- Crypto gets boost after the assassination of an Iranian general

- Traders around the world running for cover

- Massive gap

It’s been a while since Monero has attracted any significant amount of attention, as it has been suffering right along with the rest of the cryptocurrency market, even Bitcoin. Monero is most certainly a “second-tier” currency, but it looks as if traders around the world have been running away from fiat currency in a bid to protect wealth.

Monero gaps higher, sparked by the assassination of Qassim Suleimani, one of the most important Iranian generals to the regime. This was due to an airstrike in Baghdad, launched by the Americans. This was in reaction to Iranian backed attacks on the US Embassy, marking a significant escalation in tensions for the region. The Iranians have vowed “harsh retaliation” after the airstrike was announced and acknowledged in Tehran.

Monero gaps higher – technical analysis

Monero chart

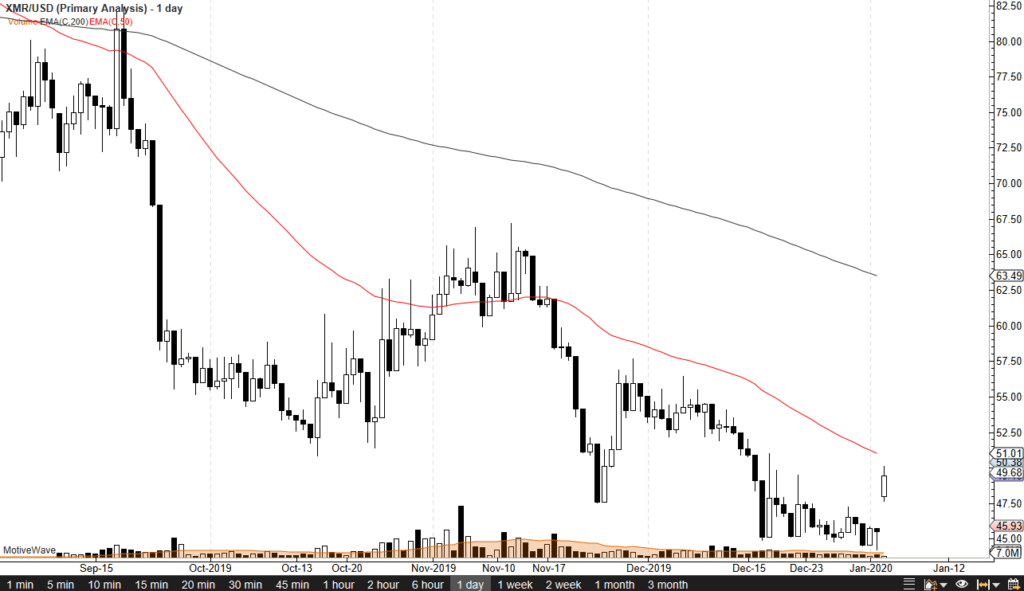

It’s been a while since traders could get excited about owning any type of cryptocurrency, let alone Monero. By gapping how it has reached towards the $50.38 level, it has gained well over 8%. This is a massive gain, one that hasn’t been seen in quite some time. The 50 day EMA is sitting just above, and racing towards this price, currently hanging around the $51 level. At this point, Monero is starting to run into the first vestiges of resistance.

While the technical analysis suggests some type of turnaround, this turnaround will more than likely be short-lived. The $50 level has a certain amount of psychological resistance built-in. Beyond that the 50 day EMA is turning lower, and things are well below the 200 day EMA. The market has been in a downtrend for some time, but this reaction was probably more or less driven by panic and fear than any type of fundamental change in the demand for Monero. It should also be noted that even in this massive gap, volumes were extraordinarily low.

The main take away and play going forward

The main take away from the Monero market is that although things look very bullish in the short term, it should be kept in mind that the market is still in a much longer-term downtrend. The $55 level would need to be broken to the upside to see a major trend change.

Most of the time, when a reaction like this is seen in a very thin market, the move almost always gets reversed. It is much easier for this market to fall from here than it is to rise. It’s very likely that looking back this will have been an excellent opportunity to short this market. The $45 level underneath it looks to be rather supportive but vulnerable, to say the least.

