- 50 day EMA holds

- Bullish flag holds

- Value hunters returning

During the Friday session, the British pound rallied quite a bit. British Pound analysis shows that this is a confirmation of the support that the 1.130 level should offer. It looks as if the sellers have been pushed back as they got a “sell on the news” situation with the UK elections. There was concern about Boris Johnson leaving the European Union without any type of deal in the so-called hard Brexit scenario, but the overreaction has been abated.

Technical British Pound analysis

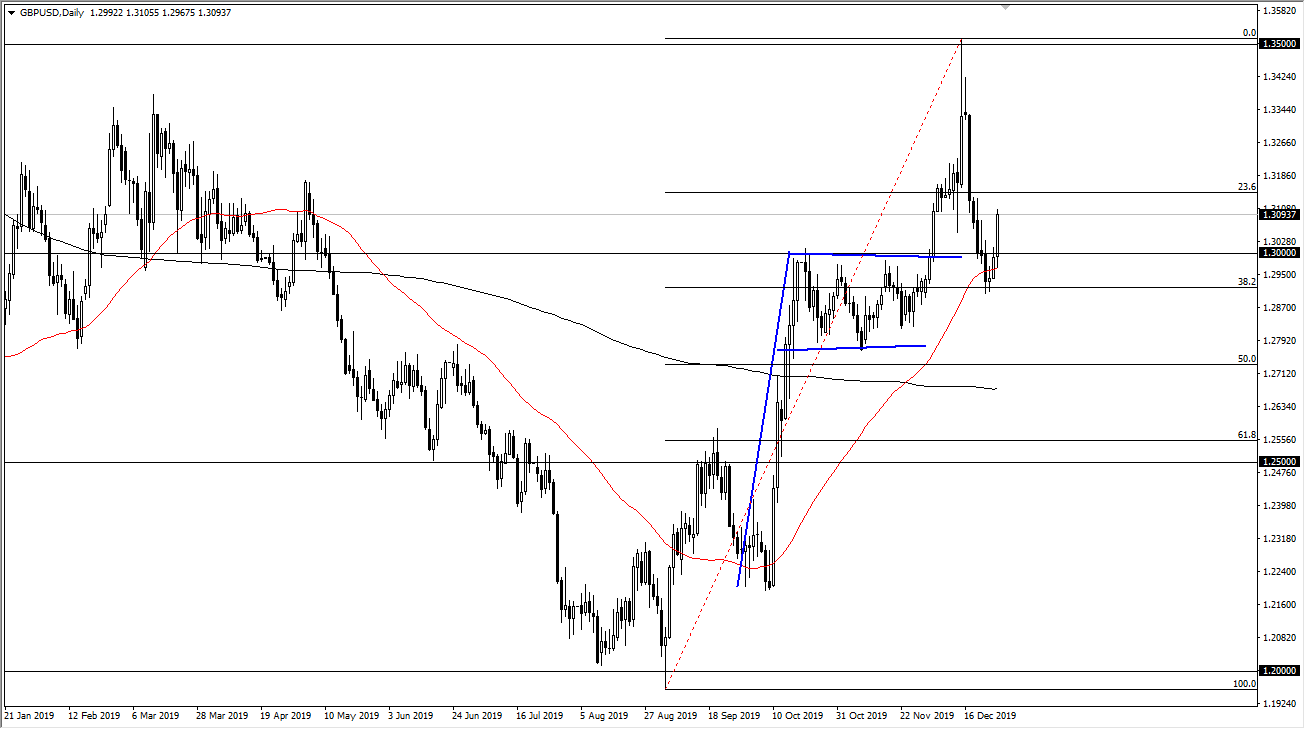

GBP/USD yearly chart

The technical analysis for this pair is strong, considering that it had shot straight up in the air and then pulled back rather drastically. There was quite an overbought condition reaching towards the 1.35 handle after the election results. Since then there has been a rather significant crash. Looking at the technical analysis on a longer-term chart, a clearer picture can be seen as it is still a very strong move and currency pair.

Looking at the 1.30 level, it is a large, round, psychologically significant figure and it will of course attract a lot of attention. The 50 day EMA is sitting just below and has offered support, so there’s another reason to think that the buyers could continue to push this market higher.

