Ethereum a Great Proxy for Global Markets

- Ethereum continues to grind sideways

- Cryptocurrency at major support level

- Quiet conditions without momentum show confusion

- “Death cross”

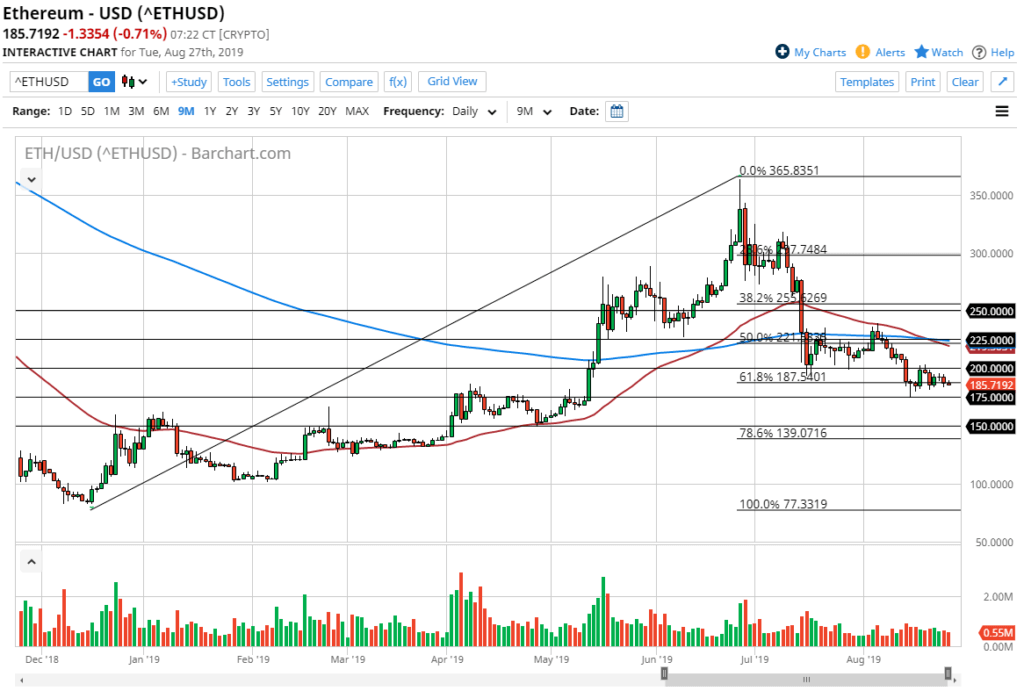

Ethereum has curiously acted very much like the rest of the global financial markets over the last several days. It is simply going nowhere. Although not as volatile as other assets such as the stock market, Ethereum finds itself held hostage to very unclear economic conditions. At this point, it’s only a matter of time before we get some type of impulsive candlestick that we can trade. In the short term though, we have been forming a bit of a descending triangle. This suggests that we are going lower, but there is a multitude of technical analysis confluence around this area.

Technical analysis

The technical analysis for this market is all over the place. We are hanging about the 61.8% Fibonacci retracement level, which of course is an area that attracts a lot of attention. The so-called “golden ratio” attracts a lot of attention. Therefore, one would have to think that there are some buyers in this area. Beyond that, there is also the $175 level – which explains why we are starting to hold up as well, as Ethereum tends to move in $25 increments.

Looking at the moving averages, we have also seen the 50 day EMA cross below the 200 day EMA, forming the so-called “death cross” – something that is an omen of lower pricing for longer-term traders. That being said, quite often it is also formed at the very end of that move lower, as it is most certainly a lagging indicator.

Long-term investment

Looking at the long term for the chart, it’s very likely that we will probably continue to see a longer-term basing pattern, but that doesn’t mean we can’t break down. It seems as if we have another push lower, but then perhaps at that point we could start to see value hunting come back into play. The $150 level would be an area that would attract a lot of attention, and most certainly the $100 level would too. That being said, Ethereum can’t avoid the volatility that we see everywhere else. After all, you are trading Ethereum against the US dollar, which has been strengthening against almost everything else.

The alternate scenario is that we break above the $200 level, but the move higher would probably be very noisy. With that in mind, the easiest way to trade Ethereum right now is to simply buy-and-hold. It is historically cheap, based on the last couple of months, so one would assume that a certain amount of value as being attached to the market. That being said, you can probably take your time to build up a larger position, as we get the sudden volatile moves in crypto every once in a while. Looking at this chart, there is very likely going to be several violent moves as the rest of the financial world seems to be essentially on fire.