- Sterling continues to be sensitive to Brexit

- The UK and EU are already disagreeing over terms

- Eurozone outperforms but the data isn’t enough to strengthen the euro

Last week, the pound experienced some gains. This was on the back of the BoE maintaining rates and a hopeful outlook of the British economy’s future. However, this week has seen the GBP/EUR dip, proving the pound is still highly affected by the Brexit situation.

While on January 31, many celebrated the UK’s departure from the EU, just as many were not pleased. It seemed, though, that the optimists were driving the market. This didn’t last, though, as concerns over the negotiations flared up.

In part, Brexit fears were fanned by statements from UK PM Johnson and Michel Barnier, the EU Chief Trade Negotiator. It became clear that the two parties’ goals are practically diametrically opposed. This weakened investor confidence in the pound.

At the beginning of last week, the GBP/EUR was trading at 1.1856 and continued to trend downwards. However, after the BoE announcement, the GBP/EUR rose to trade at 1.1902. Today, the GBP/EUR dipped to 1.1713, forming a new two-week low.

UK and EU views of the future don’t align

UK Prime Minister Boris Johnson dashed any hopes of smooth negotiations between the EU and the UK. In a speech in Greenwich, he made it clear his preference was for a trade deal akin to that of Canada’s with the EU.

Otherwise, he’d be more willing to accept an Australian-style deal than align with EU regulations or European court oversight.

In other words, PM Johnson essentially said he’d rather walk away with no deal than to comply with EU rules.

The EU, on the other hand, wants the UK to align with rules in the EU regarding a number of issues. These include the environment, taxation, state aid, and social and labor policies.

Brussels claims that they don’t want the British government to start subsidizing parts of the economy. Aerospace, steel, and the automotive industry were some examples.

The UK isn’t willing to bend, though Johnson said the standards won’t necessarily be looser. He pointed out that the UK hasn’t needed state aid as frequently as other EU member states.

Michael Barnier said that EU demands shouldn’t come as a surprise to the British. In the political declaration’s text, he said, “Boris Johnson and we … both say that we are keen to avoid any distortion of competition and any unfair competitive advantages.”

Johnson responded by saying that conditioning a free trade agreement with acceptance of EU rules isn’t right. After all, it would be akin to obligating the EU to abide by UK rules.

Other points of contention including fishing rights, judicial oversight, and the Irish border. Negotiations are set to begin in March and must close by October.

Eurozone positive data unable to buoy the common currency

While the GBP/EUR dipped, the euro experienced less significant gains versus the weak sterling than other major currencies. The limited demand for the euro occurred despite relatively positive data out of the Eurozone.

One reason for the relatively weak euro was that the US dollar strengthened. A common pattern with the two currencies is that when the USD strengthens, the EUR weakens, and vice versa.

Yesterday saw concerns over the coronavirus abate somewhat, leading to a stronger USD, as well as other important currencies. However, due to the negative correlation, it led to a decline in the EUR. This is despite manufacturing PMIs out of the Eurozone outperforming.

In the near-term, if Brexit concerns don’t escalate, the sterling could stabilize. Thus, investors would focus more on data. On Wednesday, the UK will publish key economic figures. If performance is on par or exceeds expectations, the sterling could see some gains.