Further compounding the potential support in this area is the fact that the previous bullish flag that has been broken out of now has offered support. That bullish flag measures for a move towards the 1.38 handle, which is the longer-term target. In the short term though, there are signs of resistance at the 1.3250 level and the 1.35 handle.

The play going forward

The play going forward in this pair is to simply buy short-term pullbacks and little bits and pieces. It is important not to jump in with both feet into the British pound as so many fellow traders have found out to their detriment over the last couple of years. Even though the market does look very bullish at this point, there are a multitude of headlines that can happen that will suddenly shock the market. That being said though, the market is likely to continue to find buyers on short-term pullbacks. These indicators show that it may be time to start looking for value in this pair.

There will be the occasional headline to send this market lower, so instead of jumping in with a large position, these types of pullbacks can be used in order to build up a larger position. As the resistance barriers above get broken, it’s likely that more money will flow into this market that has clearly seen a significant shift in attitude. Longer-term, the British pound is historically cheap, and traders are starting to realize that reports of the demise of the United Kingdom were greatly exaggerated.

- Conservatives lead has dropped from 14 points to 12 points

- The Pound has weakened on the back of UK election polls

- The US will publish the second estimate of Q3 GDP and October Durable Goods Orders

The latest news from the UK shows that the Conservatives’ lead is decreasing. The lead has dropped from 14 points to 12 points this week. Moreover, the Pound has weakened on the back of UK election polls.

Early election to guide direction of GBP

The UK has published the October BBA Mortgage Approvals which fell to 41.219K from 42.216K. The situation around Brexit has a big influence on the UK and GBP, and the early election should be the main driver in the coming days.

Latest US data also fails to impress

On the other side of the Atlantic, the latest US data is also disappointing, with the CB Consumer Confidence Index falling to 125.5 in November. The October number was upwardly revised to 126.1.

This week, the US will publish the second estimate of Q3 GDP and October Durable Goods Orders, which are expected to be in line with expectations. The US will also release Pending Home Sales and Personal Income, but these figures will not have a big influence on the financial markets.

While trade tensions between US and China are still bringing about market uncertainty, US officials report that good progress has been made. In fact, US President Trump said this Tuesday that the US is in the “final throes” of reaching a trade deal with China.

Background noise and conclusion

Polls about the election in the UK are probably going to be the major driver for the GBP in the coming days. It is also important to mention that Boris Johnson promised Brexit before Christmas if the Tories win the election. A Tories victory is looking likely, and will offer an alternative scenario to a Labour Party election victory which would send the Pound lower.

In the US, trade tensions between the US and China is still generating market uncertainty despite good progress having been made. In the case of economic news, the focus is on US October Durable Goods Orders and the second estimate of the Q3 Gross Domestic Product this Wednesday.

- Brexit Party has decided to step down from 43 additional constituencies

- UK PM Boris Johnson says all Conservative candidates pledged to support his deal

- Conservatives leading in latest opinion polls on upcoming election

According to the latest news, the Brexit Party has stepped down from 43 additional constituencies where Labour won. This move will facilitate the way for a Conservative majority, which will increase the chances for the UK PM’s withdrawal agreement to pass Parliament.

Boris Johnson said that all Conservative Party candidates have supported his deal, but the market is still waiting for the confirmation. It is also important to note that the pound advanced on the news, which lifts chances of the upcoming Parliament passing Johnson’s Brexit deal.

UK election campaign takes center stage

Johnson stated on Monday that he will deliver Brexit on time. He introduced a fresh round of tax cuts and also said he will increase unemployment allowance. Finally, he will also increase the structures and buildings allowance from 2% to 3%.

The political news remains at the forefront for the investors as markets continue to focus solely on the upcoming general election, Brexit, and trade tensions. The main political parties in the UK are expected to publish their manifestos, and the pound will become headline-driven as the election gets closer.

One of the major political events in the UK this week will be a television debate between Boris Johnson and Labour leader Jeremy Corbyn, which may affect some market expectations. More opinion polls are probably going to be the major driver for the pound in the upcoming weeks. In the latest opinion polls, Boris Johnson’s Conservatives are leading and the Brexit Party pledged not to contest Conservative Party seats.

