend to focus on the level and whether or not it holds rather than a particular candlestick type. Sometimes, you simply need to make a bit of a “leap of faith” and believe that the market structure will hold. At this point, it becomes an exercise in money management more than anything else.

If you have a reasonable position size on, taking a loss here won’t be that expensive. You are essentially paying a small amount of your account to figure out where the market may or may not go next. For example, if you risk 1%, you are essentially paying 1% to find out whether or not the Euro will stay in this range. If it does, then obviously you profit. If it does not, then you begin to look at the market in a different light. This is because the 1.12 level is crucial.

The overall take away

The overall take away that I have at this chart is going to be that we are testing major support. Yes, the most recent sell off has been a bit scary and brutal but let us not forget that the move higher was just as brittle and even made a fresh, new high. As traders, we tend to look at the last 15 minutes as opposed to the big picture. Quite frankly, that is quite often the difference between the winners and losers longer term. While it may not be the easiest trade to take right now, buying the Euro could just be where the profits are made.