- Boris Johnson wants comprehensive deal with EU

- NZD affected by coronavirus concerns

- Asian currencies rebound slightly

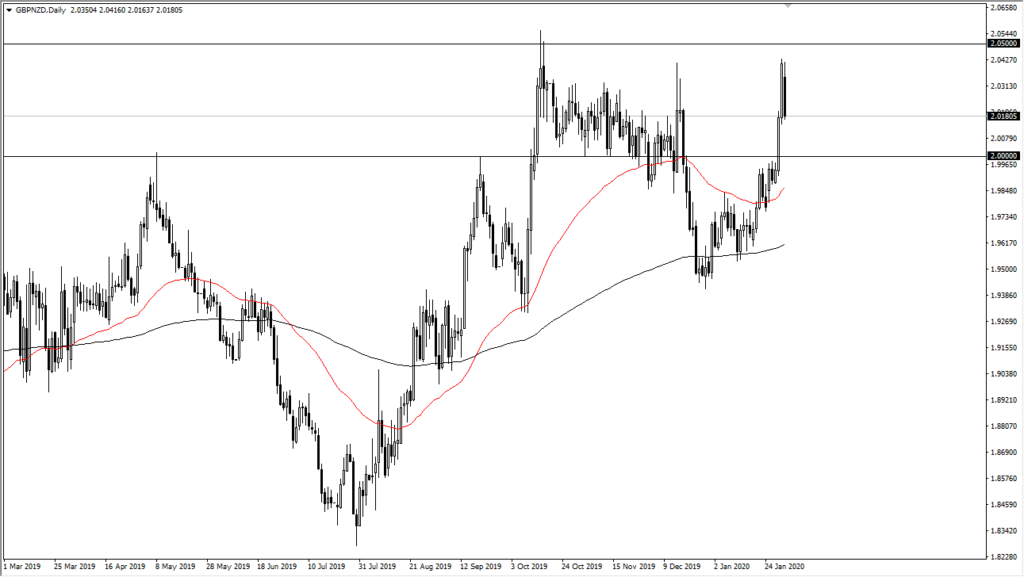

The British pound has been hit relatively hard during the trading session on Monday to kick off the week, showing signs of pulling back from a major resistance barrier against the New Zealand dollar.

However, the market has seen the British pound get hammered against several currencies to begin with, so losing ground against the New Zealand dollar should not be much of a surprise.

Brexit concerns on EU agreement

As if Brexit hasn’t been in the headlines long enough, now there are fresh concerns about whether or not the British and the Europeans can come together to form some type of agreement. The comments made by Boris Johnson on Monday suggest he wasn’t willing to settle with the EU on anything along the lines of a partial deal. Rather, he was looking for a comprehensive deal like Canada has.

This brings fears that perhaps the UK and the EU will have to default to the WTO agreement that both have signed, which could have issues when it comes to adding tariffs.

As usual, comments will continue to move the British pound back and forth, but it should be noted that it was a little overbought to begin with.

Coronavirus impacting the New Zealand dollar

While most will not make the immediate connection, the New Zealand dollar is highly sensitive to the Chinese economy and will therefore be moved by the concerns around the coronavirus.

However, the fear that has been in the financial markets may have been overdone. So, to kick off the week, there has been a rebound after the initial sell-off in Shanghai.

If Asia is to recover, the New Zealand dollar will by default do the same, as a majority of New Zealand exports go into that region. The technical analysis in this pair doesn’t indicate this will last very long.

GBP/USD pair looking bullish

GBP/NZD 6-monthly chart

The technical analysis for this pair is still very bullish. The pullback suggests that the 2.05 level will continue to offer resistance, but not necessarily that the pair can’t go any higher. After all, the 2.05 level has offered significant support and resistance over the years, just as the 2.00 level has been. The market is essentially stuck between the two levels, with the 50-day EMA turning higher, and quite sharply so.

While there are concerns about Brexit headlines, the reality is that the United Kingdom is far beyond the worst of the situation, while Asia and the Pacific are just starting out with the reality of a massive contagion. Because of this, the uptrend should remain intact with an eye towards both of these levels for direction.

- Data indicates the possibility of a rate cut

- German unemployment figures push euro up

- Brexit day and the potential effect on the pound

- Update: BoE holds rates steady

This morning, UK investors were clearly nervous about what the Bank of England would decide regarding interest rates. As a result, the EUR/GBP rose to trade at 0.848, equating to an increase of 0.3%.

Some experts felt the BoE was on a “knife-edge” regarding their decision. Neil Wilson, a Market.com analyst, stated there was a chance the BoE might decide to cut rates now.

He said, “Recent comments from several policymakers at the Bank, some softer inflation data and GDP numbers, and persistent risks to the global outlook suggest the MPC may choose to act now to cut.”

As the UK will officially leave the European Union tomorrow, there’s a chance a rate cut will happen. The UK’s departure from the EU means the country’s economic future is uncertain.

On the other hand, Britain’s economy experienced a fair amount of improvement after the election. Many firms have also begun investing once again. This might lead to the BoE deciding to keep the interest rate at its current level of 0.75%.