Background noise and conclusion

The UK didn’t release any relevant economic data over the last several days. The macroeconomic calendar will remain “light”, with nothing scheduled for Monday, and only the CBI Industrial Trends Survey on Orders expected for Tuesday.

The situation around Brexit has a big influence on the financial markets, with the early election in December expected to be the main driver.

- GDP Q/Q and M/M released

- Manufacturing Production M/M released

- Industrial Production M/M also released

The UK released several economic figures during the trading session on Monday to kick off the week. Unfortunately, most of the figures have missed quite drastically.

The market has taken most of these announcements in its stride, but it may give a glimpse into why a couple of the members of the Monetary Policy Committee have suggested rate cuts out of London.

The numbers released

- Preliminary GDP Q/Q 3% versus 0.4% expected

- GDP M/M -0.1, as expected

- Manufacturing Production M/M -0.4 versus -0.2

- Industrial Production M/M -0.3%, versus -0.1%

Many of the numbers have missed, and with the specter of Brexit out there, this will spook people when it comes to the United Kingdom. There has been noise during the session about a possible hung parliament, and the British pound has rallied as a result. But this is a short-term fact, not something that can be sustained based on these figures.

The numbers suggest that Brexit is continuing to cause issues, but at the same time, there are a lot of problems in the European Union. It’s possible that part of what the numbers show is the knock-on effect from a weakening European Union, as the EU is still the biggest trade partner of the United Kingdom.

Going forward

The market going forward will be looking at these figures even more closely, as although they were expected to be somewhat negative, the fact that they were worse than anticipated will scare a lot of traders.

Obviously, the Brexit situation will continue to outweigh anything else, but this list of bad news certainly doesn’t help going forward. As such, the market is very likely to continue to show a lot of weakness when it comes to risk appetite in the United Kingdom. But if Brexit is somehow solved, that will probably have traders looking through these numbers and at the possibility of a complete reversal.

During the session on Tuesday, the United Kingdom will release its Claimant Count figures, the Average Earnings Index, and the Unemployment Rate. These numbers will give traders a further look into the possibility of whether or not the market can expect even further weakness out of the United Kingdom.

Furthermore, the headlines coming out about Brexit will continue to throw the markets around back and forth. It appears that the “foundation” of UK economy is under serious stress. This will continue to cause a lot of negativity and concern when it comes to all things British, be it pounds, stocks, or even gilts, as people favor stability these days.

- Sitting above 200-day EMA

- Bouncing nicely from lows of the session

- Continues to grind upward

The British pound has initially fallen during the trading session on Wednesday but then turned around to form a relatively bullish candle by midday in America.

That being the case, it looks as if the market is going to continue to find its supporters given enough time. It’s likely that we will continue to see volatility, but it certainly seems as if there is more of an upward slant or tilt to this market. Buyers continue to pick up value when they see it, shown in the form of pullbacks.

Plenty of headline noise

One of the biggest things a trader must deal with when trading the British pound is the massive amounts of headline noise that seems to be almost unending. Obviously, Brexit is the biggest contributor. With the European Union giving the United Kingdom another extension of 90 days to sort things out, this has relieved some of the pressure on the pound.

This continues to show that the market believes that things are getting better, but they aren’t quite where they need to be. Historically, the British pound is still cheap, but at this point, there are so many possible variances of headlines that one should be very cautious about their position size trade if the British pound ran out.

Technical analysis

The technical analysis of this pair is extraordinarily bullish. Not only have we turned around to form a bullish sign of trading during the day, but the market is most certainly seeing plenty of bullish signs underneath.

We are well above the 200-day EMA, but we’re also are forming a bit of a bullish flag. That is a very bullish sign, and we are banging against the 1.30 level. That is a large, round, psychologically significant figure that will, of course, attract a lot of attention. Therefore, if we were to break above the 1.30 level, the market would show that the trend is most certainly changing overall.

However, if the market broke down below the 200-day EMA, which is closer to the 1.27, then it would very likely go down to the 1.25 handle. This is a significant figure as well, and a scene of clustering from previous trading. With that in mind, it should be a bit of a “floor” in the market.

