How to Use Schiff Line Trading Efficiently

A pitchfork is defined as three parallel lines that start from three pivot points, with the line in the middle being the most important one. Its major effect is to attract prices, and it can be used as a leading tool for finding the end of either the third or the fifth wave in an impulsive move. The pitchfork and the Elliott Waves theory are therefore interconnected in such a way that they offer a valuable tool to properly count the waves. However, Andrew’s Pitchfork is not only used together with the Elliott Waves theory, but also as a separate tool for finding the end of trends and signalling the beginning of new trends. We covered the basics of spotting trend reversals with Andrew’s Pitchfork in a previous article here on Forex Trading Academy, and the purpose of this one is to add some more articles and go into further detail on how to use the Schiff line.

| Broker | Bonus | More |

|---|

Using the Schiff Line

Before discussing how to use the Schiff line, we need to define it in order for anyone to quickly identify the line. A Schiff line is obtained by connecting the start of the pitchfork with the end of the third pivot point, or connecting the first and third pivot points. In a rising pitchfork, the Schiff line is always rising, and in a falling one, the Schiff line is, of course, falling. A break in this line therefore signals the end of the bullish trend in the case of a rising pitchfork, or the end of a bearish trend in the case of a falling one.

Spotting Trend Reversals

In a strong trend, the price will tend to stay between the three lines that define the pitchfork. A classical trend will always have price hovering between the lower line (LL) and the median line (ML) in a bullish pitchfork; and between the upper line (UL) and the ML, in a bearish one. That being the case, all eyes should be on the moment the price breaks the LL in the case of a bullish trend, or the UL in the case of a bearish trend. By the time these lines are broken, the focus should shift onto the Schiff line. It means that bulls are starting to take control in a bearish trend, or that bears are starting to get more involved in a bullish trend, and the break of the Schiff line would indicate that the party is over for the previous trend, and that a new one has started. This is the moment when many traders feel lost, in the sense that very often after the Schiff line is broken, the price makes a strong move in the direction of the previous trend. This is a move just guaranteed to confuse people as, remember, the trend that starts is not always the simplest one to trade. In terms of Elliott Waves, it may be that the new trend that has started is a corrective wave, in which case retracements are only normal. Nevertheless, the break in the Schiff line indicates that the previous pitchfork has been invalidated, and new pivot points should be found to draw the new pitchfork corresponding to the new trend.

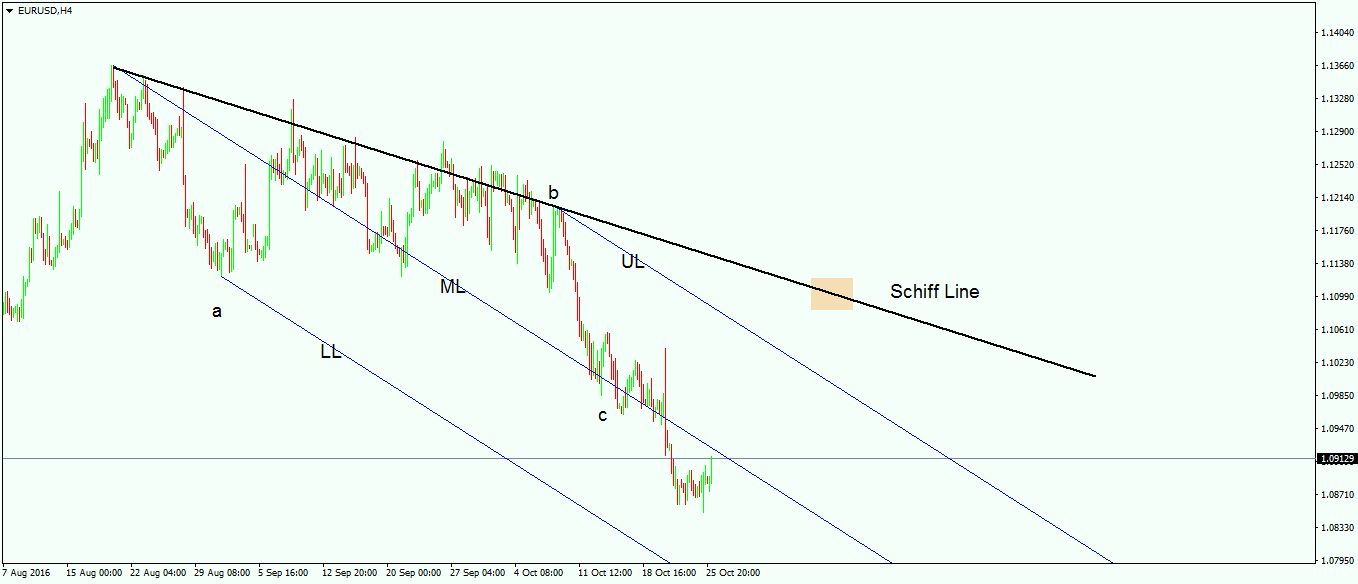

In the example from above, we can see a clearly defined pitchfork that has the pivot points aligned with a corrective wave, as described in the Elliott Waves theory. The corresponding move lower is being attracted by the ML, and the price stays mainly on the upper side of the pitchfork, or between the UL and the ML. From this moment on, bulls should stay away from buying the pair as it is a risky thing to do. Things will become interesting if/when the price breaks the UL, as that will signal that the bearish trend is losing its strength and bulls are starting to be interested in the pair. Moving forward, attention will shift to the actual Schiff line (the black line to be seen on the screen), as a break there implies that the previous trend (defined by the a–b–c in black) is completed, and the bearish pitchforks should be deleted from the screen. A new one should be drawn respecting the same principles, and using the basics of Elliott Waves theory for finding the right places for the pivot points.