Others also felt this might be a possibility. Paul Hollingsworth, a BNP Paribas economist, felt that the policymakers will want “more hard data.” They’ll also want to “see the extent of any fiscal response in the March budget.”

Positive German unemployment data boosts euro

The EUR/GBP also rose on the back of positive German unemployment data. Thus, Germany’s unemployment change for January dropped to -2,000 from 8,000, beating forecasts.

Detlef Scheele, the head of the German Labor Office, had a positive outlook. He said the weakness in the German economy was still affecting the labor market. However, these figures are also an indicator of a positive start to the year.

Germany will be releasing its preliminary harmonized inflation figures for January later today. Analysts expect it to rise to 1.7% from 1.5%. If the figures meet or exceed expectations, the EUR/GBP could remain steady or even rise further.

Coronavirus outbreak helps the euro

Like the yen and the US dollar, many consider the euro a safe-haven currency. Therefore, the continuing concerns surrounding the Wuhan coronavirus outbreak are giving the euro a slight boost.

Markets aren’t certain what to expect. However, according to Reuters, the consensus is that China’s economy, the second-largest in the world, will take a hit. This could reverberate throughout the rest of the world, with possibly unforeseen consequences.

Potential effects of Brexit day on the pound

Tomorrow, January 31, marks the last day the United Kingdom will be part of the European Union. If there is even a suspicion the UK won’t get a good deal with the EU, the pound will suffer.

The Eurozone’s inflation number will also be published tomorrow. Analysts expect it to remain at the same level as last quarter, namely 0.2%. The figure is expected to slide to 1.2% from 1.3% last year.

Also, the UK GfK consumer confidence index is scheduled for release tomorrow. Experts predict the figure will remain at -9.

If inflation in the Eurozone meets expectations, the euro will likely continue to strengthen. This is especially true if UK consumer confidence stays subdued.

Even if consumer confidence in the UK does improve, it’s not a certainty that the pound will strengthen. Brexit day might concern investors far too much for them to have faith in the pound.

Update: BoE decides to hold rates steady

This afternoon, the GBP climbed slightly after the Bank of England decided not to change interest rates. The pound rose by 0.5%. Markets expect that a rate cut will come but towards the end of the year.

- Flash Manufacturing PMI and Flash Services PMI released

- Figures show overall confidence in the future

- Negative fallout from Brexit much milder than expected

Early on Friday, the UK released purchasing managers figures for the month, giving us a look at what the outlook for its economy may be.

The fact that it is better than anticipated suggests that the British business world is starting to come to terms with the Brexit situation, something that the rest of the world will follow right along with, given enough time.

The results of the announcements

The announcements that came out included the Flash Manufacturing PMI and the Flash Services PMI figures for the month. These are an initial look at how purchasing managers feel about the economy and whether or not they are going to put forth capital expenditures.

The Flash Manufacturing PMI reading was 49.8, which was better than the 48.8 figure anticipated. Furthermore, the previous month was revised upward from 47.4 to a reading of 47.5 for the month of December. Also, the Flash Services PMI figure came out at 52.9 above the 51.1 reading that was anticipated. The previous month was revised to 50 from the initial reading of 49.

This shows that, perhaps, purchasing managers in the United Kingdom are much more confident about the direction of the economy than most of the trading world. This is typical, though, because the markets are full of news outlets looking for people to click websites or watch shows. This suggests that the overreaction of the naysayers has a lot to do with emotion and less to do with fundamental analysis. That’s why there is so-called “smart money” that gets into a position much quicker than a lot of retail traders.

The results suggest that money will eventually flow into British equities and the British pound. The currency markets have already seen the British pound rally, but that has more to do with some type of certainty with Brexit than anything else. With this, the longer-term traders are starting to look at Great Britain through the lens of it being a value proposition, and that can help.

The United Kingdom going forward

The reports of the UK’s demise have been premature, to say the least, and we are starting to see economic figures that back up the idea of the UK recovering. If that’s going to be the case, the market is still looking at the early part of the recovery.