- Monero continues to struggle right along with the rest of the crypto markets

- Downtrend line continues

- Major moving averages sloping lower

Monero is considered to be a “second-tier” crypto market. Because of this, it needs larger markets out there to help lift it going forward. Think of it this way, it is much like the currency markets, where you have major players such as the EUR/USD pair, the GBP/USD pair, and the USD/JPY pair. If you are going to trade the Euro, British pound, or Japanese yen, you need to know how it is doing in the biggest markets, meaning against the US dollar.

In other words, if you wish to make any money whatsoever in these currencies you need to decide whether or not they are strong in general. The same thing can be said for cryptocurrencies, they tend to follow Bitcoin and to a lesser extent Ethereum.

That being said, it has been very difficult for crypto over the last several months, as Bitcoin has gotten absolutely hammered, and of course Ethereum hasn’t done much better. In that scenario it’s difficult to imagine some of the “second-tier” currency such as Monero and Ripple. Unless there is a specific fundamental reasoning, these markets will simply follow right along with the big players. Currently, Monero has been struggling over the same timeframe.

Technical analysis

Monero chart

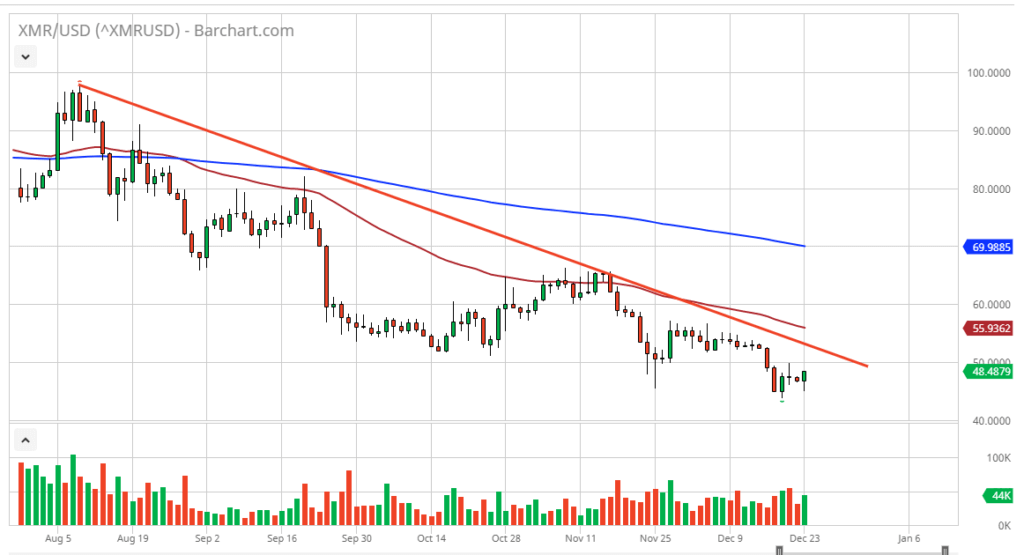

The Monero market continues to struggle with a major downtrend line that is currently squashing any type of growth. The trend line is currently slicing through the $50 level, which of course has its own importance due to it being a large, round, psychologically significant figure. With this, one would expect a lot of selling pressure in that area. Furthermore, the 50 day EMA is sloping lower, hugging the top of this downtrend line. The 200 day EMA is sloping lower and spreading out from the 50 day EMA. All things being equal, it looks as if the longer-term traders will continue to push this market lower.

All things being equal, there’s nothing to keep the market going lower, but if the market was to break above the 50 day EMA then you would have to start thinking about the idea of a trend change. However, you would first need to see Bitcoin start to rally, because it would then start to pick up the rest of the markets.

Going forward

Cryptocurrency markets are in serious trouble. Currently, there is no real catalyst to go higher so fading rallies will continue to be what most people are looking to do in this market. Until we get at least a daily close above the 50 day EMA, it’s hard to imagine the technicians will be excited about this market. That being said, crypto markets do tend to change direction rather quickly.

- Crossing 50-day EMA

- Breaking above $60

- Recently bounced from high-volume

Monero, just like the other crypto markets, has been hammered over the last several months. But this crypto is starting to turn things around, reaching towards the 50-day EMA.

