What is The XM Ultra-Low Account?

What is The XM Ultra-Low Account?

XM Global Limited is a company with a lot of experience in the field of Forex trading. The site is regulated by multiple reputable organizations like the CySEC and the International Financial Services Commission. Needless to say, variety is something that is evident through the different aspects and properties of the site.

In this article, our primary objective is to focus on the Ultra-Low account type and give you extensive information about it. Therefore we will be discussing account types available on the site.

So everyone’s thought in mind would be that what is the Ultra-low account? Well to sum it up and say it in the simplest terms before we dive into the vast information about it, we can categorize it as an account type designed for beginner traders.

XM Ultra-Low Account vs Other Accounts

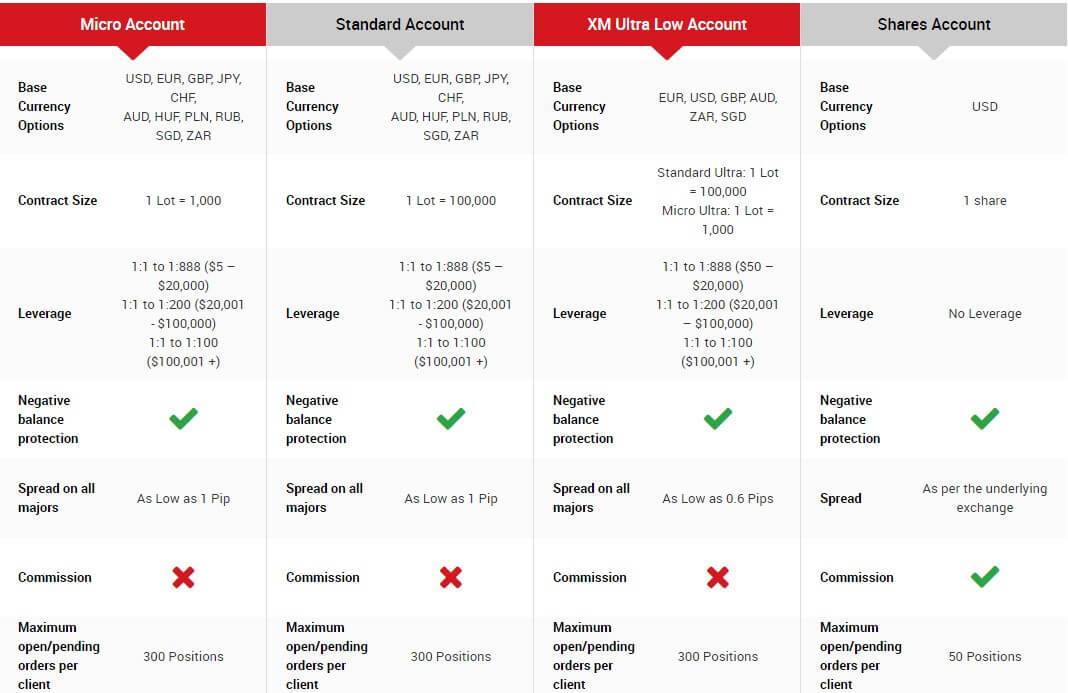

Besides the XM Ultra-Low account, there are three more distinctive account types available on the site. These are the standard account, micro account, and the shares account. All offering a variety of features.

The XM Ultra-Low account is the most advantageous account type on-site compared to anything else we could find on the broker’s website. One can find trading accounts with distinctive and exceptional trading conditions. With any of the account types, one has unlimited access to the offered trading platforms which include both MT4 and MT5. Execution quality is the same for all of the available accounts.

Accessibility is the common feature all of the accounts do share which is incredible as any account user can take advantage of the multilingual support team and take advice from the personal account manager. Also, negative balance protection is in place for all of the account types.

There are no commissions for the standard, Micro, and Ultra-low account types. Also, an Islamic account is an optional choice for these types of users. The only time you do have to pay a commission fee is if you use the shares account. The distinctions that are very clear between the accounts are their base currency options which are unique to each account type.

XM Ultra-Low Trading Features

A company is as good as its products and services. In the case of a Forex Broker, we could say exactly the same about the trading features which it offers to its consumers. Specifically, we are going to focus on the XM Ultra-Low trading account and all its features that are incredibly useful and innovative. A defining feature of any Forex brokerage firm is the leverage ratio, spreads, and currency pairs. Additionally, other important factors are the contract sizes, available asset types, and many more.

Currency Pairs

The XM Ultra-Low account has the most optimal base currency options. Unlike its counterparts, it doesn’t have too many options or not enough. There is a perfect amount of options for the consumer to choose from. Only the most popular currency pairs are available for the users of this account type. The available base currencies of the Ultra-Low account are the following

- EUR,

- USD,

- GBP,

- AUD,

- ZAR,

- SGD

These six currencies are the most common and popular not only on the XM site but also among other brokerage firms.

