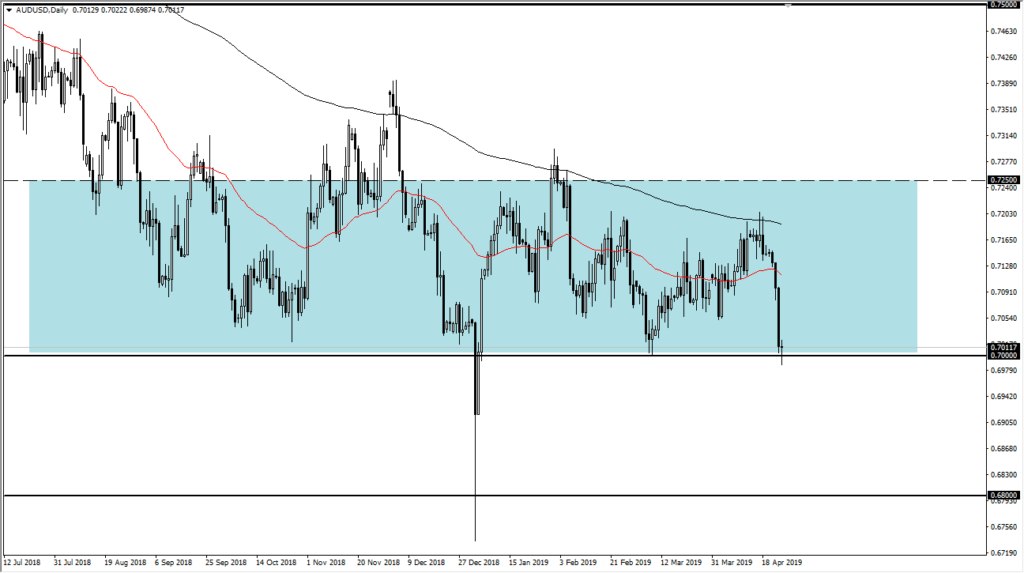

Is the Australian dollar finding a bottom?

The Australian dollar has fallen yet again during the trading session on Thursday, but we continue to see a lot of support in the same region, namely the 0.70 level. As we approach that level during the day on Thursday, we did see a bit of hesitation by the sellers, and it now looks as if the Aussie may be ready to start bouncing again.

Major level

The 0.70 level has been crucial more than once, and the fact that the buyers are starting to step up at this level again during the trading session on Thursday is a good sign for the Aussie. Remember, this pair is a bit different than many of the other currencies that are struggling against the US dollar, as we have the China influence as well. Ultimately, this is a market that should continue to see reactions to the USD/China trade relations and headlines. As it looks like they are ready to negotiate again, perhaps this will be a bit of an outlier when it comes to struggling against the greenback.

Even if we were to break down below the lows of the session on Thursday, which would typically be a selling signal, I would be a bit hesitant to start shorting simply because the area below us is so crucial for support. Quite frankly, if the US dollar gives up some of its gains, it’s very likely that the Australian dollar will be one of the first places you see money run to. Obviously, there is a lot less to chew through to the upside in the short term for the Aussie then there is other currency such as the Euro which has already broken through support.

AUD/USD Daily Chart

Gold

Gold does tend to have an influence on the Australian dollar but it’s not the only thing. Gold has been all over the place during the day and it looks like some value hunting has come back into play. Gold is currently bouncing around the $1275 level, trying to figure out which direction to go from here. If gold breaks down, that could provide more weight upon the Aussie, and at that point I would not want to be a seller but would rather avoid this market altogether. However, if gold takes off to the upside the Australian dollar should get a bit of a boost as well.

The main take away, it’s a one way bet

Looking at the Australian dollar, there are only a couple of things you can do at this region. For example, as we know there is a 200 PIP range of support underneath, why bother fighting to the downside? If you are looking to buy the US dollar there are easier trades to take. However, the US dollar starts to sell off, then 200 pips of support suddenly looks really attractive in comparison to many of the other currency pairs that you could be involved with. With that, we are either buying this pair or simply stepping away. There really isn’t much in the way of alternatives at this point.