Crude oil markets reverse in dramatic fashion

Crude oil markets reversed in dramatic fashion during the trading session on Monday as Donald Trump had tweeted that the OPEC leaders needed to do something about the cost of petroleum. Quite frankly, it looks a whole lot like the market was trying to find a reason to sell off, and it did. Remember, most trading these days is done by algorithmic trading, and that means machines were probably reading headlines and started selling first and asking questions later.

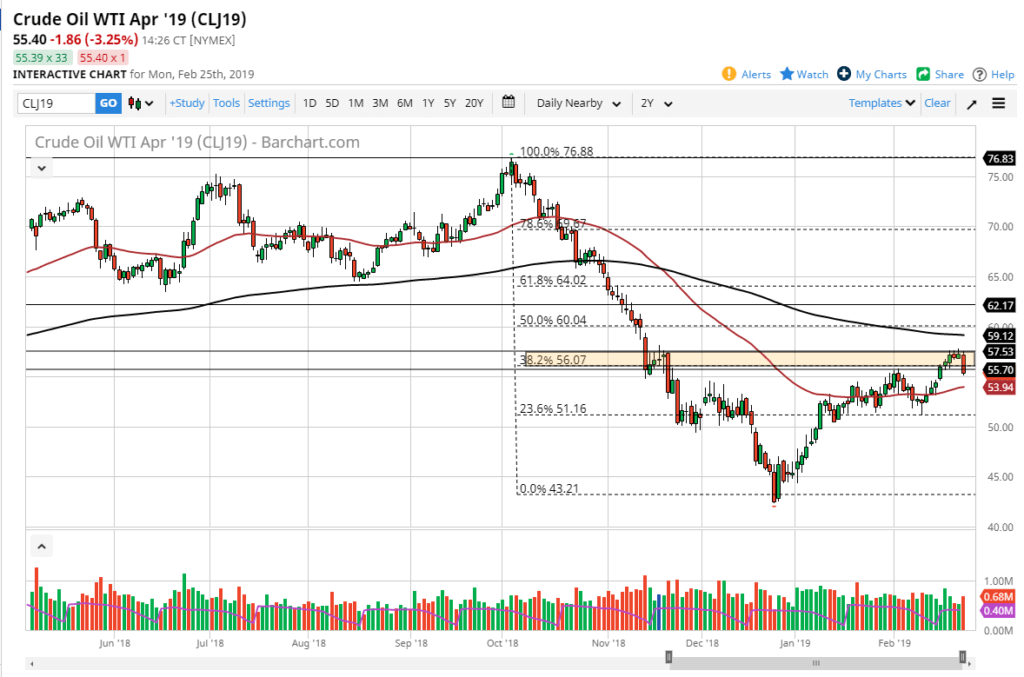

Very bearish candle

The day ended up forming a very bearish candle stick, which of course is a negative sign, but the $55 level did hold, so it’s very interesting to see how this market behaves in this general vicinity. As you can see, the candle stick was very negative, and it’s the same place that we had formed a very negative candle stick back in November when the market continues to roll down to the $43 region. Beyond that, the bearish candlestick has formed at the 38.2% Fibonacci retracement level, which attracts a certain amount of technical trading as well.

With a bearish candlestick like this, it’s very likely that we will see a lot of resistance above. The small bounce could be coming, and you may be able to see it based upon short-term charts but breaking above the top of this candlestick is going to be very difficult to do.

50 day EMA

The 50 day EMA is just below and turning higher. This of course is a technical signal that the buyers are trying to pick the market up, but at this point most traders will look at it as dynamic support, so breaking down below that would of course start to accelerate the downward pressure. That being said, we still have a way to go before we reach that level, and we need to break down below the $55 level initially. That of course is going to take a certain amount of negativity, and the fact that the market bounce from just above there during the trading session suggests that it may be easier said than done.

The bullish case: was it really a catalyst?

Donald Trump does not run OPEC. However, it seems as if the trading world forgot that during the session on Monday. It would not be a surprise therefore to see buyers come in and pick up this mispricing of the commodity. Ultimately, we have yet to fill the gap above at the $60 level, something that futures markets are notorious for doing. Because of this, a lot of buyers will still be aiming towards the upside, and perhaps the fact that the 200 day EMA is coinciding with that gap might be to juicy of a target.

The other catalyst could be the US dollar, and if it starts to fall for in a bit more significant manner, we could see the commodity markets in general rally based upon that. Ultimately, if the US dollar strengthens, it could be a bit negative.

In the end, the next session or two will be extraordinarily important, and at this point it’s very likely that the $55 level will play a major role in where we go next. If we can stay above there, that would be a good sign and could send buyers into this market in a choppy and positive manner like we have seen as of late. However, at the 55 Dollars Level Gives Way, we have further to go to the downside.