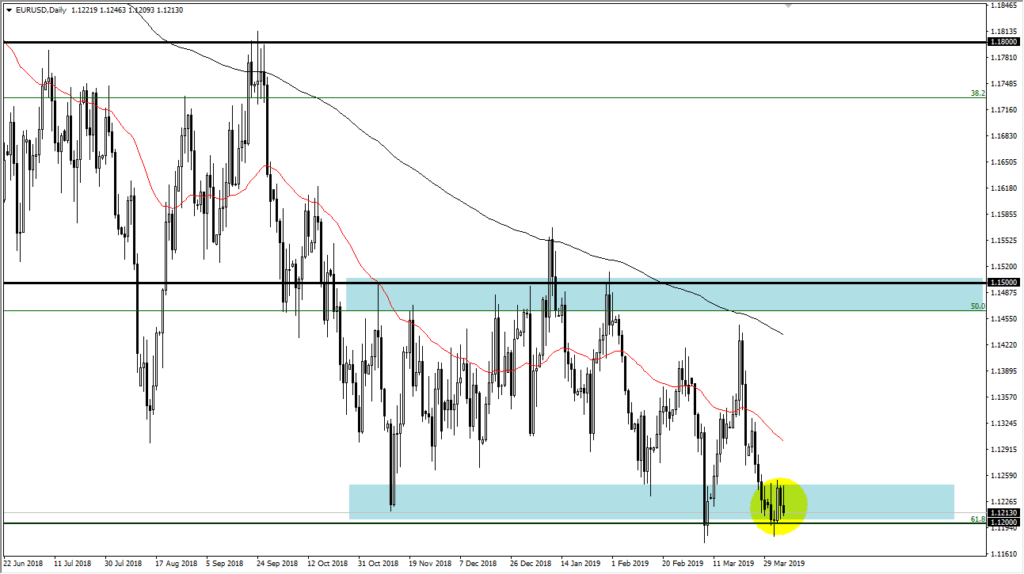

Is the Euro trying to form a bottom?

Looking at the Euro against the US dollar, we have seen a lot of choppy and back and forth trading just above the crucial 1.12 level for several days. Ultimately, this is a level that is crucial from a longer-term standpoint, as the 1.12 level has been important more than once. We continue to bounce from here and the question now is whether or not we are trying to accumulate Euros to push higher?

61.8% Fibonacci retracement level

Looking at the longer-term trend, the 1.12 level is the 61.8% Fibonacci retracement level from the ultimate lows, and as a result there will be a lot of natural interest in this area. Beyond that, we had recently seen a lot of accumulation in this area by a sudden surge higher. Overall, it’s likely that the market will continue to see a lot of interest from both directions in this area, because we have the sellers looking at a weakening global demand scenario, and perhaps more of a “risk off” scenario. That should continue to favor the US dollar. However, the US dollar is getting a bit overstretched.

Central banks

One thing that you should pay attention to is that central banks around the world are looking very loose from a monetary policy standpoint, and the Federal Reserve isn’t going to be any different. With the Federal Reserve stepping away from raising rates anytime soon, it’s very likely that the US dollar will start to soften. After all, it had shown a massive amount of bullish pressure due to the raising interest rates, but that now is gone so it’ll be interesting to see how this plays out. This does suggest that perhaps the US dollar is a little bit overbought.

Beyond that, the Chinese have thrown a massive amount of liquidity into the markets, and that should continue to favor global demand down the road. If we can see a pickup in China, that will have a bit of a “knock on effect” when it comes to other parts of the world including the European Union. At this point, the question then is whether or not all of this central bank easing and measures of liquidity will help demand? If it does it’s very likely that the Euro will benefit as the US dollar will sell off overall.

The technical set up

Euro daily

The technical set up is one that shows a massive move lower, but a bottoming pattern over the last several days. This suggests that perhaps we are starting to see people accumulate “cheap euros”, and longer-term investors may be looking for value. At this point, most pundits believe that the Federal Reserve stepping away from tightening should put downward pressure on the US dollar. We simply need to see a few European economies pick up a bit, especially Germany, then we could see the Euro rallied.

If we can break above the 1.1250 level, it’s very likely that the market will probably reach towards 1.1350 level, and then possibly even as high as the 1.1450 level. In general, this does favor an upward proclivity just due to the fact that there’s so much support underneath. However, the breakdown of the 1.1150 level could send this market down to the 1.11 handle, and then possibly the 1.10 level after that.