Memorial Day keeps trading quiet

Obviously, when you have one of the world’s largest markets closed for the day, it will put a bit of a lid on things. This is especially true when you have a couple of currencies that are so intertwined such as the US dollar and Canadian dollar. However, this isn’t to say that there won’t be anything to glean from the charts. Quite frankly, this is one of the more interesting pairs to me right now because it offers such a clear-cut look at where I could go.

Range bound

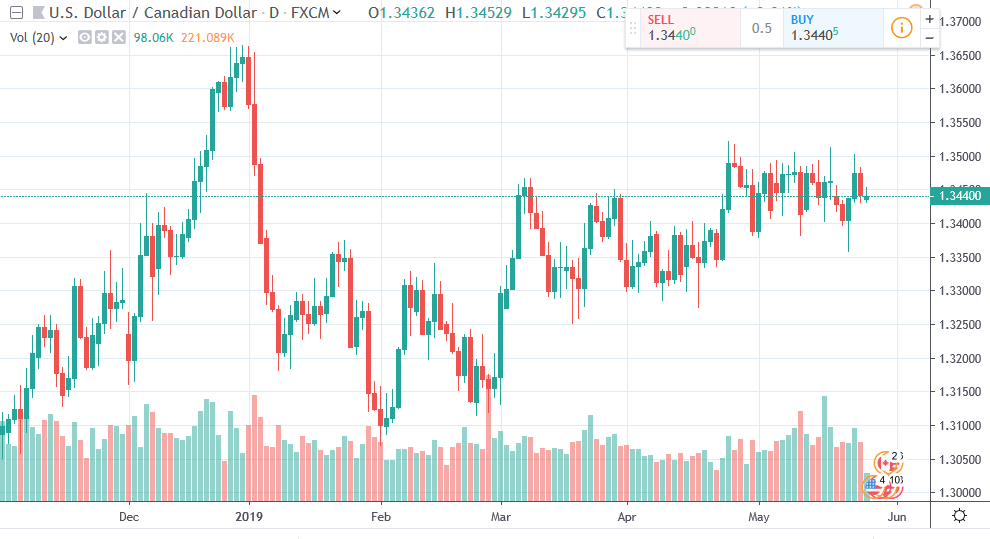

USD/CAD

The US dollar/Canadian dollar pair does tend to be rather choppy anyway, because quite frankly if you’ve ever been to the border at Buffalo or Detroit, you know that it’s just one semitruck after another going back and forth across the border. The economies are so intertwined that it’s difficult to discern between the two at times. However, it should be noted that Canada is only one 10th the size of the United States as far as population is concerned.

Knowing that, it’s easy to understand in times of fear why the US dollar would outperform the Canadian dollar. Historically, the pair has gone back and forth in neat increments and simply carved out reasonably predictive patterns. We are seeing that again, and quite frankly these are the types of currency pairs that I love: ones that aren’t necessarily exciting, but they are reliable.

The significance of 1.35

Recently, we have seen a lot of resistance right around the 1.35, which makes a lot of sense as it is a” 500 PIP” increment, and therefore it will attract a lot of big order flow. We have pressed up against it several times, but have not been able to break above it. If we do break above that level on a daily close, they could open up the floodgates the much bigger moves. That being said, knowing that the level is that important also shows the tenacity of traders as although they couldn’t break out, they certainly haven’t given up.

100 pips

This may seem like lazy technical analysis, but at the end of the day the USD/CAD pair tends to trade in 100 PIP increments. Maybe it’s because of the interconnectivity of the currencies, and the fact that the United States is now the world’s largest producer petroleum, so even though the Canadian dollar gets a bit of a boost from oil markets at times, it’s not going to get as much of abuse against the greenback as it once did.

The main take away

So the main take away here is that I like buying tips. I like using 100 PIP increments to place my traits, so therefore look at the 1.34 level as significant support. There’s no need to over complicate this pair, because it does move quite predictably at times, but you must be patient to trade at one of these large handles. Short-term dips right now look like buying opportunities to me.