Silver Markets Likely to Roll Over

- Silver markets finally discovering gravity

- Overextended market due for a pullback

- Fibonacci levels below make likely targets

- Gap still to be filled down near $17.50

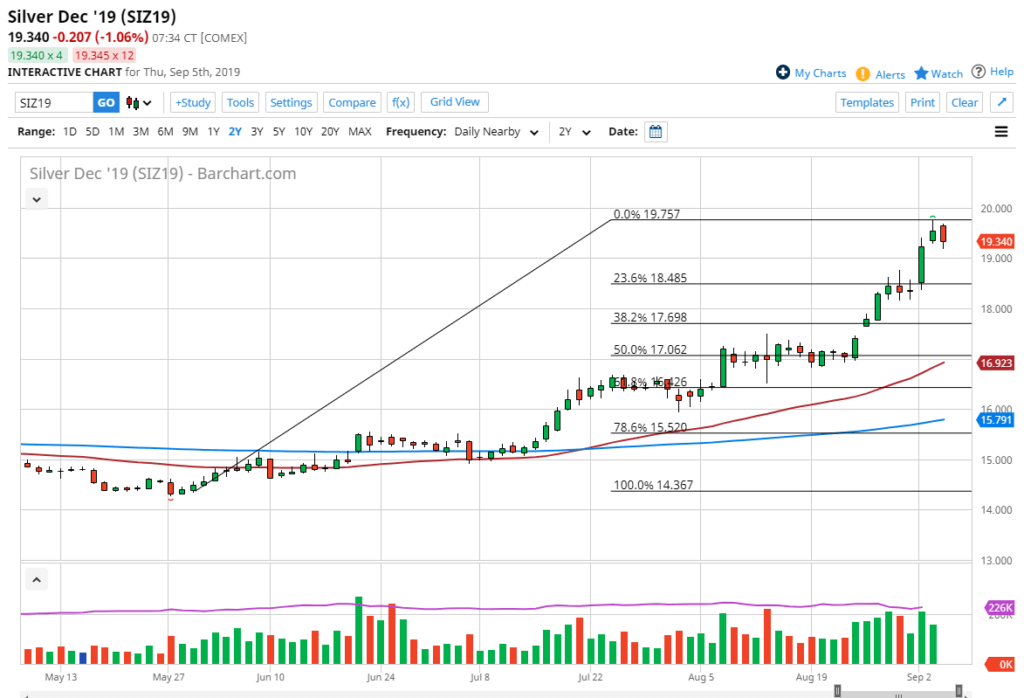

Silver markets have been on fire as of late. That, of course, shouldn’t be breaking news. The market has reached towards the $20.00 level, falling just short. The candlestick for the trading session on Wednesday has been very bearish, even though it ended up being green. After all, the market has formed a shooting star, which is a potential reversal signal. Beyond that, we have also broken below that level during trading on Thursday, which is a sign that perhaps the market is finally coming to terms with gravity. What goes up must come down, and the $20 level above will be a major psychological barrier.

Fibonacci levels to pay attention to

Silver daily chart

The 38.2% Fibonacci retracement level is sitting at the $17.70 area, and that will be the first target Fibonacci traders will be paying attention to. That’s not to say there isn’t going to be a certain amount of support at the $18.50 level, but the reality is that we still have a large amount of Fibonacci levels that the sellers could push the market to. The 50% Fibonacci retracement level is near the $17.00 level. After that, we could even fall as far as the 61.8% Fibonacci retracement level, which is down at the $16.50 level.

Major gap

Financial markets hate gaps. They tend to get filled given enough time, and we certainly haven’t filled a major one underneath at this point. It is closer to the $17.50 level, and therefore it would not be a huge surprise to see the market pulled back to that level. Even if it did, that means a level just above the 50% Fibonacci retracement, which would be the garden-variety selling pressure. This would not put an end to the overall trend. Depending on how quickly it came, we could see the market reach that level to test the 50-day EMA, as it is heading towards that direction as well. That would essentially set up a “perfect storm” for buyers to come back in and take advantage of.

At this point, the market has gotten so far ahead of itself that there will be quite a bit of profit-taking. Think of it this way: there are traders out there that have $3.00 worth of profit on each contract. That’s $15,000. They will not want to give up much of those gains as, for several traders and especially retail traders, that could be a huge portion of the gains for the year. The market is overdone, but we do have levels underneath that should attract buyers for the next leg higher.

The alternate scenario is that we turn around and break above the $20.00 level. That would represent essentially a “blow off top”, and we could go much higher in the short term. However, if we see it happen, that would be even more precarious and signal much more in the way of potential downward pressure coming down the line.