All things being equal, the British pound does look like it’s trying to build up the necessary momentum to finally break above the significant 1.30 level. That doesn’t mean it won’t be noisy, or that there will be the occasional headline that throws things into a tantrum, but overall this seems to be the pattern.

- Longer term uptrend

- Brexit moving forward

- Large bullish pennant

The British pound has been grinding back and forth against the New Zealand dollar over the last several sessions. This resulted in forming a bit of a bullish pennant in a sign that the market is very likely to continue going higher. With this in mind, there are several things to pay attention to the market. Not the least of which of course is Brexit as it moves forward and looks to have avoided being a “no-deal Brexit” for October 31.

While the worst-case scenario seems to have been either taken off the table or at least put to the back burner, this has lifted the British pound against most currencies. The New Zealand dollar is no different.

Bullish pennant and technical analysis

The bullish pennant is without a doubt the most important thing to pay attention to on the chart from a technical analysis standpoint. However, it’s not the only thing. The market currently is dancing around the 2.01 level. This is a significant figure. Beyond that, the market is also showing signs of support at the 38.2% Fibonacci retracement level. That is a very common level for traders to re-enter a market, especially when it is in an impulsive mood such as the GBP/NZD pair.

Also, worth noting is that we have recently seen the so-called “golden cross”. This is when the 50-day EMA crosses above the 200-day EMA. This is a longer-term “buy-and-hold” signal. Although admittedly for larger players. To the downside, the 2.00 NZD level will, of course, attract a lot of attention.

The projected target would be for an eight-handle gain. This would translate to roughly 2.10 NZD, a nice large figure, which tends to attract a lot of attention. With that in mind, this could be a nice set up on a break above the downtrend line and roughly 2.02 NZD above. With all that being said, the downside scenario should be explored as well.

If the market was the breakdown, it would need to slice through the 61.8% Fibonacci retracement level at the end 1.98 NZD handle. If it did, then the market would more than likely wipe out the entire move and go back to the 100% Fibonacci retracement level which is closer to the 1.93 level. All things being equal though unless there is some type of extraordinarily negative news involving the Brexit, this is a pair that should continue to go higher. The other wildcard, of course, is the US/China trade situation but that doesn’t seem to be going anywhere anytime soon.

- Parliament elects to “punt”

- Continual political chaos

- Ongoing concerns about Northern Ireland

Brexit continues to cause major issues: the UK Parliament has decided to push for an extension of the process while the European Union hasn’t stated whether or not it will offer that extension. In other words, the United Kingdom may not have a choice but to leave on October 31. Granted, there is an enormous amount of economic damage that can be had by the EU if the UK leaves suddenly and without a deal, so one would have to believe that the EU will probably grant that extension.

Unfortunately, this means we will have more nonsense when it comes to trading the British pound going forward. While recently the British pound has rallied against most other currencies in the hope that there will be some type of an agreement, the market has been thrown all over the place for the last three years, and it will probably continue to see that happen. Traders are starting to assume that something is going to be worked out, as the British pound has gained 1000 pips over the last two weeks against the Japanese yen and 800 against the US dollar.

Major danger

British pound traders have gotten so bullish over the last couple of weeks that things are now suddenly parabolic. Unfortunately, this could be reversed quite quickly with the wrong headline. If the EU refuses an extension, it’s very likely that the British pound will get absolutely hammered at that point. However, if they do continue to work things out, it’s likely that there will at least be more hope going forward. Hope seems to be the only thing driving the British pound right now.

One of the biggest dangers will be the contention over the Northern Ireland border regarding whether or not it will have to deal with the EU customs union and how it will be handled. There have been multiple proposals, but the reality is that the situation has not been settled. It also seems as if Parliament will continue with its own agendas.

Caution

There will be plenty of headlines coming out across Twitter, newsfeeds, and all over the Internet that will continue to trick algorithms into buying and selling the British pound. Because of this, the British pound will continue to be one of the more dangerous assets to be involved in going forward, as the markets will continue to try to guess what happens next. Unfortunately, that is the market that we are in right now, as the British pound has been so volatile.

