- The death toll of the virus outbreak rises to 17

- Millions on lockdown in two Chinese cities

- WHO postpones decision to declare international health emergency

Thursday saw the Chinese yuan drop as authorities locked down two cities at the epicenter of the coronavirus outbreak. The USD/CNY was trading at 6.9363.

The Japanese yen continued to gain on the back of ongoing concerns that the coronavirus might spread even further. This was fueled by the first case of the coronavirus appearing in the United States, in Washington state.

The yen also gained due to weak Japanese export figures, which declined YOY by 6.3% in December. This is compared to expectations of a 4.2% drop.

Coronavirus outbreak continues to escalate

The coronavirus outbreak has now infected over 630 people and caused the death of 17, as reported by Chinese authorities. However, scientists from the Imperial College London estimate the figures are much higher.

In a report on Wednesday, they stated that over approximately 4,000 people may have been infected. They pointed out, though, that this is likely due to delays in confirming and reporting the cases.

Medical professionals have compared the new coronavirus outbreak to the 2003 SARS outbreak. It took nearly two months for SARS to infect 456 people, whereas this virus spread to over 630 people in just a few weeks.

The CDC, along with other medical professionals, noted that the disease doesn’t appear to be as severe as SARS. The virus can spread through respiratory transmission, according to Reuters, and there is no vaccine against it. Some speculate it could take a year or more to develop such a vaccine.

Two large Chinese cities under lockdown

Chinese authorities have taken measures in an attempt to prevent the disease from spreading further.

In Wuhan, a city with 11 million residents, most forms of transport were shut down on Thursday. A few hours later, Huanggang, a nearby city of 7 million residents, followed suit. Authorities also shut down outgoing flights from Wuhan at 10am. Local reports said some airlines were still flying even after the deadline. Highway toll booths also closed, cutting off road access to the city.

Wuhan residents rushed to hospitals to get tested and fought over supplies in the stores. They emptied out supermarkets and queued up to get gas for their cars.

Most indoor entertainment venues, including cinemas and cafes, were also closed in Huanggang. In Beijing, major public events were canceled, including Lunar New Year celebrations. The people themselves have been taking precautions too. They wear face masks and only go where absolutely necessary.

World Health Organization postpones decision

On Wednesday, the World Health Organization held an emergency meeting. The goal was to decide whether to implement an international health emergency. However, they postponed their decision, stating they didn’t yet know enough about the virus.

The WHO is holding another meeting today and will reveal its decision at a press conference after 6pm (GMT).

Effects of the coronavirus on the economy

Besides the health implications, the coronavirus outbreak could have a significant economic impact too.

While China has been open about the situation, unlike the SARS outbreak, global shares still declined. Chinese stocks experienced the greatest decline in over 8 months. Ned Rumpeltin, European head of currency strategy at TD Securities, said, “Ultimately, the coronavirus is a slow-burning but important story for markets that is likely to last for months rather than just a few days.”

As a comparison, China saw a year-over-year decline of 45% in tourism with the SARS outbreak. The International Air Transport Association (IATA) estimated that Chine lost approximately 1% of its GDP due to the SARS outbreak.

- President Trump passes legislation in support of Hong Kong protesters

- Yen rises as investors retreat to safe-haven currencies

- US dollar flat due to worries over increasing tensions with China

Thursday saw the yen rise as investors moved away from risky currencies, such as the yuan, amid worries that tensions could rise between the United States and China.

On Wednesday, President Donald Trump formally backed the protesters in Hong Kong by passing legislation to this effect. This could cause complications with the US – China trade deal.

The Hong Kong Human Rights and Democracy Act of 2019 requires the federal government to levy sanctions against any Hong Kong and Chinese officials engaged in any abuse of human rights. Furthermore, the law requires the Department of State and other federal agencies to review Hong Kong’s political status every year.

The review is meant to determine whether Hong Kong should be allowed to maintain the favorable trading conditions it has with the United States, or whether it should fall under the same conditions imposed on China.

China has vehemently protested against the law, essentially accusing the United States of meddling. In response to the legislation being passed into law, the Chinese foreign ministry threatened that they would take strong countermeasures.