Over time, it has been proven that crypto cannot hang on to gains for any significant amount of time until Bitcoin does the same. It is a massive amount of volume when it comes to this asset class, so at this point, no matter what you are trading, you should have Bitcoin available to monitor.

Technical analysis

XMR/USD chart

The technical analysis for this currency is very bullish, as Monero has crossed the 50-day EMA during the trading session on Wednesday. Not only that, but the volume has been relatively strong lately.

The shooting star from a handful of sessions ago also shows significant resistance that is now being tested. Now that we are seeing this market break this area again, it’s very likely that there will be a significant move to the upside. At that point, technical analysis suggests the market would head to the next large, round, psychologically significant figure of $70.

To the downside, the $60 level should offer a bit of support now that the market has broken above there. It should also be noted that there is a significant amount of volume in that range of price. Ultimately, the market also has formed a bit of a “rounded bottom”.

Overall, the market could not only go to the $70 level, but perhaps to the 200-day EMA that’s currently trading at the $73.23 level. In other words, Monero has a bit of range to continue driving higher.

The trade going forward

The trade going forward is relatively simple when it comes to Monero. There are two things you should keep in mind almost immediately.

The first is to pay attention to what Bitcoin is doing. If it is rallying, and Monero is doing the same, it builds quite a lot of confidence in the upside. At that point, buying every time it dips makes quite a bit of sense. This looks as if it is a trend reversal, just as we are seeing in several other currencies in the crypto markets.

The alternate scenario would be a turnaround and a break below the $50 level. If that happens, and a daily candlestick closes below there, then it is a sign of selling pressure just waiting to happen again. At that point, the market could very well find itself reaching towards the $40 level. That said, based on recent action, it seems to be a lot less likely than the bullish case.

Overall, it looks as if “a rising tide is lifting all boats” in the case of Bitcoin, as it is lifting not only Monero, but several other coins too.

- $70 level offering massive support

- signs of a bounce during early Wednesday session

- previous support just below

- crypto starting to wake up again

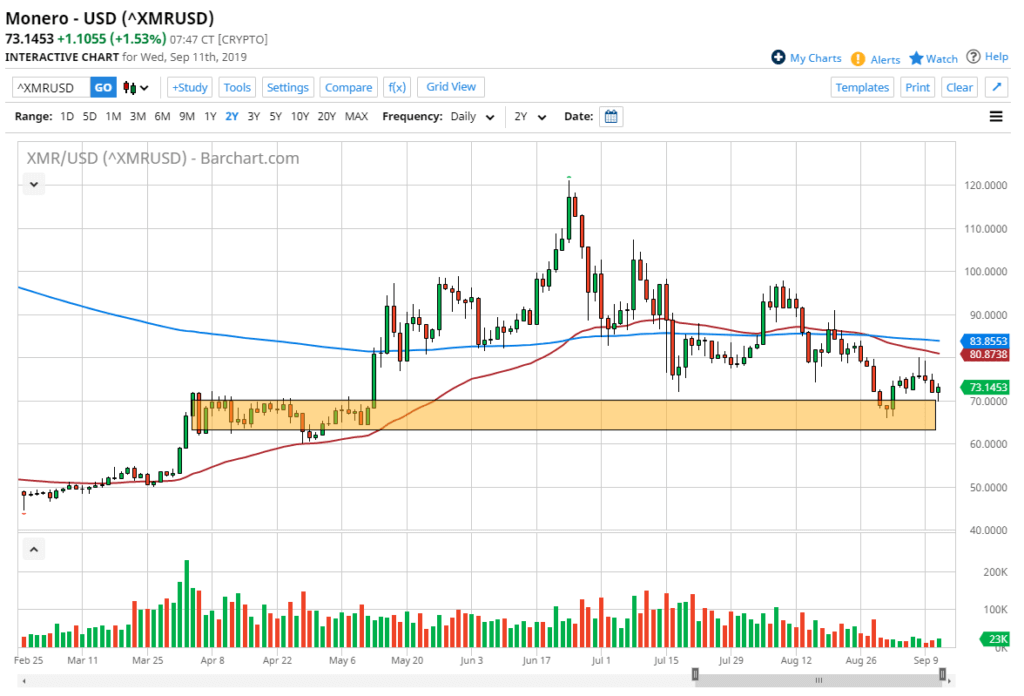

Monero drifted a little bit lower during the early hours on Wednesday to reach down towards the $70 level. However, this time the market didn’t slice right through that level, but rather bounced again. At this juncture, it looks as if the market is trying to turn things around at what has previously been a very crucial level. This is an area that has offered support more than once. In fact, it has even done so rather recently.