That being said, there are also concerns about Brexit headlines as the UK and the EU negotiate the divorce. It behoves both of them to cooperate in good faith now, as the divorce is certainly going to happen.

The bluster will continue, but probably with much fewer reactionary forces in the markets as the ending is now a known scenario. Now, the markets are simply waiting for the details.

- UK leaving EU on January 31

- Deal negotiated during 2020

- PM signaled UK will conduct fruit trade talks with US at same time

In a sign of strong will, Boris Johnson signaled that the United Kingdom would be negotiating with both the European Union and the United States at the same time.

Johnson is aiming for a free trade agreement with both, but it is probably much more realistic to get a free trade agreement with US than it is with the EU. After all, part of the strategy by the Europeans has been to punish the British for leaving. They are concerned about other countries trying to leave the EU, as there are a lot of discontented people in places like Poland, France, Italy, and many other countries.

Quite frankly, if another large economy leaves the union, that could be it for the EU.

Negotiation timeline

The negotiation timeline gets accelerated due to the fact that the UK will be leaving the EU at the end of January. Granted, there is a bit of a “standstill period” between then and December, when nothing really changes. However, there is still a sense of urgency being felt, something that has been desperately needed.

With the Tories running the British government, things will finally get done, as they ran their campaign on a platform of getting out of Europe.

The UK is now free to negotiate with other partners around the world. By getting the Americans involved, this puts a significant amount of pressure on the EU, as the markets are similar in size. In other words, the British are essentially telling the Europeans that they can take their business elsewhere.

Beyond that, what is particularly telling about this scenario is that Donald Trump and Boris Johnson get along quite well, so it’s very likely that the Americans and British will come to terms with a deal rather quickly. In fact, Trump has already suggested this in the past, indicating that Great Britain would be at the “front of the line” when it comes to deals.

Possibility of free trade deal

Looking forward, the Americans and the British will possibly have something close to a free trade deal, if not an actual free trade deal. How things play out with the EU might be a completely different scenario, but more than likely, the Europeans will find it is in their best interest to bargain in good faith.

Now that the UK has a unified government, and perhaps even Donald Trump on their side, it’s very likely that the momentum has shifted to London. Furthermore, there are a lot of concerns out there that Donald Trump may move his focus to trade deals with the European Union now that “Phase 1” is going to be signed between the Americans and the Chinese. This could be a rough year for Europeans.

- UK markets holding their breath for Brexit

- German PMI beats forecasts but still lower month-over-month

- Investor sentiment improves amid hopes of a better 2020

Thursday morning saw the GBP/EUR exchange rate remain flat at approximately 1.179. This month’s Brexit and unimpressive German PMI figures weighed on pound and euro respectively, keeping the rate steady.

Despite weak German manufacturing figures, investor sentiment still improved. The figures may have still indicated a contraction, but they were higher than forecasts. Furthermore, orders have stabilized, which some are taking as a sign of economic recovery.

In the UK, markets are on edge as the date for the UK to depart the European Union creeps closer. Worries over post-Brexit negotiations with the EU aren’t helping the situation either.

Brexit soon to be a reality

January 31st is creeping closer, and markets are on edge as the UK’s departure from the EU becomes a reality.

The pound will likely be driven mainly by the evolution of the negotiations between the bloc and the UK. Many are concerned that the 11-month window allotted for the negotiations is insufficient.

UK Prime Minister Boris Johnson introduced a clause in the Brexit bill that forbids any delays. This continues to worry investors as the UK may be forced into a bare-bones deal.

Samuel Tombs, Pantheon’s Chief UK Economist explained that markets aren’t aware of the level of “Euroskepticism” among the new Tory MPs. The PM is also reaffirming the commitment to not extend the period of transition beyond December 2020. “The stage is set, therefore, for Brexit risk to dampen the economy again in the second half of next year,” he said.

Rabobank’s head of foreign exchange strategy, Jane Foley, shared her views with the Financial Times. “In the UK, the year is unlikely to bring much reprieve from Brexit-related news. Trade negotiations between the UK and the EU will dominate much of the domestic political landscape this year.”

She also stated that if negotiations are difficult, a no-deal Brexit could still become a reality. This would put pressure on the pound, but could also drag down the euro.