They also stated that any attempt on the part of the United States to get involved in the situation in Hong Kong is “doomed to fail.”

Le Yucheng, China’s Vice Foreign Minister, also voiced displeasure in a discussion with Terry Branstad, US Ambassador to China. He stated that what the US did represented “serious interference in China’s internal affairs and a serious violation of international law.”

Conversely, Hong Kong’s streets were filled with protesters waving American flags on Thursday. Some protesters could even be seen holding signs thanking President Trump and the United States for supporting them. This led to the offshore yuan sliding as investors become more concerned that the rising tensions will affect the trade deal.

Yen rises despite declining retail sales

The yen rose by approximately 0.12% against the US dollar to trade at 109.42. This is despite the fact that retail sales in Japan dropped by 14.4%, which was far higher than the expected 10.4%.

Yukio Ishizuki, a Daiwa Securities forex strategist, explained that investors are buying the yen because of the issues between the US and China. Even the US dollar felt the pressure as it traded flat, despite positive economic data.

The Commerce Department released a GDP that increased by an annualized rate of 2.1%, compared to the initial estimates of 1.9%. Furthermore, durable goods saw an increase of 0.6%, compared to the decline of 1.4% they experienced the previous month.

The Swiss franc also benefitted from the market’s uncertainty. It managed to recover slightly from the 2-month low it was trading at against the dollar. Thus, the USD/CHF was trading at 0.9990. The CHF was also helped by positive Swiss economic data, including a Q3 GPD increase of 0.4%.

Other assets considered to be safe havens also inched higher. For example, gold was trading at $1,456.66, indicating an increase in price of 0.16%.

- USD/JPY was trading near a critical resistance area this Friday

- US and China will roll back tariffs in phases if a deal is reached

- Labor cash earnings and overall household spending above expectations in Japan

The USD/JPY is trading this Friday around the 109.15 level, and according to the current market sentiment, the direction for the pair remains bullish. The US-China trade tensions are still in the center for the investors, but progress has been made in trade negotiations. According to the latest news, the US and China are planning to roll back tariffs in phases once a deal is reached.

Rise in US yields driving the pair higher

The US has moderate economic growth, and the policymakers will probably not cut rates further any time soon. A solid US employment report is keeping US government debt yields in the positive. This has a very good influence on this pair. Still, investors and traders are waiting for information about tariffs removal before they make any big decision.

Japanese data was generally encouraging this Friday. The country released September labor cash earnings, which went up by 0.8% YoY and up by 9.5% for overall household spending in the same period.

It is important to say that JPY is bought as a safe-haven currency in times of uncertainties. Every bad news that is connected with global political risk will likely result in some demand for the safe-haven yen. This will have a negative influence on USD/JPY.

Technical analysis

USDJPY

The USD/JPY has reached 109.47 this Friday, and the pair is currently trading around the 109.15 level. The US dollar is strengthening this week. According to the current market sentiment, the direction for USD/JPY remains “bullish”.

When we look at the daily chart (one candle is one day period) of this pair, we can see that the major trend is bullish (uptrend). As long the price is above this trend line, there is no indication of the trend reversal and USD/JPY is in the “buy” zone.

Background noise and conclusion

The rise in US Treasury yields is driving the USD/JPY higher this trading week, although the pair has lost some value this Friday. According to the fundamental and technical analysis, the major direction for this pair remains “bullish”, and as long the price is above this trend line, there is no indication of trend reversal.

The pair needs to fall below the 108.00 support level to extend moves lower. If the price breaks the strong support level at 108.00, then that would be a strong “sell” signal.

