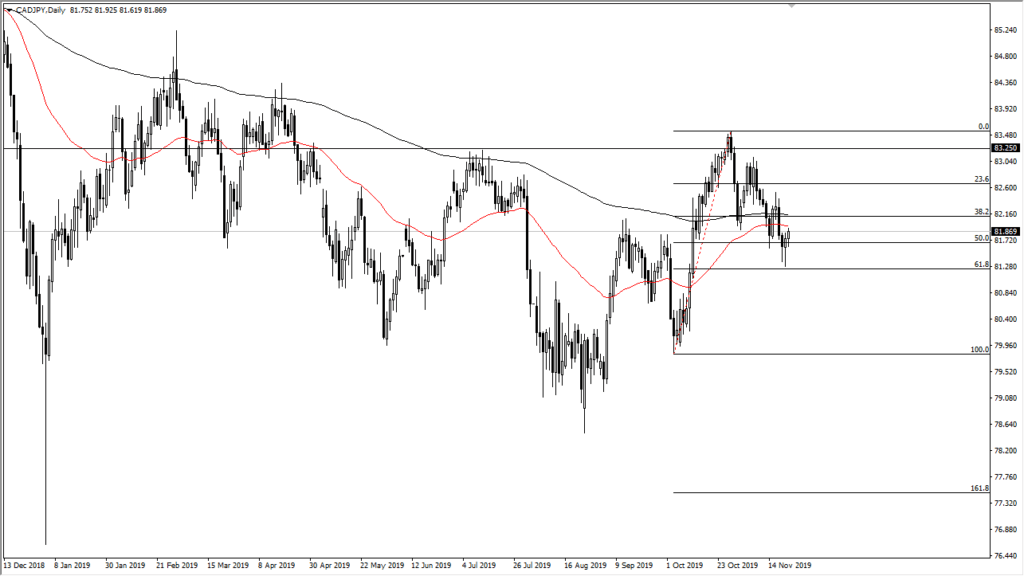

Canadian Dollar Finds Support Against Japanese Yen

- Major Fibonacci level holds

- Two hammers appear

- Testing moving averages

The Canadian dollar initially pulled back a bit during the day on Friday but has found enough support to turn back around. What’s interesting about this pair is that, while crude oil has seen a bit of a boost, the Canadian dollar is a bit mixed in the sense that there has been recent speculation that the Bank of Canada has paved the way for interest rate cuts.

That being said, this market does tend to move on not only crude oil, but the overall risk appetite of the markets in general. If that’s going to be the case, then it makes sense that if we can get some positivity in the market, this pair should take off to the upside.

Technical analysis

CAD/JPY yearly chart

The technical analysis for the pair is quite interesting as there are several moving pieces at the same time. The 61.8% Fibonacci retracement level has been tested twice in the last three days and offered support both times. This is something to pay attention to, because when a market forms a couple of hammers on the daily chart, it clearly shows that there is a lot of buying underneath. As such, it’s likely that support will hold and the overall trend could turn higher.

At this point, the market will likely continue to see a lot of upward development, especially if crude oil picks up. There are hints that perhaps OPEC may be open to extending the production cuts at the next meeting in December. All eyes will go beyond Vienna to see what happens with the currency from Ottawa.

The play going forward

The play going forward is to simply trust the support and be long of the Canadian dollar against the Japanese yen as long as we can stay above the ¥81 level. That is roughly just below the 61.8% Fibonacci retracement level, and a break down below there would wipe out a lot of support. Until then, the fact that a couple of hammers have formed and that we have seen the market break above there is a bullish sign.

One would have to assume that the longer-term rise towards the ¥83.50 level is being reasserted, and following the trend of shorting the Japanese yen probably works out the best.

Keep in mind, though, that risk appetite will come into play as well. As the markets get spooked about something, the Japanese yen will certainly get a bit of a bed, driving this pair lower.