Today, IHS Markit will release the UK Manufacturing PMI figures for December. The numbers are predicted to exhibit some improvement, with forecasts at 47.6 from 47.4.

However, this is unlikely to boost the pound seeing as the UK industry is still contracting.

Euro fails to gain against the pound

This morning, IHS Markit released the German Manufacturing PMI for December. The figures were better than expected, rising to 43.7, from a forecast of 43.4. However, it wasn’t enough to push the euro up against the pound.

Despite figures being better than expectations, they still show that the German industry is contracting. It’s the 12th month of contraction in a row . The PMI was also lower than November’s, which came in at 44.1.

Furthermore, new business inflow also declined, representing the 15th consecutive month of declines. This drop is the result of trade uncertainties and the poor global economic situation. Employment also declined at one of the fastest rates in the past ten years.

Despite this situation, investor sentiment increased to the highest level in 15 months. This is on the back of new orders stabilizing to some degree, as well as hopes that 2020 will improve.

Further market optimism is driven by developments between the US and China. US President Donald Trump stated that he expects the “Phase One” deal to be signed on January 15th.

As Germany’s economy relies quite heavily on exports, this has improved market confidence. Investors are now more hopeful that Germany’s economy will soon recover.

- Eurozone economy showing signs of recovery

- Speculators back out of euro short positions

- Brexit fears dominate 2020 forecasts

The GBP/EUR exchange rate has been sliding since the beginning of the week when it opened at 1.1736. The downtrend continued today as speculators closed out their short euro positions on the back of Eurozone optimism.

The GBP/EUR closed the week at 1.17278. The currency pair reached a low of 1.16770 around the middle of the week, and a high of 1.17489. It mainly stuck around the 1.17 level, though.

Euro saw some gains amid hopes for a better 2020

The Eurozone has had a tough 2019, with many of the bloc’s economies slowing down or even contracting. This put a lot of pressure on the euro.

The US dollar, on the other hand, did well for most of the year. This was mainly on the back of the resilience exhibited by the economy in the US.

Thus, the weak results out of the Eurozone and the US dollar’s strength led to the euro struggling throughout 2019.

However, December seems to have buoyed confidence as it seems the Eurozone might be recovering. Somewhat better economic data and the truce between the United States and China have improved business confidence.

This optimism has led to the euro seeing some gains, especially since the hope is that 2020 will be better.

There are also concerns regarding the US dollar. Indications are that the Fed could take a more dovish stance next year if US forecasts don’t improve.

Euro strengthened as investors closed short positions

The euro also saw some gains today as investors closed out short positions. Some experts say this is based on optimism. Others claim it’s a matter of “negative sentiment running out of steam.”

Ulrich Leuchtmann, a Commerzbank analyst, stated, “What I’m seeing here, it’s mainly some euro strength. This very negative euro sentiment has prevailed over 2019 and has run out of steam … coming to this period of low liquidity, more people are more inclined to remove those short positions.”

Regardless of the reason, leveraged funds reduced their short euro positions from $14.84 billion to $9.16 billion, according to Reuter. This occurred in the second week of December, with more investors following suit later.

The low level of liquidity in the market due to the holidays amplified the effect of these moves. This led to the euro seeing some gains. However, there is concern that it’s only a temporary situation as there are a significant number of options set to expire between $1.1155 and $1.1160. This could eradicate at least some of the euro’s gains.

Pound continues to feel the pressure of Brexit

The pound has been suffering lately, despite having seen some gains after the Conservatives won the UK election. Last week, Prime Minister Boris Johnson introduced a clause into the Brexit bill outlawing any extensions.

The UK will leave the EU at the end of January 2020. However, the UK will then enter a transition phase, which will involve further negotiations. During this time, the country will still follow the major laws in the EU.

The end of the transition phase is set for December 2020. Many experts believed this phase would have to be extended beyond December. Many issues need to be addressed, and eleven months is a short timeframe to do so.

Ursula Von der Leyen, President of the European Commission, suggested that Johnson should reconsider his stance on delays. She said she’s seriously concerned over the time available for negotiations.

