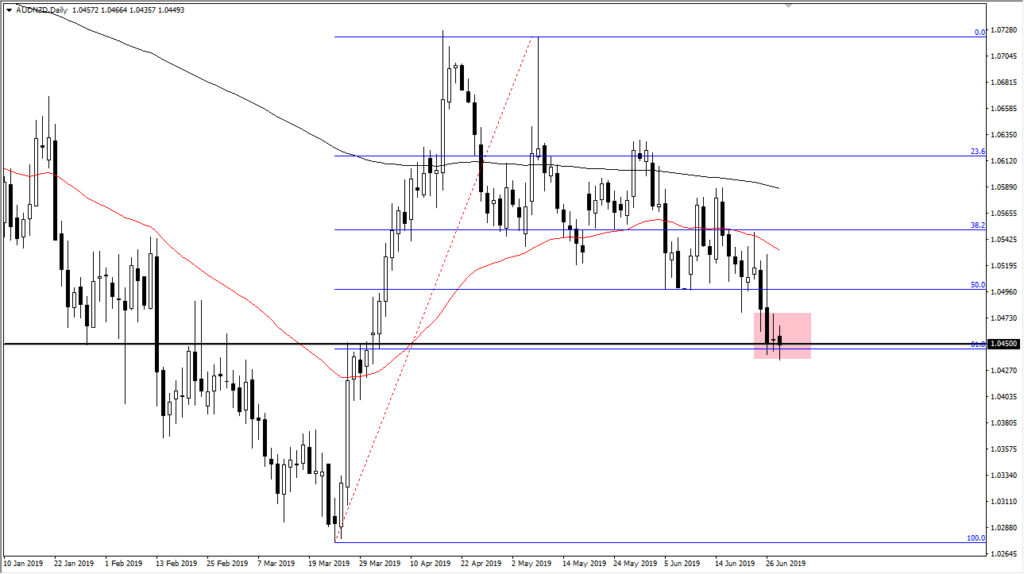

AUD NZD Choppy and Looking for Support

The Australian dollar had fallen a bit during the Friday trading session but as you can see we have seen signs of life. The Aussie is starting to try to break out against the US dollar as well. Coming off the back of the G20 meeting last weekend, it looks as if traders are trying to get ahead of some type of good news coming out of the US/China meeting. After all, the Australian dollar is highly sensitive to what goes on between the Americans and the Chinese, and therefore it’s likely to be volatile. However, we are at a point on the chart that could dictate where we go longer-term.

61.8% Fibonacci Retracement Level and More

The 61.8% Fibonacci retracement level is at current levels, as we hover around the 1.0450 level. At this point, it’s likely that the market will continue to find this area interesting, at least until we make some kind of headline coming out of the conversation between the Americans and the Chinese. That being said, there is a couple of obvious points of interest that we should be paying attention to.

The shooting star from the Thursday session shows significant resistance, so if we were to break above the Thursday candlestick, a lot of those traders would then be trapped, offering the ability to go long of this market. However, if we turn around and break down below the candlestick from the Friday session, then it’s likely that the market breaks down and continues to go down to the 1.03 level, as wiping out the 61.8% Fibonacci retracement level typically means that we wipe out the entirety of the move.

AUDNZD Fibonacci Indicator

Attitude the Most Important Factor

This is ultimately going to be about attitude, in reaction to the Chinese situation. Both of these economies are very sensitive to what goes on in China, as New Zealand features more of an agricultural economy and Australia features more of the hard commodities economy as the mining sector is huge. The theory goes that as China expands, there will be a need for copper, gold, and many other metals. This tends to have more of an effect on the Aussie than demand for milk and the like would be for the Kiwi.

Both of these currencies feature central banks that are looking to cut interest rates, so at this point, it seems to be more of a race to the bottom by several central banks. At this point though, you should take advantage of the correlation between the Australian dollar and gold, which of course has been strong as of late. The more gold that is needed, the more Australian miners will be receiving Australian dollars for their goods, facilitating the need for currency exchange. As long as gold is strong, Australia will eventually have the upper hand. That being said, the best thing you can do right now is to simply trade the chart as it gives us a relatively straightforward set up in the short term.