Beyond that, it has also driven a lot of money into precious metals and other such assets as well. This is a global issue that looks likely to continue for at least a few more months.

- The British pound continues to rally on Monday

- Clears 50-day EMA

- Reaching towards psychologically important 1.25 GBP level

The British pound has rallied during the trading session on Monday to kick off the trading week, slicing through the 50-day EMA yet again. This is a positive development, as traders continue to try and figure out what’s going on with Brexit this week. Currently, it looks as if Boris Johnson has been stymied a bit. But at the end of the day, even if Brexit gets delayed, there is going to be one underlying factor in this pair: uncertainty.

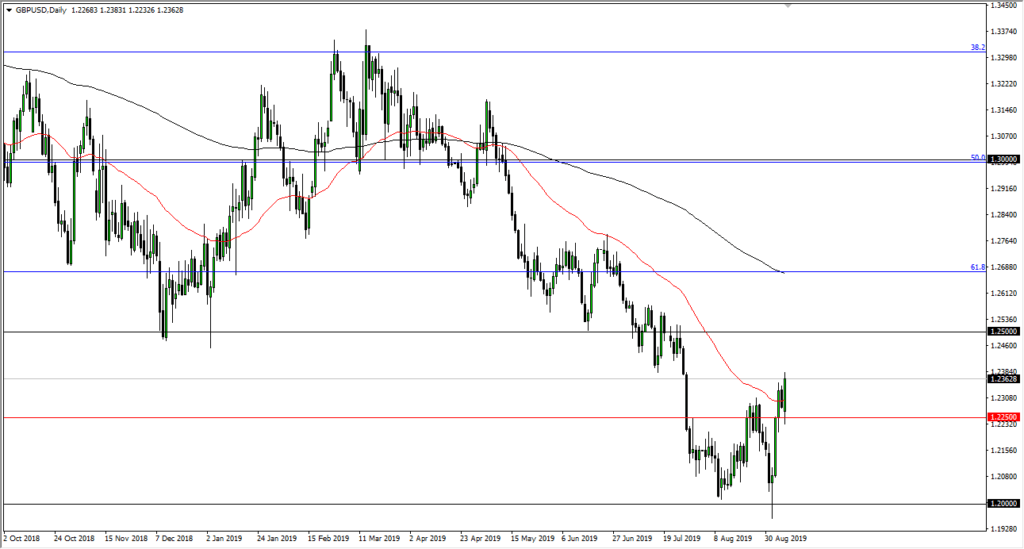

GBP/USD daily chart

Technical analysis

The technical analysis is short-term bullish, longer-term bearish. The 50-day EMA being sliced through, as we have seen earlier on Monday, is a good sign. However, there is still a significant amount of resistance near the 1.25 handle above, as it is an area that looks to be very congested. It has a certain amount of psychological significance to it, due to the fact that it is a large, round, psychologically significant 500-point number. Quite often, you will see large orders at these levels. Beyond that, you can also see that it had zigzagged quite a bit last time it was there, which shows a lot of energy being absorbed by the market.

The 200-day EMA is currently at the 1.2680 level and racing towards the 1.25 level. As such, it’s likely that we will continue to see a lot of interest in the market, as it is the most news-driven pair right now. Everything indicates that longer-term money is simply waiting for an opportunity to sell at higher levels.

The trade going forward

The trade going forward is going to be one that takes some patience. Simply waiting for a move towards the 1.25 level seems to be the most prudent thing right now, because the situation with Brexit is still so fluid. At this point, there is still a fair amount of uncertainty out there that could continue to plague this market. There is plenty of reason to think that the volatility will only get worse, especially as we start to get close to the October 31 deadline. Ultimately, waiting for signs of exhaustion above will be the way to play this market. It’s also worth nothing that the 1.20 level has offered significant support while the market was a bit overextended at that point in time.

Wait for exhaustion candles, and then go with the longer-term trade, which has obviously been very negative. There will probably be one more massive “flush lower” once Brexit gets settled. At that point, it’s very likely that value hunters will come in to pick up the currency after some stabilization. Until then, the trend is still very much negative, even though the last couple of trading sessions have been quite the contrary.