The repercussions could be significant for both sides if an effective deal isn’t reached. For example, if the UK leaves the EU without a trade deal, the country would experience serious economic disruption. Restrictions on quantities sold in the EU would be applied, as well as taxes.

This has, of course, placed pressure on the pound. It’s likely that, throughout the transition phase, the pound will mainly be driven by news regarding the negotiations.

- Winter holidays prompt low liquidity

- German import prices decline at a slower rate

- Markets seem unsure over Brexit

Monday saw the EUR/GBP exchange rate holding steady at £0.8537. This is despite lower German import prices and Brexit concerns.

The markets are quiet mainly because of the winter holidays. The euro and the pound are likely to remain steady over the winter holidays due to poor liquidity.

According to Stephen Gallo of BMO Capital Markets, traders shouldn’t make assumptions about any movements. He referenced the slight dip of 0.6% the pound experienced against the euro and the US dollar at one point.

Gallo stated that the pound’s decline over the previous few days was over Brexit concerns. However, he further said, “[…] one wouldn’t draw too many conclusions about today’s moves as liquidity is poor.”

German import prices slowed their decline

The German import price index declined by 2.1% in November 2019 year-over-year according to Destatis, Germany’s Federal Statistical Office. October saw a YOY decline of 3.5%, while September saw a drop of YOY 2.5%. Markets expected a decline of 2.3%.

On a month-over-month basis, the import price index increased by 0.5% compared to a decline of 0.1% in October.

The YOY decline was mainly the result of a drop in energy prices of 12.9%. The import price index only declined year-over-year by 0.6% when excluding energy.

The German export price index declined YOY by 0.1% in November, compared to 0.2% in October. Month-over-month, the export price index held steady, as it did in October.

UK Conservative win increased business confidence

After the Conservatives won the UK election, markets seemed extremely positive. Business leaders in the UK experienced an increase in confidence that hadn’t been seen since the 2016 referendum.

The Institute of Directors (IoD) polled its members right after the election. Net confidence in the British economy for 2020 jumped to +21% in December from -18% in November. Respondents also exhibited increased confidence in their own companies, which hit 46% from 26%.

According to Tej Parikh, the chief economist at IoD, the Conservative win was a definite positive for many business leaders.

“A firm majority government means that business leaders, whatever their personal views, now at least have a framework around which they can put in place plans to invest, hire, and expand,” Parikh said.

Brexit still causing uncertainty

However, it hasn’t been all smooth sailing, as the rollercoaster the pound has been on for the past week shows. The pound lost all its election-induced gains in less than a week.

Prime Minister Boris Johnson announced intentions to stop any extensions of the Brexit transition period. This sparked new fears that a no-deal Brexit was still was a possibility.

On Friday, though, the pound rallied as PM Boris Johnson’s withdrawal deal passed with 358 votes for and 234 against. The UK will officially depart the European Union on January 31, 2020.

Subsequently, the UK will enter into a post-Brexit transition phase until December 2020. During this time, the UK and the EU will have to hammer out a free trade agreement.

If they don’t, a no-deal Brexit will happen thanks to a clause Johnson introduced into the bill. According to this clause, it is now illegal for any minister to delay or extend the timetable.

This clause has some investors worried. Eleven months isn’t enough time by far, according to some experts, for the UK and EU to negotiate a deal.

Dean Turner, a UBS Wealth Management economist, stated that negotiating a deal in this timeframe was ambitious. The only way he sees it could happen is if Johnson accepts an “off-the-shelf deal or a bare-bones one.”

Next year will likely see the pound continuing to be affected by Brexit. This time, though, it will be by post-Brexit negotiations. Details pertaining to the trade agreement will affect both the euro and the pound.

Thursday morning saw the release of November’s figure of new car sales in the United Kingdom, which exhibited a decline of 1.3%. It’s not a surprising result seeing as it continues 2019’s trend of declining new car registrations. However, it does drive home that Brexit is having a significant impact on the UK economy.

Ian Plummer, Auto Trader’s Commercial Director, explained that Brexit was hurting the UK industry as well. Manufacturers are under a lot of pressure in this climate. The pound’s value is unstable, and no one knows what trading regulations will look like in the future.

