Canadian Retail Sales Mixed, Canadian Dollar Unfazed

- Canadian Retail Sales month over month

- Core Canadian Retail sales month over month

- CAD still moved by lack of demand in oil coming from China

During the trading session on Friday, the Canadians released figures around retail sales, in a very mixed fashion. With the recent volatility around the world, the Canadian dollar has been hit by a lack of demand for crude oil. It should be noted though that crude oil had fallen rather precipitously, driving down the value of the Loonie against the US dollar and several other currencies around the world.

The Chinese coronavirus outbreak has driven down demand for crude oil out of the country by at least 20%, and that has had a very negative effect on the Canadian dollar over the last couple of weeks, but it had started to stabilize going into this announcement.

The numbers show an appetite for goods

the Retail Sales month over month figures coming out of Ottawa posted a reading of 0.0%, less than the 0.1% anticipated by the market. However, Core Retail Sales month over month, which in Canada much like the United States excludes automobile sales, came out at 0.5% which is slightly better than the 0.4% anticipated. This shows that although not necessarily strong, the Canadian consumer still has an appetite for goods.

Unfortunately for Canada though, this announcement was not enough to lift the currency, as oil seems to be the main feature to the Canadian dollar right now. As long as there are concerns about the Chinese economy, that will probably outweigh anything coming out of Canada, barring some type of statistical anomaly.

The strength of the Canadian dollar

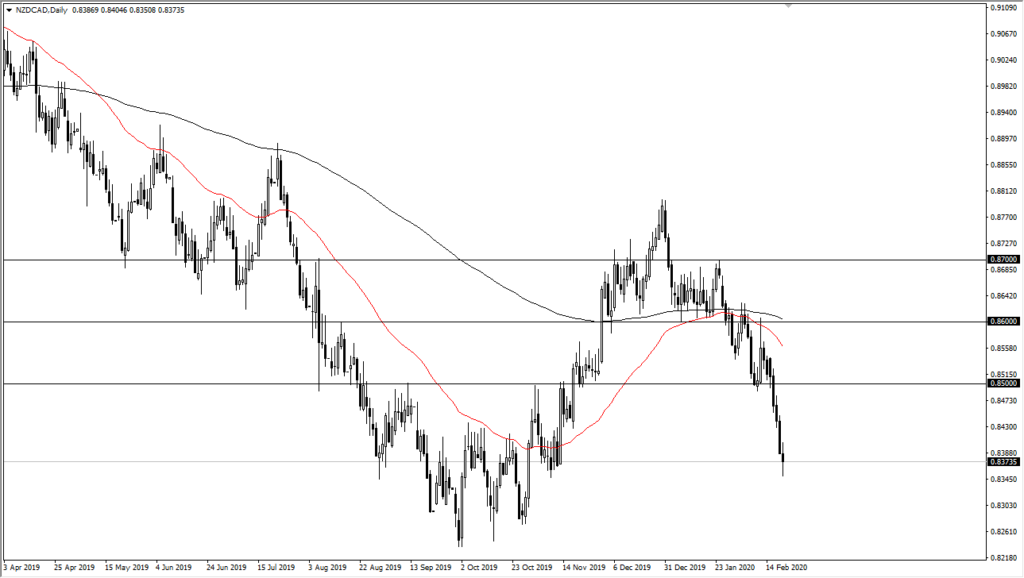

NZD/CAD chart

As far as the Canadian dollar is concerned, as long as you are not trading it against the greenback, you should see a certain amount of strength. While the Canadian dollar is quite often a proxy for crude oil, that typically is expressed in the USD/CAD pair. However, if you reach out beyond the usual major currency pairs, you can see that the Canadian dollar is holding its own against multiple other currencies such as the British pound and the Japanese yen. In other words, money still flows into North America and as the largest trading partner to the United States, Canada is somewhat insulated.

Furthermore, if the US economy can continue to strengthen, that will continue to pull the Canadian dollar right along with it, just not against the US dollar. Going forward, Canada still looks strong against many of the other currencies, with particular interest being shown in Asian currencies. If China gets back to work, that should drive up the price of oil even further than its recent bounce, perhaps giving the Canadian dollar a bit of a boost even further against other currencies.