Introduction to Double & Triple Flats

Elliott found that some patterns are difficult to be completely retraced by a wave of the same degree, and double and triple flats fall into this category. As a matter of fact, these patterns are really rare, but when they do form, a trader who uses the Elliott Waves theory knows what to do in order to be profitable. It goes without saying that both a double and a triple flat are complex corrections that have at least one x-wave in the first case, and two x-waves in the last one. For more details regarding the nature of these x-waves and what the implications are for future patterns, please refer to the articles dedicated to this subject here on our Forex Trading Academy.

Of the double and a triple flat patterns, the double flat is most likely to form, with the triple one being really rare. Such an event, with such really rare patterns, should be taken with a grain of salt in the sense that it depends on the financial product that it is being traded. On some markets, that statement is very much true. On other markets, though, unlike the case of the Forex market, double or triple flat patterns are not that rare, and so it is important to know their implications.

| Broker | Bonus | More |

|---|

What Are Double and Triple Flat Patterns?

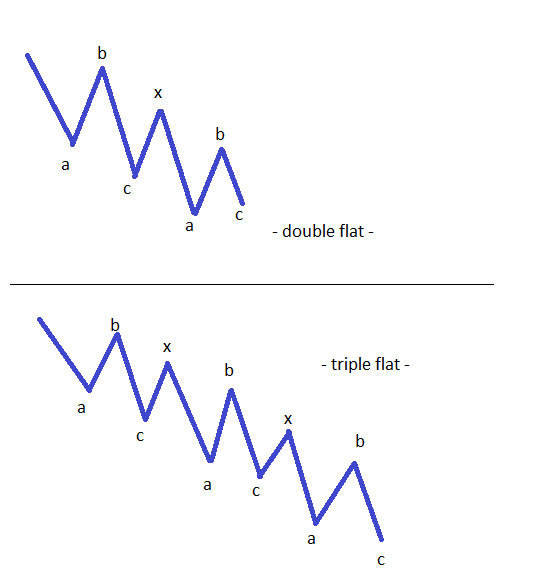

Double and triple flat patterns are complex corrections that have either two or three simple flats, connected by one or two small x-waves. It is important to know where these patterns appear, and what types of flats form these patterns.

Deciphering a Double Flat

The fact that the b-wave fails to retrace more than 80% of the previous a-wave, coupled with the inability of the c-wave to completely retrace the previous b-wave, makes this type of a flat pattern an extremely powerful one. As a matter of fact, whenever such a flat is encountered, it is a sign that the market is preparing to make an important move in the other direction. The simple fact that the pattern has not only one, but two “failures” is really a sign that the trend prior to the flat pattern is about to resume. When this happens, the whole move is a really violent one.

Another thing to consider in a double flat pattern is that this is one pattern that channels really well. However, the very notion of channelling is a bit misunderstood when it comes to Elliott Waves theory. You see, according to Elliott, channelling doesn’t imply that price must be contained between two parallel lines! In reality, in order for a pattern to channel according to Elliott rules, it is enough to connect two, or maximum three, points (depending on whether the correction is a double or a triple one), and to see whether the price is hovering around these lines. If yes (even if does not quite reach the edges of the channel, or exceeds them a bit), the pattern is considered to be one that is channelling.

Continuing on the same line, the logical process works the other way as well: In order for a pattern to be considered a double flat, it MUST channel according to Elliott rules. This way, it is practically impossible not to be able to find out the end of a specific pattern, especially if it involves a double flat. As for the places in which a double flat may appear, it is most likely to be found as the a-wave of a flat of a bigger degree, or the e-wave of a triangle that is about to break in the opposite direction. If it is the e-wave of such a triangle, then the double flat will almost surely end in a flat with a failure. When completed, the reversal in the other direction will be so abrupt and violent that most of the unprepared traders will be taken by surprise.

What Makes a Triple Flat Pattern?

A triple flat pattern is made up of three different flats (refer here to the types of flats mentioned in previous articles on the Forex Trading Academy) connected with two small x-waves. It is really rare that the market forms such a pattern, and Elliott identified two possibilities where it may appear. One is the longest leg of a contracting triangle (this means either the a-wave or the b-wave, as these are the longest segments in a horizontal or irregular triangle), or the terminal phase of an impulsive wave. In simple terms, it should appear as the fifth wave in a terminal pattern, or the longest leg of a contracting triangle. Both situations are rare, but not that rare on the Forex market!

The whole Elliott Waves theory is a beautiful one, and the more one thinks he/she knows about the subject, the more there is to be discovered. It is, however, the one and only theory that allows for incorporating the time element into any analysis, and therefore it is worth every trouble involved in mastering it.

Other educational materials

- Types of Zigzag Patterns

- Contracting and Expanding Triangles

- How to Use the Apex of an Expanding Triangle

- Trading with the Apex of a Contracting Triangle

- Types of Contracting Triangles

- Special Types of Triangles

Recommended further readings

- A web-based CBR agent for financial forecasting Liu, J. N., & Leung, T. T. (2001). . In Workshop 5 Soft Computing in Case-Based Reasoning.

- Design and evaluation of automatic agents for stock market intraday trading. Jabbur, E., Silva, E., Castilho, D., Pereira, A., & Brandão, H. (2014, August). In Proceedings of the 2014 IEEE/WIC/ACM International Joint Conferences on Web Intelligence (WI) and Intelligent Agent Technologies (IAT)-Volume 03 (pp. 396-403). IEEE Computer Society.