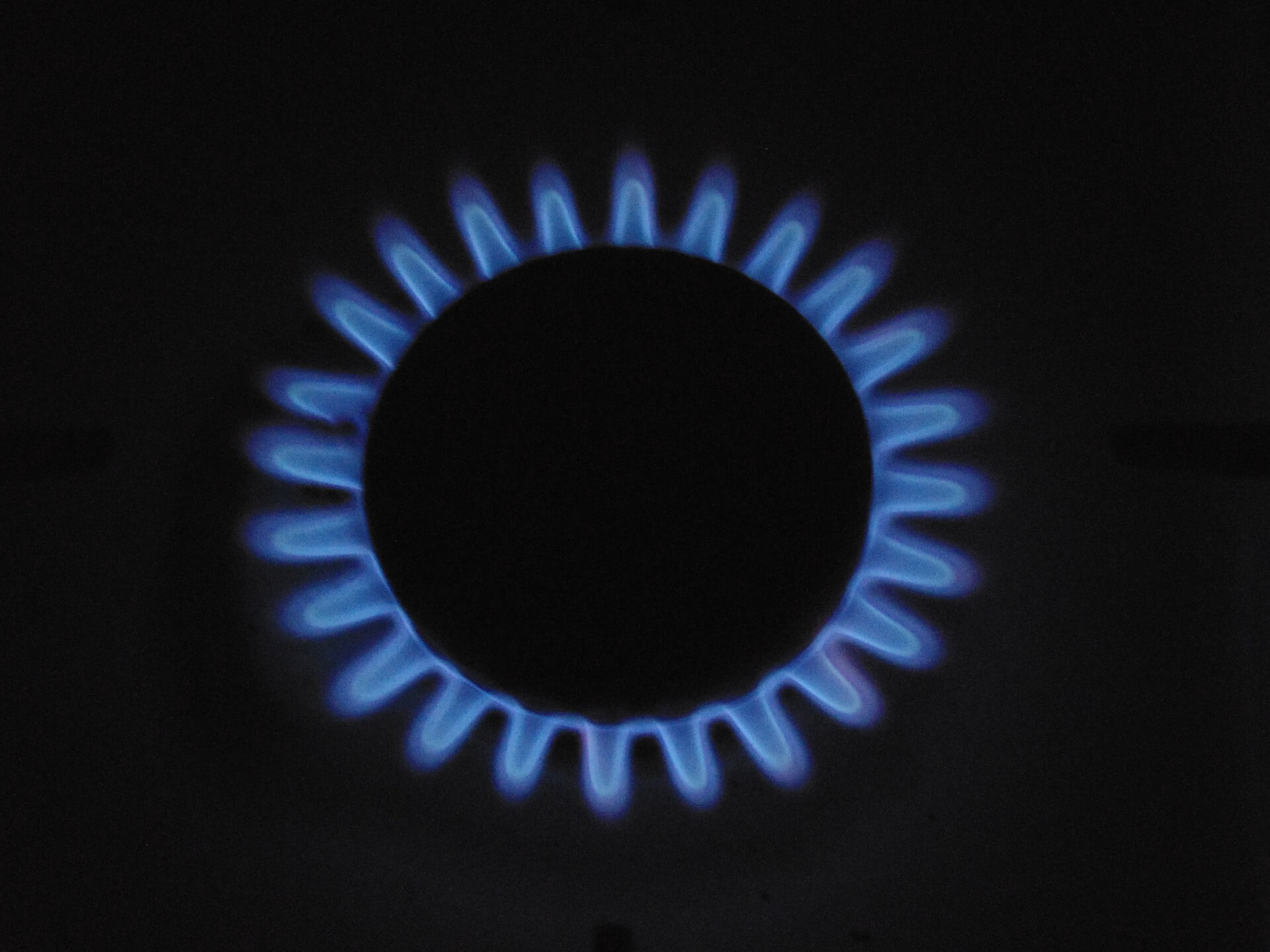

Natural Gas to Continue Volatility

- Historically bullish time of year

- Higher US gas production major issue

- Weather to continue to be in focus

During this time of year, you will typically see natural gas rally, sometimes quite sharply due to colder temperatures in places like Boston, New York, and Chicago. In the northeastern part of the United States, there are the largest consumers of natural gas in the world, as most heating is done using this commodity.

As a result, for several years traders have simply bought natural gas futures in the middle of November and sold them back a few weeks into the following year. By the time the calendar switches to January, spring is on its way, resulting in less demand.

The typical trade

The typical trade in this market is to simply purchase futures contracts and roll them over for the next couple of months. Sharp gains occur almost like clockwork during this time of year as demand skyrockets. Severe cold eventually shows itself in the US Eastern and Central regions, causing higher demand for heating.

However, this year has been anything but “typical”. Although there have been weather events, most recently a cold-weather storm in the US Western region, natural gas markets continued to fall. In this sense, the “typical trade” simply hasn’t appeared quite yet.

Massive short positions

Unfortunately, there have been massive short positions amassed in the natural gas markets, which is going to take quite a bit of momentum to break through.

The overproduction of US gas has kept the US market well supplied. That said, the most recent reading was more bullish than anticipated, but then the question remains as to whether or not that is sustainable. One week does not make a trend, so the initial pop from that announcement has been turned around already.

Speculators have been net short for the last three consecutive weeks, according to the latest US CFTC data available. Still, natural gas markets tend to be very erratic and noisy, so it’s going to come down to the next weather report.

That will be the way this market behaves for the next couple of months, and it will take some sustained cold weather to finally break through the oversupply of natural gas. If there is extraordinarily cold weather in the northeastern part of the United States, or at least sustained cold weather, then it’s possible to see massive short covering, which will spike the market.

The market going forward

Going forward, it’s very likely that we will eventually see a rise in prices. However, the massive drilling during the earlier part of the year continues to weigh on the market.

Once we do get that spike, it’s possible that we will see massive selling of natural gas at some point in January. This might go lower than this year’s lows, as natural gas simply can’t get out of its own way.

Longer-term, natural gas is most certainly a bearish market, but there is the possibility of a quick “smash and grab” type of trade to the upside in the next few months.