- GBP/JPY pair forming rising wedge-like pattern

- British pound sits below the ¥130 level

- Still in a downtrend

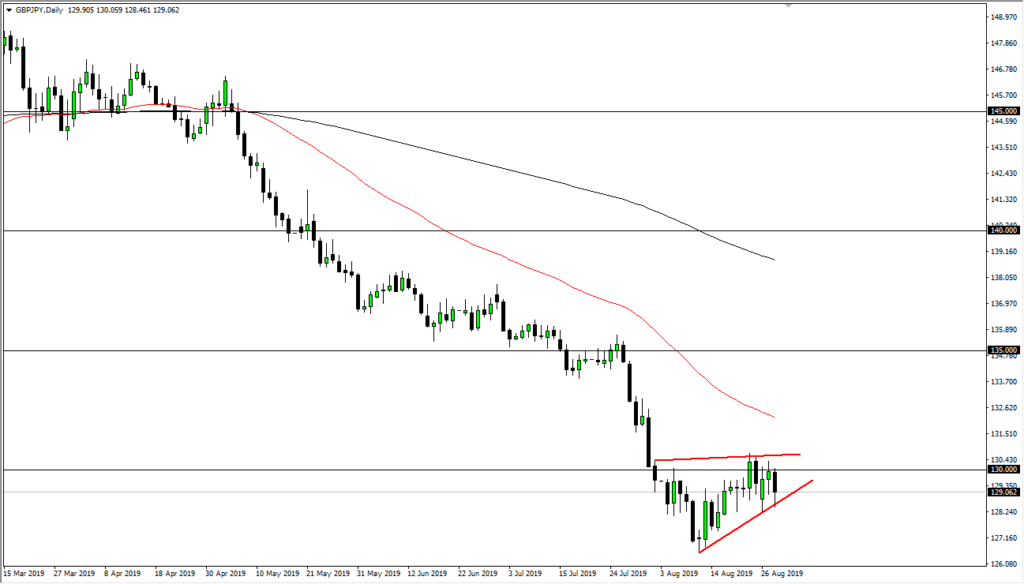

The British pound has fallen a bit against the Japanese yen during trading on Wednesday, as the ¥130 level has offered a bit of resistance. Beyond that, there seems to be a lot of noise in this general vicinity as we have been shopping around for some time. We are a bit overextended, but at this point it makes quite a bit of sense that we remain a bit negative due to the fact that the Brexit still can’t be solved, and it’s very unlikely that were going to see that resolution anytime soon.

Granted, we have seen a couple of short-term headlines that suggest that perhaps people are willing to work with each other, but we’ve seen this movie before. It’s only a matter of time before the whole thing falls apart, because quite frankly there’s no way that these people were going to get it together. At this point, somebody has to capitulate, and it certainly doesn’t look like it’s about to happen.

Crucial round figure

GBP/JPY Chart August 29th

The ¥130 level is a crucial round figure that attracts a lot of attention. That’s one of the main reasons why we continue to grind back and forth, as the level will catch a lot of headlines. We also have a bit of a rising wedge forming, which of course is a technically negative pattern. At this point, if we break down below the bottom of the candlestick for Wednesday, it’s likely that we will go looking towards the 126 young level underneath, which is the bottom of that pattern. Ultimately, if we were to break to the upside, it’s very likely that we would then go towards the 50 day EMA above.

The 50 day EMA above is near the ¥132.50 level, an area that has a certain amount of structural importance to it on short-term charts. This is a market that has been negative and will be negative, so it’s very interesting to see that there is a lot of noise.

Risk barometer

The GBP/JPY pair is known as a risk barometer, as the Japanese yen is considered to be a safety currency. Typically, this pair will break down at times of concern, and the fact that we have the whole Brexit thing going on only adds more fuel to the fire. For a simple measurement of the strength of the British pound, you simply look at the GBP/USD pair. As it is negative, it means the British pound itself is negative. All currencies are measured against the US dollar by the time it’s all said and done.

Trading this market

Trading this market is quite simple. I’m a seller every time we try to rally, but I look for short-term signs of exhaustion in order to take advantage of what has been a very reliable and strong downtrend. In fact, buying this pair is all but impossible until the Brexit is solved and of course the geopolitical concerns, down.