Identifying Strong Support/Resistance Areas

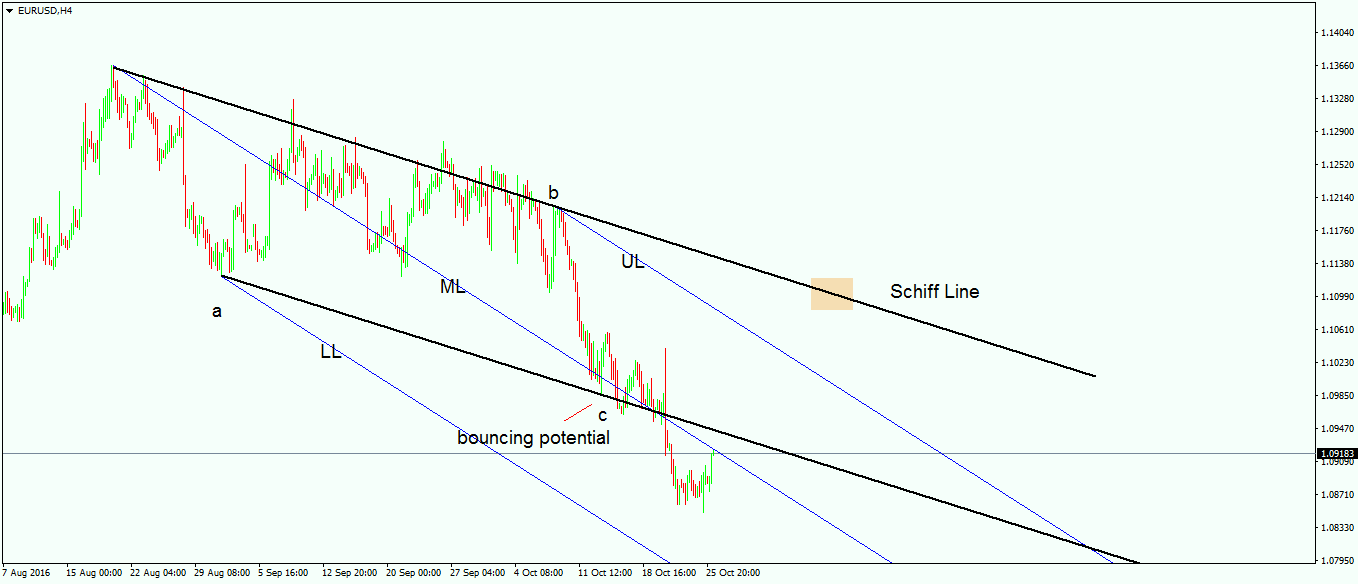

There is another way to trade with the help of the Schiff line, and this entails copying the line and pasting it on top of the second pivot. In a bullish pitchfork, this will result in a rising channel, while in a bearish one, a bearish channel will be visible. Using the same example as the one above, by copying and pasting the Schiff line onto the previous a-wave (the second pivot in this case), traders can identify potential support levels for the move to the downside.

That level represents a bouncing potential, and indeed the market bounced and hesitated at it. It goes without saying that the usual caveat when trading support and resistance levels applies here as well: By the time it is broken, support becomes resistance, and resistance becomes support. In the example above, we’re talking about dynamic support and resistance levels, since the projected Schiff line is moving to the downside, and it is not a horizontal one. This means that moving forward, the projected Schiff line is going to provide resistance every time the price tends to move above it. Buying in such a support area as the bouncing potential area from the chart above shows is a risky trade. It is usually associated with scalping rather than long-term trading. This means that aggressive traders, contrarian ones, are using such areas to trade counter-trend to catch small moves the price is going to make from predictable places. The Schiff line can indicate such places, and the overall strategy works nicely. The timeframe is important in this case also, in the sense that if the pitchfork is applied on the monthly chart, it is unlikely that traders will use the bouncing area for scalping purposes.

We have now outlined the major uses of the Schiff line and its importance in finding support and resistance levels, as well as showing the end of a previous trend. Moving forward, we’re going to focus on Japanese Candlestick Techniques, an important tool in technical analysis.

Other educational materials

- How to Use Parabolic SAR to Buy Dips or Sell Spikes

- Trading Multiple Types of Doji Candles

- Introducing Andrew’s Pitchfork in Forex Trading

- Forex Market Terminology

- Profit from Forex Trading Using Different Trading Styles

- How to Set Up an Expert Advisor

Recommended further readings

- “Trading in the Foreign Exchange Market (Forex): A Study on Purchase Intention.” Nassimi, Masoud, Yasha SazmandAsfaranjan, Alireza Keshvarsima, and Fatemeh Baradari. International Journal of Scientific and Research Publications 4, no. 3 (2014): 1-10.

- Macroeconomic policy and stability in international financial markets Kubelec, C. J. (2005). (Doctoral dissertation, University of Warwick).