British Pound Continues Struggle to Begin Week

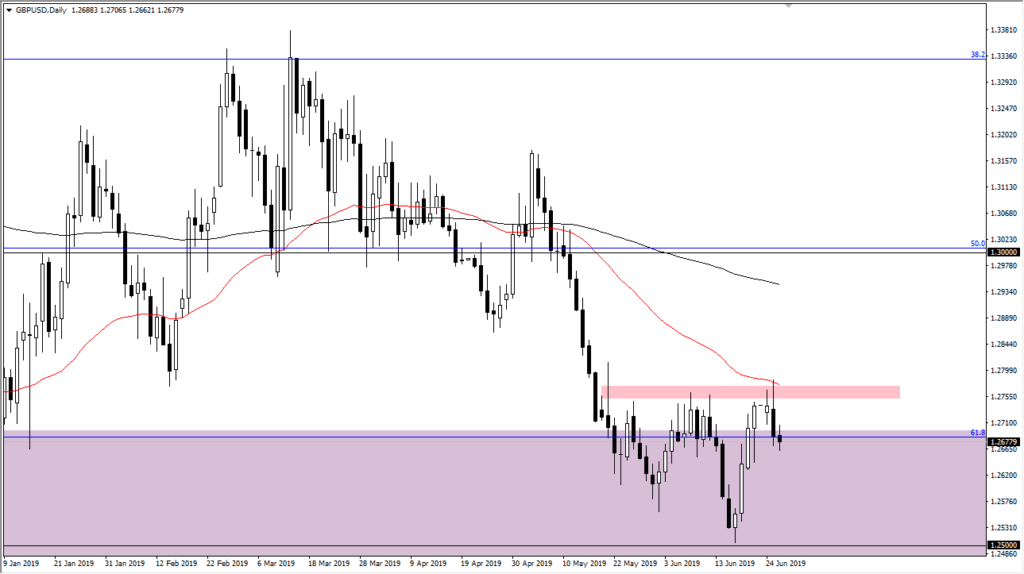

The British pound has slumped slightly during early trading despite a recovery to end the previous week. That being the case, we have tested the 50 day EMA and then turned around and fell rather significantly. Now we have support underneath though, so quite a bit of choppiness can probably be expected.

At this point, the British pound continues to underperform against most other currencies around the world. This of course would include the US dollar as it is the benchmark on how we measure the strength of the currency overall. Recently, we had seen a bit of a reprieve but at the end of the day it’s very likely we will continue to see a lot of volatility when it comes to Sterling.

Range Bound

One way to look at the British pound is that it is range bound at this point. The 1.28 level above is significant resistance, as it is not only a large, round, psychologically significant figure, but it is also where we see the previously mentioned 50 day EMA. The candle stick that formed during the day on Tuesday was very bearish and it tells me that we are likely to see a lot of negativity again. However, one can also make the argument that perhaps we are somewhat range bound with the 1.25 level underneath being massive support. In other words, I believe we have carved out the summer range because nothing material is going to happen in the Brexit anytime soon. It’s obvious that this is going to be a long drawn out situation, so why rush into a huge move?

GBPUSD Daily Chart

Short-term, Selling Works

The entire world has bet against the British pound, so that adds quite a bit of weight around the neck of the currency. However, the 1.25 level has offered enough support to cause the market to bounce and of course we have the Federal Reserve stepping to the sidelines and perhaps even looking to cut interest rates later this year. That, of course, is negative for the greenback but the Brexit is the larger story here. That being the case I think we continue to see a lot of softness in this currency pair for the immediate future, but if we were to turn around and break above the 1.28 level, that obviously is a major break out and could have this pattern that we have formed lately looking a lot like a bottoming pattern.

To the downside, the 1.25 level is massive support and if we were to break down below there it would kick off a whole new level of negativity when it comes to this pair. I don’t think that’s going to happen though, so short-term selling works but I think that we are still in the process of trying to build some type of bottoming here. That’s normally a long and drawn out process, so don’t be surprised to see buyers step back into this market summer closer to the 1.26 handle this time.