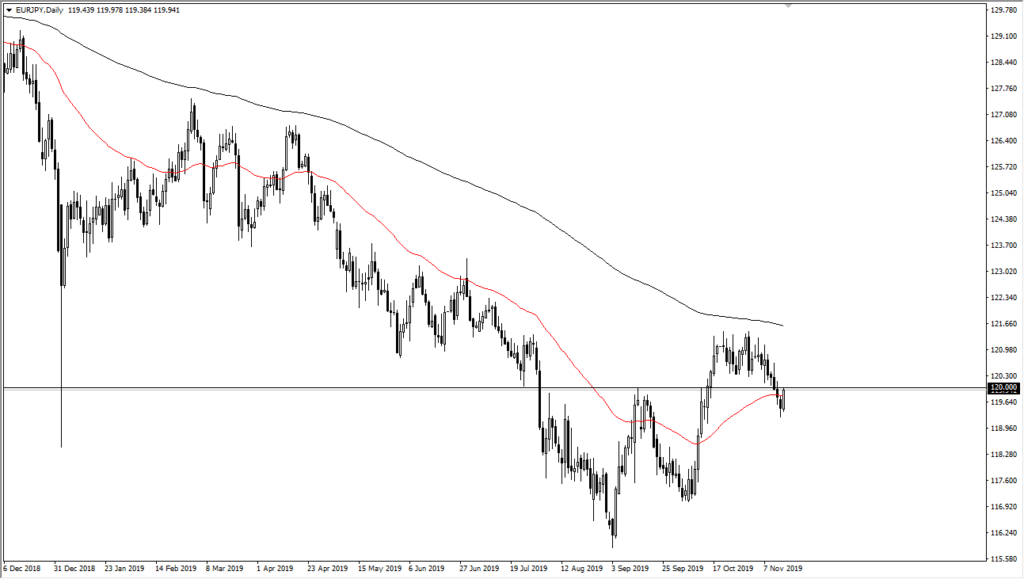

Euro Testing Major Figure Against Japanese Yen

- Euro testing ¥120

- 50 day EMA slicing through price

- 200 day EMA above

- Risk appetite barometer

The Euro has rallied a bit against the Japanese yen during early trading on Friday, heading into the weekend with a bit of a “risk on” attitude. The pair does tend to move with risk appetite as the Japanese yen is considered to be “a safety currency.” At this point, it comes down to what the latest attitude is when it comes to a whole host of issues right now.

The technical analysis

EUR/JPY Daily chart

The EUR/JPY pair is highly correlated to risk appetite, as the Japanese yen will be bought when people are concerned and sold when people are not. As there seems to be a bit of optimism when it comes to the US/China trade situation, which seems to go back and forth. Looking at this chart, you can see that the currency pair is dancing around the ¥120 level, which in itself attracts a certain amount of attention. Beyond that, the 50 day EMA is slicing through the candlestick and is flattening out.

So the question now is whether or not the pair will continue to rise, or if it will begin flattening out and rolling over. The answer is probably going to be revealed over the next couple of days.

Now it will serve as a target if the market can break above the ¥120.50 level.If the market was to break down below the ¥119.50 level, however, then the market could roll over and start looking towards the ¥117.50 level.

The trade going forward

The trade forward is to simply let the market decide which direction it wants to go and follow. One thing that does help the buyers here is that “higher highs” have started to appear which is, of course, a very bullish sign. It’s a bit early to call a trend change, but once the daily close is above the 200 day EMA, then it suggests that the market will have completely changed the trend, and it should send this pair much higher.

At this point, it would probably coincide with a major “risk-on” type of scenario. In this case, you could expect to see the stock markets rally globally, with a special focus on the S&P 500. As it is pressing the all-time highs, if it does break out higher it could send the Japanese yen lower in general. As a barometer, pay attention to the USD/JPY pair to see whether or not the Japanese yen is going to be weak or strong, and you can check the same thing for the EUR/USD pair. If it starts to rally, that could put upward pressure here as well, due to a process called triangulation.