The investors’ shaky confidence in the pound led to the GBP/USD holding steady, despite weaker-than-expected US economic data. The GPB/USD was trading at $1.3130 on Thursday morning.

Pound supported by Conservative lead in the polls

The market is still holding on to hope when it comes to the pound. UK opinion polls show that the Conservative Party is still in the lead. Thursday’s poll averages showed the Conservatives in the lead with 43%, followed by the Labour Party with 33%.

According to Jim Reid, a Deutsche Bank analyst, the pound has received some support from investors. They hope the Conservatives will win the elections, which should lead to Parliament more smoothly ratifying the Withdrawal Agreement. The result would be less uncertainty in the short-term of how Brexit would proceed.

Market sentiment was very positive regarding PM Boris Johnson’s Conservatives winning, so much so that the pound had risen by 1.5% against the US dollar. It also reached the highest level against the euro since May 2017.

US dollar flat despite underperforming economic data

The US dollar remained flat against the pound and other major currencies. This is despite the fact that the ISM non-manufacturing reports and the ADP employment figure underperformed forecasts.

Investors were quick to overlook the data. Instead, they focused on the US dollar as a safe-haven asset. This is amid continued worries over the issues that continue to plague the trade negotiations between the United States and China.

According to Reuters, China stated that the tariffs should be lowered if the two countries reach a phase one deal. However, the two sides haven’t made much progress and seem to be stuck in talks over “core issues of concern.” These include the Hong Kong protests and how China is treating their Uighur Muslim minority.

In fact, on Wednesday, China warned the United States that bilateral cooperation could suffer. This is in response to US legislation demanding a stronger reaction to how Beijing is treating Uighurs in Xinjiang.

Despite these issues, President Donald Trump stated on Wednesday that talks were proceeding very well. A Chinese source also told Reuters that both leaders had discussed reaching a deal. The source also said, “officials are now finishing the work.”

GBP/USD could slide on the back of US nonfarm payrolls

On Friday, the US nonfarm payrolls figure for November will be released. It is expected to increase to 180,000 from 128,000. December’s Michigan consumer sentiment index will also be released tomorrow. It is expected to decline slightly to 96.5 from 96.8.

If the two figures come in as expected, it would be a sign that the US economy is starting to improve. This would increase market confidence and lead to gains for the US dollar.

The pound, on the other hand, will be mainly driven by politics at least up until the December 12 elections. Essentially, any sign that the Labour party is gaining on the Conservatives will put pressure on the pound.

- Conservatives lead has dropped from 14 points to 12 points

- The Pound has weakened on the back of UK election polls

- The US will publish the second estimate of Q3 GDP and October Durable Goods Orders

The latest news from the UK shows that the Conservatives’ lead is decreasing. The lead has dropped from 14 points to 12 points this week. Moreover, the Pound has weakened on the back of UK election polls.

Early election to guide direction of GBP

The UK has published the October BBA Mortgage Approvals which fell to 41.219K from 42.216K. The situation around Brexit has a big influence on the UK and GBP, and the early election should be the main driver in the coming days.

Latest US data also fails to impress

On the other side of the Atlantic, the latest US data is also disappointing, with the CB Consumer Confidence Index falling to 125.5 in November. The October number was upwardly revised to 126.1.

This week, the US will publish the second estimate of Q3 GDP and October Durable Goods Orders, which are expected to be in line with expectations. The US will also release Pending Home Sales and Personal Income, but these figures will not have a big influence on the financial markets.

While trade tensions between US and China are still bringing about market uncertainty, US officials report that good progress has been made. In fact, US President Trump said this Tuesday that the US is in the “final throes” of reaching a trade deal with China.

Background noise and conclusion

Polls about the election in the UK are probably going to be the major driver for the GBP in the coming days. It is also important to mention that Boris Johnson promised Brexit before Christmas if the Tories win the election. A Tories victory is looking likely, and will offer an alternative scenario to a Labour Party election victory which would send the Pound lower.

In the US, trade tensions between the US and China is still generating market uncertainty despite good progress having been made. In the case of economic news, the focus is on US October Durable Goods Orders and the second estimate of the Q3 Gross Domestic Product this Wednesday.