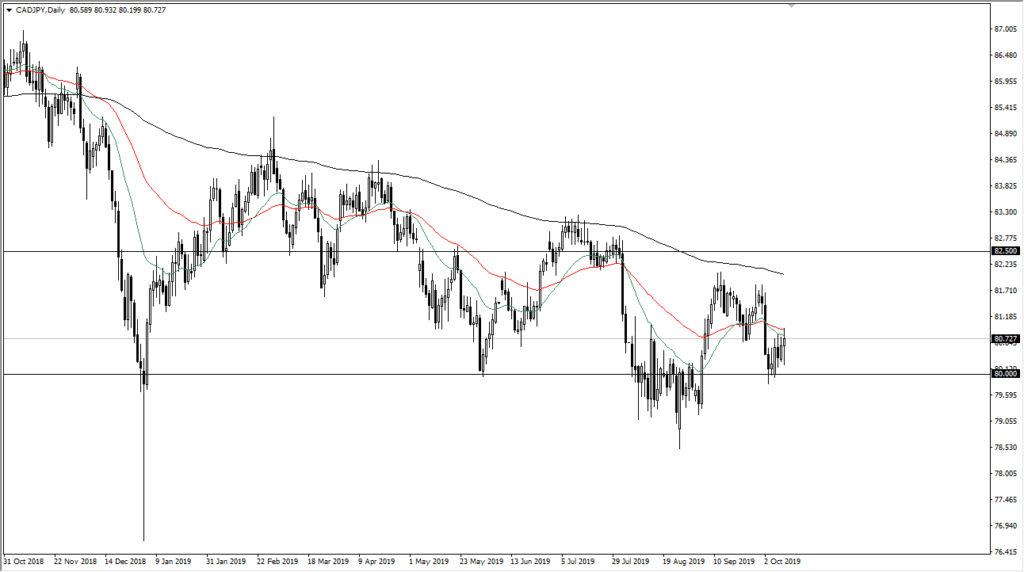

- CAD/JPY continues to find interest at ¥80

- Crude oil markets finding support

- Risk attitude of overall market will be crucial

The Canadian dollar initially fell during the early hours of Thursday, but then turned around to rally towards the 20- and 50-day EMA indicators at roughly ¥81. The ¥80 level underneath will continue to be attractive for traders, as we have seen both resistance and support at this level, and “market memory” should come into play.

A potentially significant milestone

Keep in mind that the ¥80 level is a “large, round number”. That attracts a lot of the larger flow in the marketplace, as large funds simply cannot jump in anywhere. What they will do typically is add or subtract from a position every time it gets close to one of these large figures.

This is because so many others do that it adds enough liquidity that allows them to get in and out of the market without moving it too drastically. This is especially true with some of the cross pairs, such as CAD/JPY. This pair isn’t quite possible to jump into with both feet, as the liquidity isn’t as high as it is in some other currency pairs, such as EUR/USD.

Crude oil influence

Whenever trading the Canadian dollar, the influence of crude oil should be taken into account. This is especially true for the CAD/JPY pair as Canada is an exporter of crude oil, while Japan is dependent on foreign imports for 100% of its crude oil. In a sense, this pair is probably the most sensitive market in the foreign exchange to crude oil because of this dynamic. It is not the only one, but it is probably one of the largest.

With that in mind, one should pay attention to the fact that both the WTI and Brent markets have found significant support just below current pricing and have started to bounce slightly. This can be extrapolated to this chart, where we see this slight bounce from the ¥80 level.

CAD/JPY chart

The trade going forward

The trade going forward in this pair is to simply buy short-term pullbacks until the ¥80 level gets broken. This doesn’t mean we are going to explode to the upside, but it clearly offers a “floor in the market” that we can trade from. With that, short-term trading will continue to be desirable.

Keep in mind that if the 200-day EMA, which is currently at ¥82, were to be broken, it would be a very bullish sign longer-term and could send this market much higher. We would almost have to see the crude oil market break above resistance, so as a proxy you could use the WTI contract and the $55 resistance barrier to mark that move. If that happens, then this pair should continue to go much higher. The most likely scenario is a simple building of a range between ¥80 on the bottom and ¥82 on the top.

