Is the British pound trying to form a bottom?

At this point, everybody knows that the British pound has been week, and has been one of the favorite punching bags for currency traders around the world. However, we have recently seen a shift in the attitude of the Federal Reserve, and that of course will have an influence on anything with the letters “USD” attached to it. It’s under this prism that I look at the GBP/USD pair.

Federal Reserve

This past week, we have seen the Federal Reserve suggest that perhaps e-zine monetary policy is still well within the realm of possibility, showing that they continue to acquiesce and serve of the markets. Market participants have been screaming for a rate cut for some time, as we continue the newer monetary policy that has been in effect since the Great Recession. Markets continue to need “monetary methadone”, in the form of cheap money. As the US stock markets have been throwing a fit lately, the Federal Reserve has suggested that it’s there to save the day.

By cutting rates and keeping monetary policy very loose, it drives down the value of the greenback. In that scenario, something is fundamentally changed in this pair. We already knew about the Brexit and all of the problems that brings, but now the greenback isn’t the rock of stability we once thought it was. In that sense, the bounce is probably more a reaction to being near support, and the fact that the US dollar is softening against many other currencies.

The technical set up

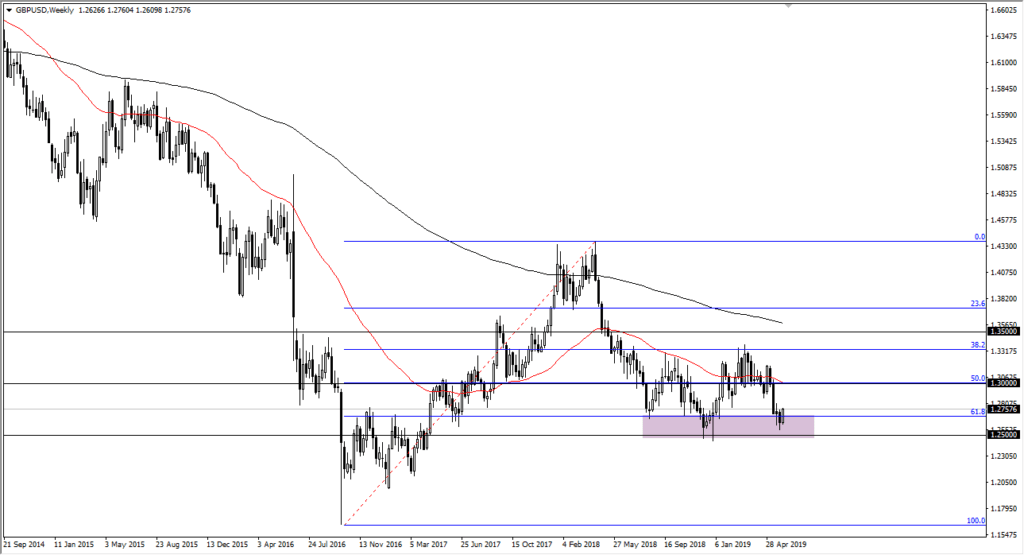

GBP/USD Weekly Chart

The technical set up is very interesting. The fact that we bounced from the area we have is no mistake, because it’s been an area of interest for some time. The 1.28 level just above is minor resistance, but there’s even more interest near the 1.30 level. I now believe that we probably go looking towards that area based upon this past week’s candle.

The 1.25 level underneath will be massive support and if we were to break down below it, that would be very negative for the British pound. That being said, we are right around the 61.8% Fibonacci retracement level, and it had previously seen the 1.25 level offer massive resistance. That resistance should now be supported and should continue to lift this market.

I believe that a move to the 1.30 level is in the cards, and that we will have to reset and decide where to go from there. I believe that a pullback from that level makes a lot of sense, as we continue to bounce around in this overall general region. That being said, we will eventually get some type of clarity with the Brexit, and once we do I think the British pound can turn around and go higher for a longer-term move. Remember, we are at historic lows, as the British pound has really been this cheap to its American cousin. That doesn’t mean we can’t fall; it just means that at one point or another you have to ask the following question: “exactly who is left to sell?”