Japanese Yen to Continue Showing Strength

- Japanese yen continues to strengthen again several currencies

- Yen is considered “safety currency”

- Geopolitical risks continue

The Japanese yen has strengthened against multiple currencies during trading on Thursday, as the world awaits the next “shoe to drop”. The markets are currently dealing with several issues at one time, including the US/China trade situation, which certainly has a lot of influence on the Japanese yen. As there are concerns with global growth, money starts to look for safety in the form of JGBs (Japanese Government Bonds) it also will go to close out loans taken from Japanese banks, by large funds.

Multiple fronts

It should be noted that the Japanese yen has increased in value against several currencies over the last few days, including the US dollar, the euro, the Canadian dollar, and several others. This shows it will continue to attract flow, as the trend of a higher-value Japanese yen continues. Beyond that, what is truly troubling for the Bank of Japan is that everybody seems to be buying the currency. Intervention probably doesn’t have much on an effect for the longer term.

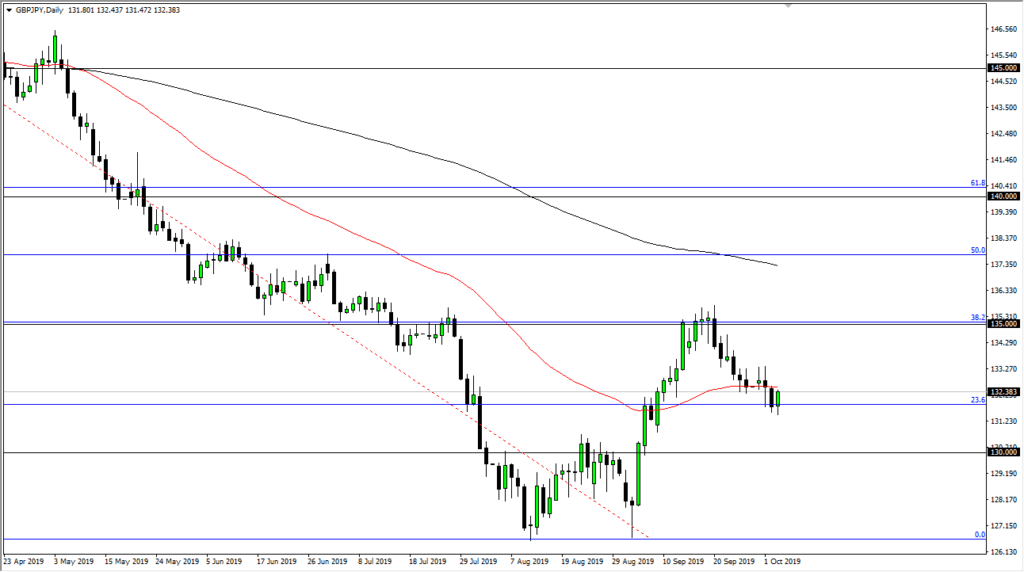

One chart that stands out is the one showing the GBP/JPY pair, although it only indicates a slight bounce and only over the course of the last 24 hours. It’s likely due to Brexit, which of course makes the British pound a bit of an outlier. This has very little to do with risk appetite, and more or less with the fact that the British pound has been oversold due to the Brexit scenario for years. The ¥132 level has caused a slight bounce, but that chart is struggling with the 50-day EMA as well.

GBP/JPY chart

When you see a currency showing relative strength against so many others, there is a story there. The fact that the Japanese yen is strengthening indicates a general “risk-off” attitude out there, and therefore it can have a ripple effect in various markets. This can be seen in the stock markets, currency markets, precious metals, and even the bond markets. Remember, bonds are considered to be a safety trade as well.

The next 48 hours

The next 48 hours will be crucial as the jobs number comes out of the United States during the trading session on Friday. This is going to give us a signal as to whether it is a “risk-on” or possibly a “risk-off” market. These days, all markets are coordinated by algorithms and global portfolios, meaning that the Japanese yen is a crucial currency to pay attention to.

If it rises, generally it tells you it’s time to start buying bonds and selling stocks. Ultimately, the exact opposite is true as well. If the Japanese yen starts to lose value, then you start looking towards “riskier assets” such as stocks or various commodity futures. With that in mind, the Japanese yen might be the most important asset to follow over the next couple of days.