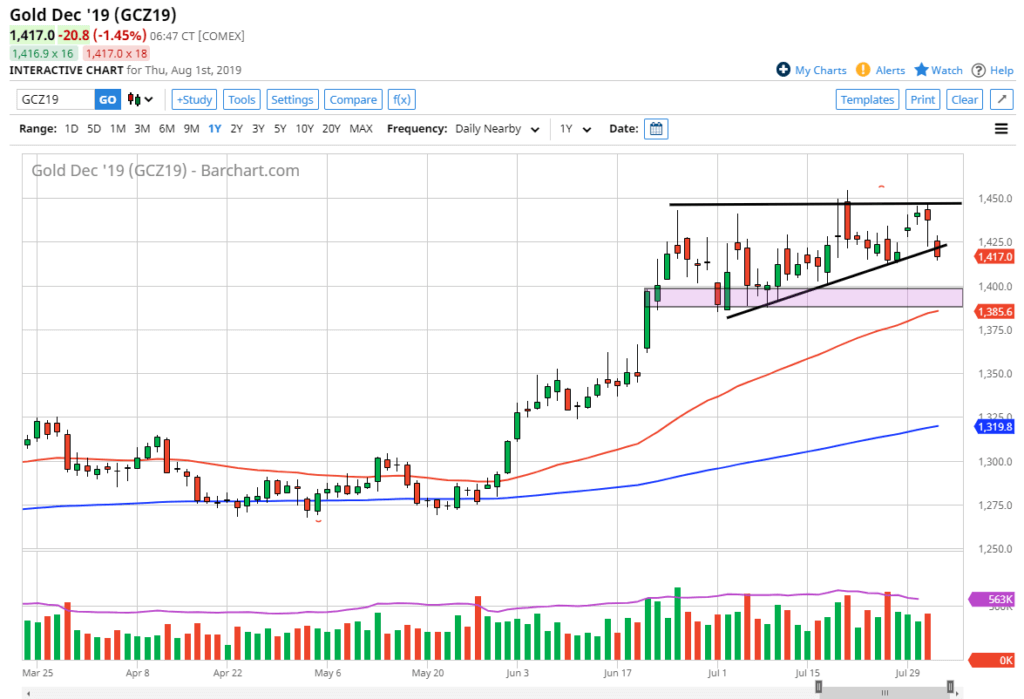

Gold markets ready to roll over

Gold markets broke down a bit during the trading session on Thursday, gapping lower and slicing through an uptrend line that has been relatively obvious over the last couple of months. That being said, it doesn’t necessarily mean that the market is going to fall apart, rather it just needs to roll over a bit so that we can find some type of support, perhaps heading towards the $1400 level as I have marked on the chart.

Broken triangle

Gold

The triangle that had been holding this market up has been broken during trading on Thursday, which of course is a bearish sign but at this point I don’t necessarily think that it’s something to be overly concerned about. After all, the alternative could be that we simply look at the bottom of what would be the rectangle marked on the chart. Not only do we have the $1400 level offering support, but we also have the 50 day EMA heading into that area. The $1400 level also has significant support down to the $1390 level on the short-term charts, so I do think that we will certainly find a lot of buying pressure in that general vicinity.

Federal Reserve

The Federal Reserve cut interest rates during the session on Wednesday, but the reality is that they did not commit to further interest rate cuts. Having said that, the futures markets dictate that there should be more future interest rate cuts, so that should help support gold given enough time. All things being equal though, a short-term pullback does make a bit of sense as we try to digest everything that the Federal Reserve said, and of course the fact that the Friday session has the jobs number coming out of the United States which course will move markets everywhere.

The potential trade going forward

The potential trade going forward is to simply wait for some type of supportive action closer to the $1400 level. You have a clear stop loss area at the 50 day EMA, or the $1390 level. If we were to break down below there then it would signify that we are probably going to continue to break down. That being said, it is probably better to wait until after the jobs figure comes out if you can to get involved in the market.

If we do bounce from the $1400 level then we will probably reach back towards the $1450 level, perhaps in a bid to try to build up enough momentum to break towards the $1500 level above. The $1500 level will of course be very psychologically important, so keep that in mind. I do believe that the market will eventually break above there, especially when the Federal Reserve starts cutting further. Central banks around the world continue to be very easy with their monetary policy, so at this point it’s almost impossible to imagine a scenario where gold doesn’t go higher over the longer-term. This doesn’t mean we will get the occasional pullback, but the fundamental situational for gold still remains very strong.