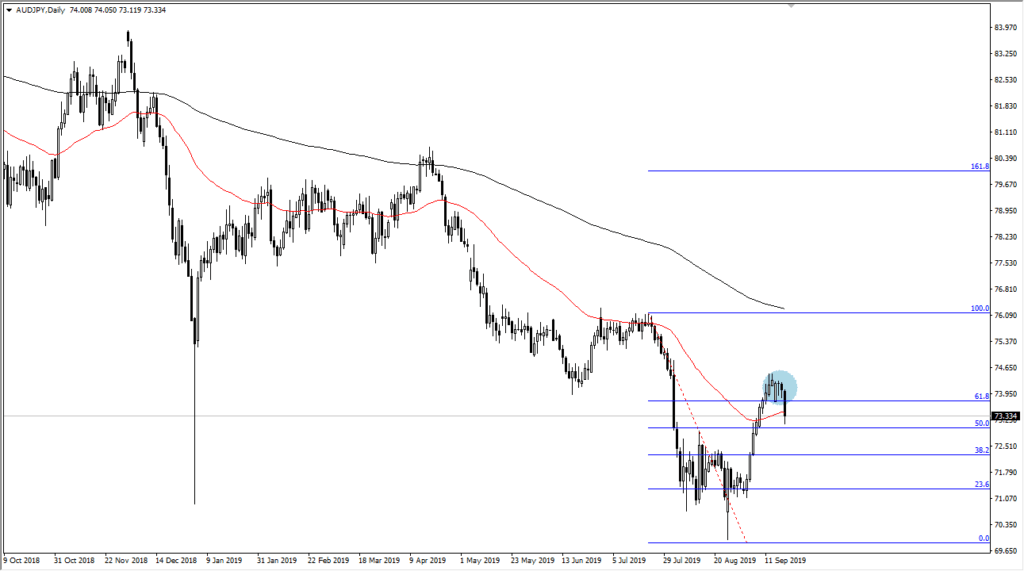

- Aussie dollar sensitive to global growth

- Japanese yen considered safety currency

- Continuation of longer-term downtrend

- Fibonacci levels holding at present

The Australian dollar has fallen a bit during the trading session on Thursday, as it is considered to be a “risk on” currency. Ultimately, as the Australian dollar is so highly levered to China, it makes sense that as long as the US/China trade relations sour, the Australian dollar will have a negative attitude towards it.

Beyond that, the Chinese economic numbers have been very poor lately. So, as Australia’s largest customer suffers, so does Australia.

Pullback

The AUD/JPY pair has bounced significantly, but it also was quite parabolic. That obviously is a major issue, so with that being the case, gravity had to take effect sooner or later. At this point, the market has broken below the 50-day EMA. That suggests that perhaps the shorter-term momentum is starting to pick up to the downside as well.

The 61.8% Fibonacci retracement level has held as resistance on the rally. This is a very commonplace area for traders to get involved. To the downside, this does suggest that perhaps the market could try to go towards the lows again. One would have to think that it is only one headline away from breaking down rather significantly.

While we have had a massive short-covering rally, there has been no real push towards the Aussie dollar. Beyond that, the Australian economy has shown a significant amount of negative pressure. There are several reasons to think that this market should continue to suffer.

Trading this pair

AUD/JPY chart

The pair is rather volatile at times, and will certainly have sudden bursts based on what’s going on around the world. However, the market has been in a downtrend for some time.

Even with the recent pop to the upside, it is still just a blip on the radar, and it certainly looks bearish from the higher time frames. In fact, it’s not unless the United States and China come to some type of major agreement at the next meeting that this pair will turn around completely. The Japanese yen will continue to attract a lot of flow as people are looking to protect their wealth.

To the downside, the market will more than likely go looking towards the lows again.

It is near the ¥70 level underneath, which has a certain amount of psychological as well as structural importance from a longer-term standpoint. To the upside, if the market were to crack above the 200-day EMA, it could change the entire look.

That being said, it seems to be all but impossible until we get that agreement between the Americans and the Chinese, as Australia is essentially “held hostage” to that external situation. There is a lot of volatility just waiting to happen, which will more than likely be in a negative manner.

