Ethereum at a Major Crossroads

- Ethereum sitting at major resistance

- Crypto sees recent breakout

- Use Bitcoin as a secondary indicator

Ethereum has gotten lost in the shuffle when it comes to cryptocurrency markets recently, mainly because a lot of attention is being paid to Bitcoin.

However, it is lagging slightly in reaction to Bitcoin when compared to the usual trend, but it is starting to approach a very interesting technical area. Because of this, there should be a “catch-up trade” happening in this market.

ETH/USD 6-monthly chart

The Ethereum chart analysis

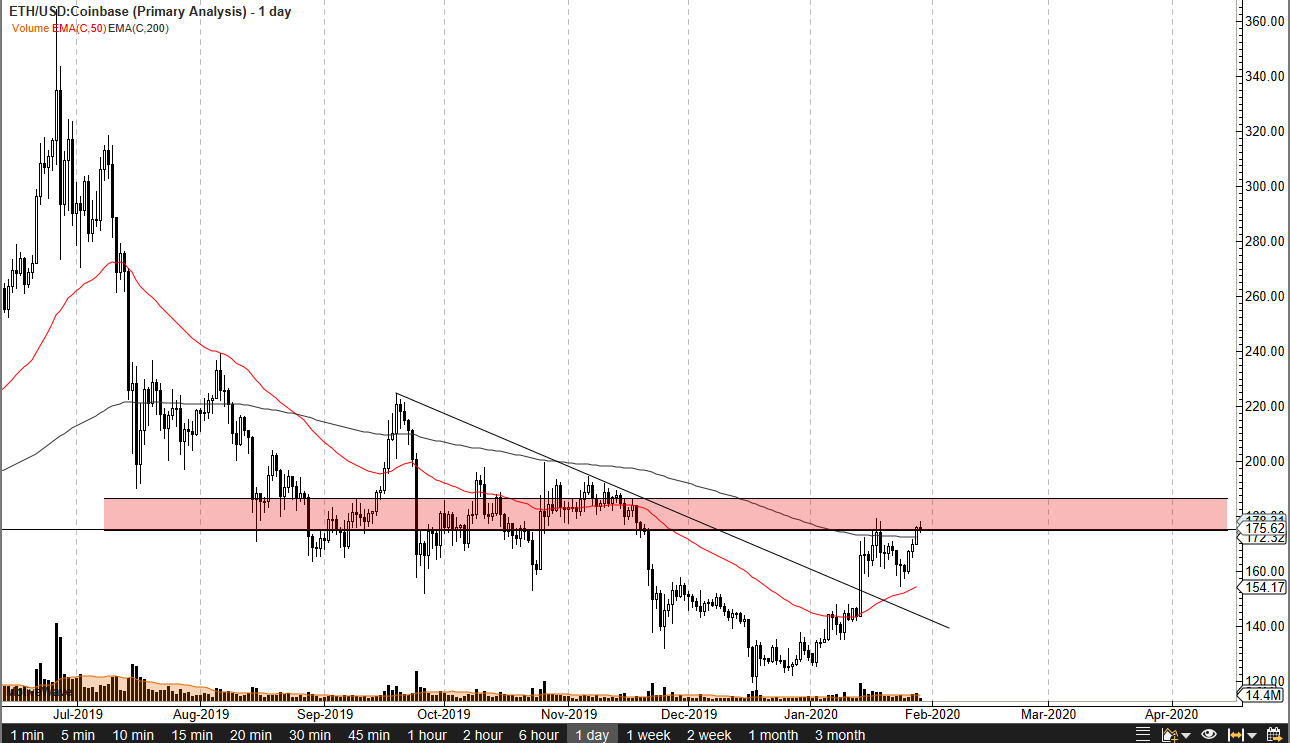

The technical analysis for Ethereum right now is very interesting considering that the market is pressing up against the $175 level. That is an area that has offered massive support and resistance in the past, and it is a fulcrum for price.

Additionally, the market has just broken above the 200-day EMA, an area that causes significant resistance. With that being the case, the question now is whether or not it can continue the upward momentum.

It’s very likely that there will be a lot decided as far as the future of Ethereum in this area, with a lot of noise extending all the way to the $200 level. However, one of the easiest ways to play this market under typical conditions is to pay attention to what’s going on in the Bitcoin world.

If Bitcoin rises, as a general rule it will lift the other crypto markets right along with it. In this scenario, it offers the ability for traders to take advantage of the correlation.

Otherwise, if the market breaks down from here, the 50-day EMA, pictured in red on the chart and currently sitting at the $154 level, could come into play as support.

The market had recently broken above a downtrend line that attracts a lot of attention. By doing so, it was the first sign that perhaps a bullish trend was starting to form. The next couple of weeks should be crucial for Ethereum, as it looks like a serious move could be on the cards.

The play may be over here

The main takeaway from this market is that, while everybody is paying attention to Bitcoin, the real play may be over here. This is because if Bitcoin can crack the $10,000 level, it should send a fresh supply of money into the cryptocurrency markets in general, and into markets such as Ethereum.

With that being the case, the market will most probably be able to easily break above the $200 level, given enough time. However, if Bitcoin rolls right over again, this market will potentially go looking towards the 50-day EMA, and possibly even look to test that downtrend line yet again.

The setup is relatively straightforward, with Bitcoin being a very important secondary indicator.