Jobs Numbers in North America Mixed But Strong

- US job numbers better than anticipated

- Canadian job numbers better than anticipated

- This causes the USD to break higher overall

- North America continues to lead the way

The Friday session started off with a bang in North America, as both the Americans and the Canadians released employment figures for the month of January. This caused quite a lot of volatility in the currency markets, the stock markets, and the bond markets as one would expect. The fact that both the Americans and the Canadians reported employment figures puts the spotlight on the United States and Canada in general.

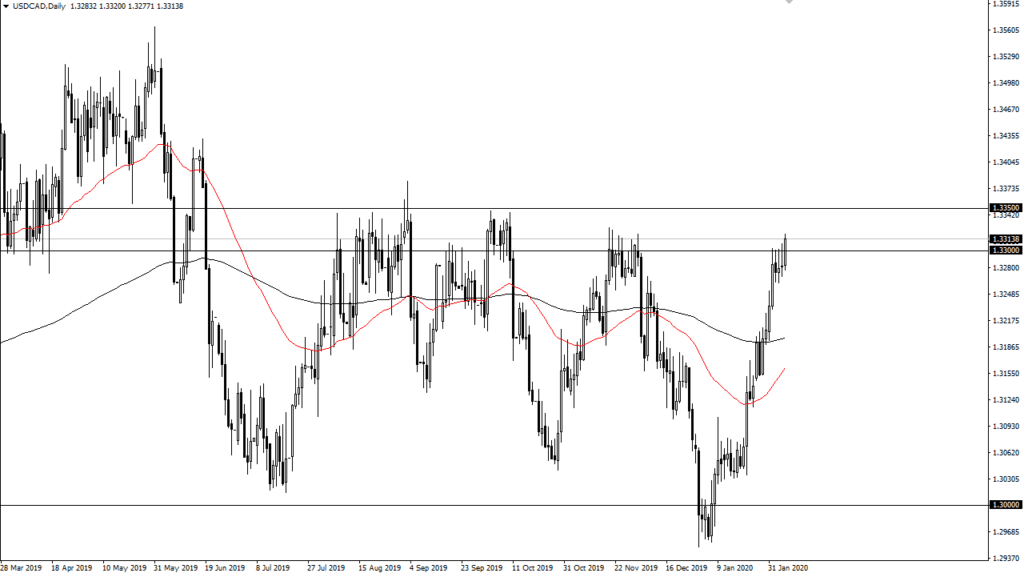

The US dollar was favored out of the two currencies directly following the announcements. The USD/CAD pair continues to break higher overall. The 1.33 level above offers some resistance, but if the pair clears it to the upside, the market will then go looking towards the 1.35 level next.

USD/CAD yearly chart

The announcements ripped up expectations

The Non-Farm Employment Change reading from the US came out at 225,000 jobs added for the month of January, much better than the anticipated 163,000. Furthermore, the revision from the headline number last month was moved from 145,000, to the level of 147,000 jobs. The Average Hourly Earnings month-over-month came in at 0.2%, which was a bit lower than the anticipated 0.3%, while the Unemployment Rate edged slightly higher from 3.5% to a reading of 3.6% for the month, suggesting that perhaps there are more people entering the jobs market.

The announcement out of Canada featured a gain of jobs reading 34,500 for the month of January, as opposed to the expected 16,300. This was much better than anticipated, but furthermore the Canadians posted an Unemployment Rate of 5.5%, which is also much stronger than the anticipated 5.7% for the month. Ultimately, this is a bit surprising considering that the oil markets have struggled so much. Obviously, the Canadian dollar is highly influenced by the crude oil markets, so having said that it is not reacting as positively as one would anticipate.

It is obvious that the United States and Canada are both doing much better than the rest of the world, and that should continue to be the case going forward. Ultimately, this is a situation that favors North America well beyond Europe, and with the coronavirus ripping through Asia, North America has essentially become “the only game in town” when it comes to the major economies.

Money to carry on pouring in to the US

Money will continue to favor the United States and to a lesser extent Canada over the next several months. There are a lot of concerns globally when it comes to supply chains and the like, but it’s obvious that both of these economies are doing much better than various others.

The European Union continues to be toxic, while the Asian area will more than likely continue to struggle until the virus gets contained. Conflicting reports out of China are now starting to suggest that perhaps the outbreak is much worse than the authorities have admitted.