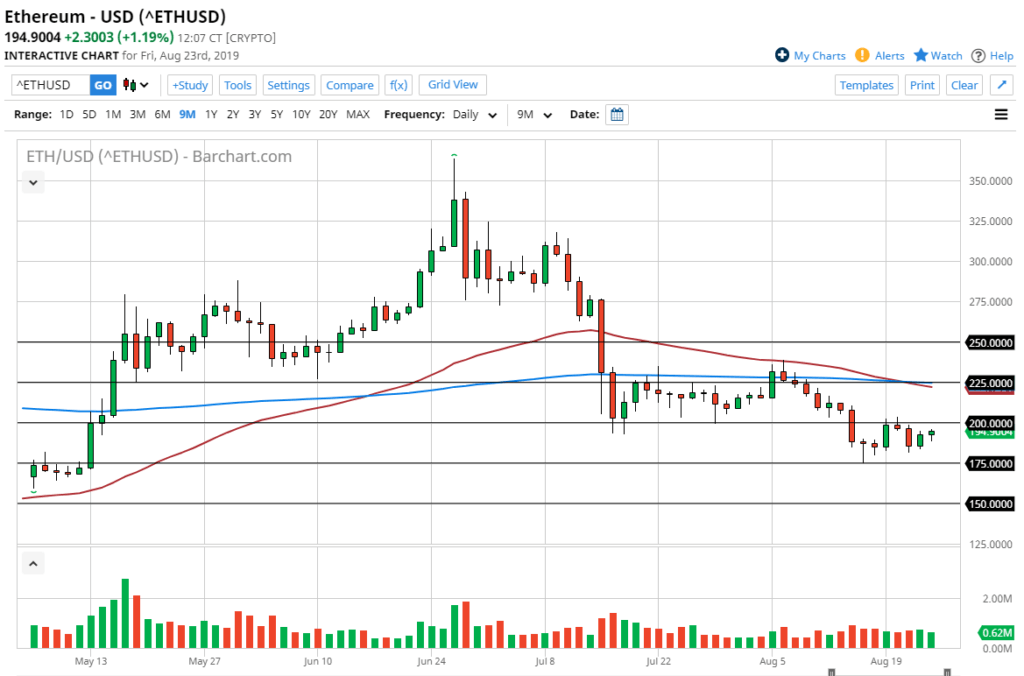

Ethereum stuck in short term range

- Ethereum continues sideways action

- crypto under pressure

- death cross

Ethereum has been very noisy over the last several sessions, bouncing around between the $200 level on the top and the $175 level. At this point, the market continues to see a lot of noise, and of course the fact that crypto currency has been falling in general, it’s likely that Ethereum will do any better. After all, if a titan like Bitcoin can’t pick up the rest of the crypto market, I have no faith in what happens next. It all comes down to the Bitcoin market at this point.

Death cross

ETH/USD

Ethereum is going through the so-called “death cross”, when the 50 day EMA crosses below the 200 day EMA. That is a scenario that suggests that longer-term traders are starting to get aggressive to the downside as well, so having said that it’s likely that we will face a significant resistance barrier above in the form of both the 50 day EMA, but several other resistance barriers as well.

The $200 level has been important more than once, so it would not surprise me at all to see the market struggle to get above there, but if it does obviously the previously mentioned 50 day EMA will come into play as well. There is a lot of volume in the market near the $200 level, and of course we will find quite a bit of interest paid to that level. If we can break above these barriers you Ethereum can take off quite significantly.

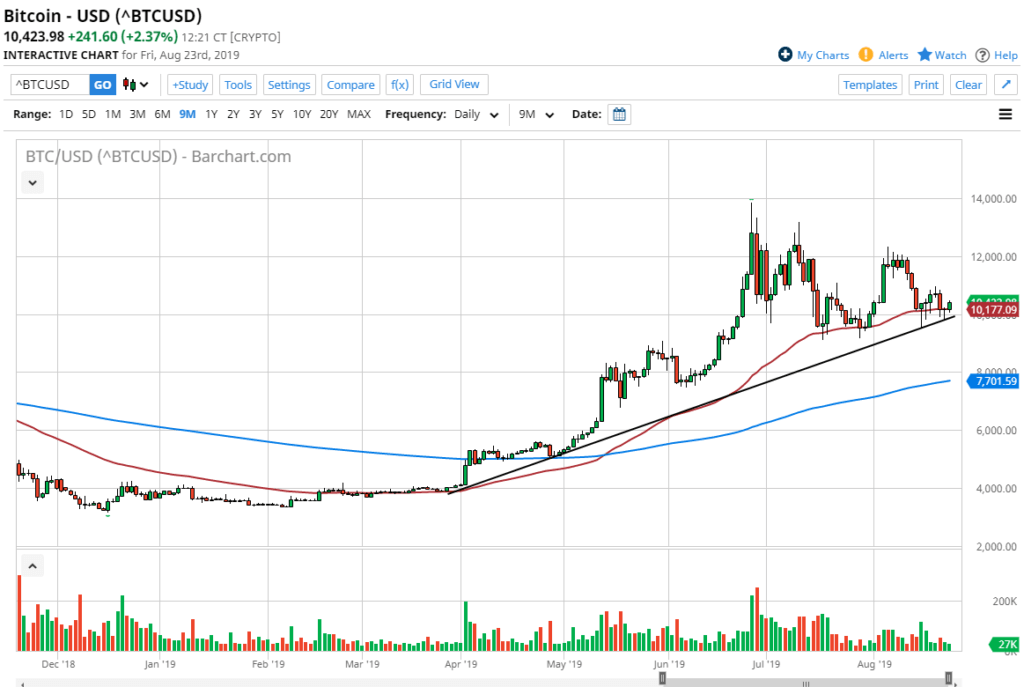

Shine coming off crypto in general?

BTC./USD

People have to wonder whether or not the Chinese coming off of cryptocurrency, because quite frankly the markets have only drifted sideways to lower over the last several months. We had initially seen a massive move higher, and a lot of that would have been due to the idea of money leaving places like China as capital controls continue to be implemented. Beyond that, we also have Venezuela, the Islamic Republic of Iran, and other places. The capital outflow from these countries has been a main driver of crypto lately.

Central banks

The central banks around the world have been cutting rates, and it makes sense that money will go looking for a better return, which cryptocurrency can be one such possibility. That being said, it does give us a bit of hope, and bitcoin did have a reasonably decent day during the trading session on Friday, so there is the possibility that we could continue to go higher. Ultimately though, it’s very likely money will flow to several different assets, not just the crypto market. I know that a certain amount of the volume has been flowing more toward precious metals than crypto lately.

Technical analysis

The technical analysis for this chart is simple, as a break above the $200 level is the first hurdle to much higher pricing. If we can break above the 50 day EMA, we could also go even higher but I don’t think it’s very likely that it will be quite that easy. We would need a bit of a boost from the Bitcoin market to help Ethereum. Ultimately, it should be noted that the Ethereum market tends to move in $25 increments.

I will be buying above $200, but only if bitcoin continues to rally as it had done on Friday. At that point, it’s very likely that Ethereum will try to play a bit of catch-up. Alternately, If Bitcoin were to break down below the uptrend line on the daily chart, then Ethereum will roll right over and break through the $175 level.