Technical analysis of Monero

Monero technical analysis chart

Monero is essentially a market that is trying to find a bottom. The $70 level has been massive support that extends down to roughly $65, and although it has been falling for some time, it is worth noting that we have done a complete return from the initial surge higher. Quite often, there should be a significant amount of support at these levels, so the fact that we have bounced is not a huge surprise.

That being said, there is a significant turnaround at this point, and it looks as if the market has a lot of work to do to start rallying over the longer term. The $80 level above features a couple of shooting stars, and of course the 50-day EMA. All of that will be a massive wall of resistance. However, if the market was to break above that level, it would be extraordinarily bullish, sending fresh money into the market.

In that scenario, traders can look for confirmation in the Bitcoin market, as it drives crypto in general. If Bitcoin is falling, it is very unlikely that Monero will rally. After all, a huge portion of crypto trading is done in Bitcoin. So, much like the stock market, traders will need to see the leaders acting in the right manner.

Trading Monero going forward

Trading Monero going forward is going to be about trying to find whether the buyers can make a stand between the $70 level and the $65 level underneath. Momentum will enter the fray if the market can break above the $80 level, which should send this market much higher based on a resistance level being broken. At that point, it’s likely that the market will go looking towards the next resistance barrier in the form of the $90 level, followed by the $100 level.

The alternate scenario is that the market breaks below the $65 level, looking towards $60 underneath and then eventually $50. This is a major, psychologically important level, so traders will have to re-evaluate the entire situation. All things being equal, it does appear that the buyers are trying to make a stand here, so the next couple of days should be crucial to determine where Monero goes next. With the various levels around current trading, the intention of the market should show itself rather quickly.

- Monero testing major support level from previous trading

- Monero entering value area

- Central banks continue monetary policy

Monero has pulled back a bit during the trading session on Friday to close down the week but is finding a bit of support just below the $70 level. Monero has been somewhat left in the background as Bitcoin has captured all of the headlines lately. All things being equal it’s likely that the market is going to find some type of support though because we are starting to bounce. Beyond that, this is an area that has previously been supportive, so it makes sense that it should continue to be a market that finds buyers based upon value as Monero is “cheap” at the moment.

Value trade

Monero has been falling for some time, so it has become cheap as mentioned, and as it is an alternative crypto coin, you should keep in mind that it’s going to follow what happens with Bitcoin. Monero is much cheaper to trade than Bitcoin, and therefore much more relatable to the average retail account. This is why the market could bounce, in reaction to Bitcoin in general showing signs of life.

If Bitcoin starts to rally significantly, then Monero should right along with it. The initial target could be $80, but quite frankly with the Bitcoin market likely to go higher, this is most likely going to follow right along. Beyond that it’s very likely that the market could go higher than that if Bitcoin continues to show signs of strength.

The alternate scenario

Monero could break down, and we should keep that in mind. The $60 level underneath would be massive support, so if it were to give way to selling it’s very likely that there would be a bit of a “flush lower” in the Monero market, including the Bitcoin market also. Quite frankly, if Bitcoin breaks down that will drag this market right along with it. In other words, the Bitcoin chart should be your secondary indicator when it comes to trading Monero.

If we do get the break down in this market, the $50 level would be the initial target, but quite frankly it’s just as likely that we could go down to the $40 level as it was a major basing level for the longer-term trend to the upside that we are pulling back from. Overall, this is essentially a “binary trade” meaning that the market will either find this area to bounce from or it won’t. This is very much like the Bitcoin market which is currently testing the $9250 level in the exact same manner. Pay attention to that market and how it reacts to that level, it will be at least half of the reason why Monero would rally or fall. Another thing to keep in mind about Monero is that it tends to move and $10 increments, so keep that in mind when adjusting stop losses and perhaps targeting as well.