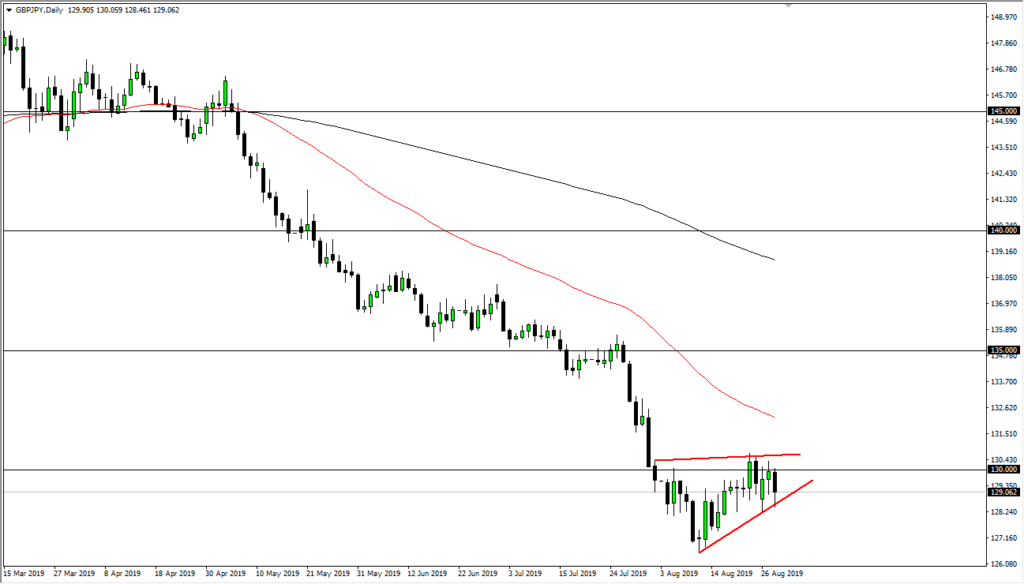

- GBP/JPY pair forming rising wedge-like pattern

- British pound sits below the ¥130 level

- Still in a downtrend

The British pound has fallen a bit against the Japanese yen during trading on Wednesday, as the ¥130 level has offered a bit of resistance. Beyond that, there seems to be a lot of noise in this general vicinity as we have been shopping around for some time. We are a bit overextended, but at this point it makes quite a bit of sense that we remain a bit negative due to the fact that the Brexit still can’t be solved, and it’s very unlikely that were going to see that resolution anytime soon.

Granted, we have seen a couple of short-term headlines that suggest that perhaps people are willing to work with each other, but we’ve seen this movie before. It’s only a matter of time before the whole thing falls apart, because quite frankly there’s no way that these people were going to get it together. At this point, somebody has to capitulate, and it certainly doesn’t look like it’s about to happen.

Crucial round figure

GBP/JPY Chart August 29th

The ¥130 level is a crucial round figure that attracts a lot of attention. That’s one of the main reasons why we continue to grind back and forth, as the level will catch a lot of headlines. We also have a bit of a rising wedge forming, which of course is a technically negative pattern. At this point, if we break down below the bottom of the candlestick for Wednesday, it’s likely that we will go looking towards the 126 young level underneath, which is the bottom of that pattern. Ultimately, if we were to break to the upside, it’s very likely that we would then go towards the 50 day EMA above.

The 50 day EMA above is near the ¥132.50 level, an area that has a certain amount of structural importance to it on short-term charts. This is a market that has been negative and will be negative, so it’s very interesting to see that there is a lot of noise.

Risk barometer

The GBP/JPY pair is known as a risk barometer, as the Japanese yen is considered to be a safety currency. Typically, this pair will break down at times of concern, and the fact that we have the whole Brexit thing going on only adds more fuel to the fire. For a simple measurement of the strength of the British pound, you simply look at the GBP/USD pair. As it is negative, it means the British pound itself is negative. All currencies are measured against the US dollar by the time it’s all said and done.

Trading this market

Trading this market is quite simple. I’m a seller every time we try to rally, but I look for short-term signs of exhaustion in order to take advantage of what has been a very reliable and strong downtrend. In fact, buying this pair is all but impossible until the Brexit is solved and of course the geopolitical concerns, down.