Contract Sizes

Contract Sizes are a way to measure the amount of investing capital deposited by the trader. It’s a great way to know what one is planning to do. For the XM Ultra-low account, there are multiple contract sizes. For standard Ultra-Low per lot equals 100,000 and for the Micro Ultra, one lot amounts to 1,000.

Contract sizes vary by asset type, usually, it is standardized by financial firms. By using it traders and brokers make the market much more transparent, clear and efficient without doing much additional paperwork. Over-the-counter trading is a great example of when contract sizes are used for everyone’s benefit.

Leverage

A brokerage firm is only as good as its defying features. This includes the leverage ratio offered for its accounts. The minimum leverage ratio for XM ultra-low accounts is 1:100, the maximum amount is 1:200. This is a perfectly great range as most regulatory bodies do have certain limitations and the firms who are regulated always follow the regulations. We have already discussed the fact that XM is a regulated brokerage firm therefore the leverage ratio provided for the XM ultra-low account is perfectly suitable and follows the qualification laws of both CySEC and IFSC.

Spreads

Spreads are another important trading tool that Forex brokerages offer to their consumers. The spreads on all majors for XM ultra-low account go as low as 0.6 pips.

However, only focusing on your spread will take your attention away from what matters. You should be conscious of the expense of your spread, but in general, the spread should be viewed in context. One should probably think twice before doing trade in a time of low liquidity when spreads are getting higher.

XM Ultra-Low account offers one a good spread. However, what you do with it is up to you. It does offer a certain advantage that one can’t find elsewhere.

Pros & Cons of XM Ultra-Low Account

We have discussed much general and specific information about different aspects of the XM ultra-low account. We have compared it to other types of available account types and have talked about different trading tools that come with it. Now we are going to analyze the given information and show you the advantages and disadvantages that the XM ultra-low account possesses.

Pros

There are many advantages that we have already mentioned but haven’t emphasized yet. In this section, we will talk about four different pros that the XM ultra-low account comes with which are extremely beneficial for the consumer of this Forex broker firm. Specifically, we are going to discuss trade volume, minimum deposit amount, and allowed activities that one can perform while trading with the XM Ultra-Low account.

Negative Balance Protection

Negative balance protection is a great feature to have for any type of account type, XM has it for all of the accounts except the shares account which is basically its own entity. The reason why regulated brokerage firms use it is very simple, with it they safeguard their client’s operations. It’s a great tool to manage one’s account with.

Trade Volume

One can use the traded Volume of a forex broker for one’s advantage. It’s a great way to improve one’s trading. The term refers to how much of a particular asset has been traded in a certain period of time. XM Ultra-Low account’s trade volume can go as low as 0.01 lots for standard Ultra and 0.1 lots for Micro ultra.

Hedging

The term “hedging” refers to a risk management strategy. With the right plans and activities this is a very useful strategy for many experienced traders. One can use the MetaTrader4 trading platform as it allows its users to hedge much like the XM brokerage firm. Hedging is allowed for every type of XM account except for the Shares account.

Minimum Deposit

XM ultra-low account has a minimum deposit amount of $50. This is a relatively good price and is up to standards with the regulatory authorities that XM complies with. The recommended minimum depositing amount according to CySEC and IFSC is $100. In this regard, we can fully justify the XM ultra-low account minimum deposit amount.

No Commission

A definite advantage of the XM ultra-low account is the fact that it is commission-free like the standard account and micro account. There are many instances where this distinguishing feature can come in handy. One only pays a small fee if one chooses to use the shares account and even then it is because of the very nature of the trading instrument itself.

Cons

There’s always something that can be improved on with any product. XM is known for its innovative ideas and open mind approach to the rising trends and critical responses to their products. In this section, we will be diving into the cons that we have found on the site. It highly important to talk about it as well because one needs to know many aspects of any company before doing any kind of business with them.

Inactivity Fee

There are no commissions for all XM accounts including the XM Ultra-Low account, with the exception of the shares account. However, there is an inactivity fee set on the site for all of the account types. After one year of inactivity, there is a $15 one-time maintenance fee, followed by a $5 monthly fee if the account remains inactive.

No protection for non-EU clients

XM brokerage firm has multiple qualifications, Both of them are by a European regulatory body. XM follows all the regulatory laws made by the upper-mentioned organizations like CySEC and IFSC. each requires XM to have protection in place for their users. Logically speaking it’s no surprise that the firm can’t follow the same pattern with non-EU clientele, as there is no footprint that can be followed and obliged to.

FAQ on XM Ultra-Low Account

Can I change my account type in XM?

No, you can not do so. One is not able to upgrade or change the already chosen account type. If you want to use another type of account the only way to do so is to open an additional trading account. Micro, standards, shares, and Ultra-Low are the four main types of XM live accounts that are accessible for traders.

How do I put money in my XM account?

Firstly in order to do any type of activity on the site one needs to sign up. After doing so go to the “My Account” section of the site, click the “deposit” button. Then Choose a depositing method. After doing so, fill in the amount you’d like to deposit. After that, you will need to enter your credit card details.