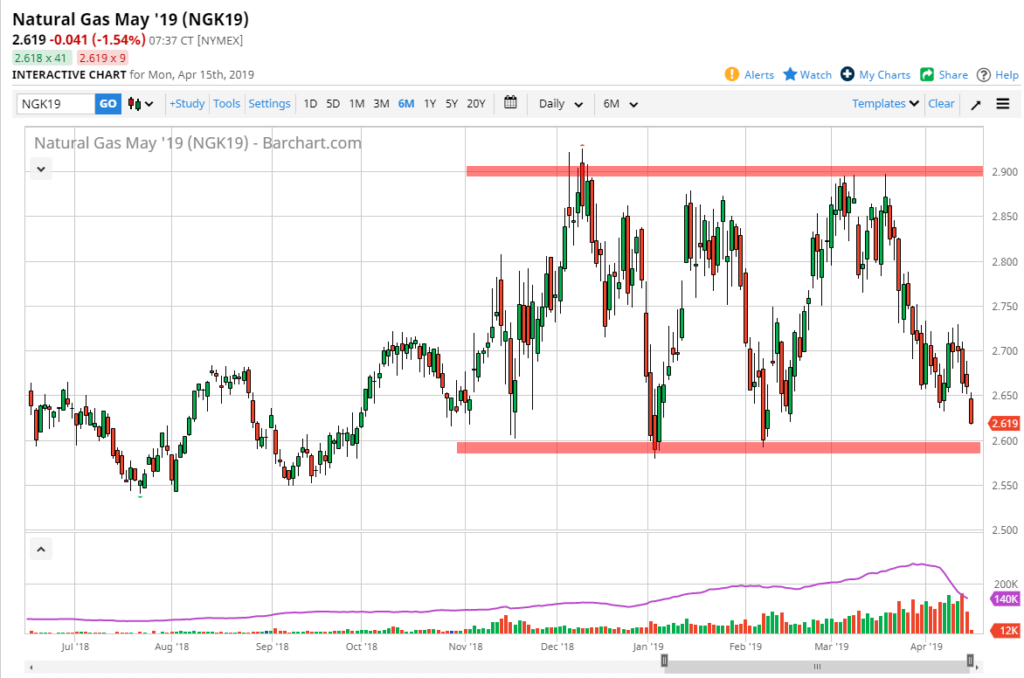

Natural Gas reaching major demand zone

Natural gas markets have been very negative over the last several weeks, as per usual. After all, the United States has enough no natural gas in the ground to power the rest of the world for over 300 years. Canada has even more, so you can see just how overly abundant this commodity is. However, that doesn’t mean that occasionally we get demand because quite frankly there does come a point where producing the commodity costs more than the market pays, and then drillers stepped to the side.

Longer-term consolidation

The natural gas market has been in longer-term consolidation for months. Beyond that, there is a range that it tends to hang about when we are not in high demand season. We are currently approaching the bottom of the overall range, with the $2.60 level being the beginning of major support. That support runs down to the $2.50 level, and quite frankly if we were to break down below that level it would be an extraordinarily negative sign. The next major support level is at the $2.25 level, but quite frankly that is not the likeliest of scenarios.

To the upside, the $2.90 level above is the beginning of major resistance that extends to the $3.00 level. If that’s going to hold as it has, we certainly have much more risk to the upside then down. Ultimately, the market will continue to be volatile, but that’s just the nature of natural gas as it tends to be a bit thinner than other futures markets such as crude oil or the E-mini S&P 500. Because of this, the moves can happen very quickly at times.

Natural Gas daily

The US dollar

Although a minor factor in this pair, if the US dollar starts to fall a bit, that could bring up the price of commodities in general. This of course has a bit of a “knock on effect” on the natural gas market although it should be noted that it’s relatively minor in comparison to other markets such as gold or oil. In general, the US dollar does look like it’s trying to soften a bit so that might be another reason to think that a bounce could be coming.

One of the easiest trades

For quite some time, the market has bounced around in this area with the exception of winter in the United States, as this phenomenon is seen every year. Because of this, natural gas is one of the easiest trades to take because we have a couple of clearly defined areas to trade back and forth to. In general, this is a market that should be taken advantage of, either through the futures markets or perhaps even options as given enough time it tends to revert to the mean.

Sometimes the market defines itself quite nicely, and natural gas of course is one of the best examples of this. At this point in time there’s no point in fighting what is so obvious.

The main take away

The main take away from this market is that there is much more risk to the upside then down. Because of this, as a trader we simply want to mitigate risk and take advantage of what the market offers. There’s no such thing as a “sure bet”, but this market is probably about as close as it comes. The risk to reward ratio certainly is in the favor of the buyers at the first signs of strength.