WTI Crude Oil at Bottom of the Range

- Crude oil noisy yet range-bound

- Building a base?

- Tensions rise, so does price

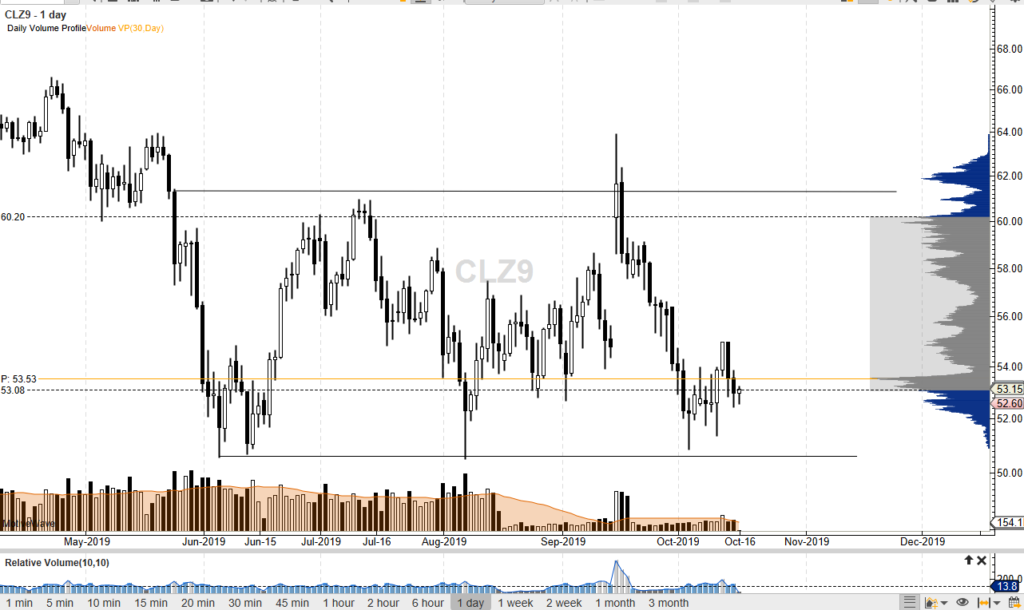

The West Texas Intermediate Crude Oil market has been zigzagging over the last couple of weeks from the lows just above the crucial $50 level. By doing so, it looks as if the market is fighting its way higher, perhaps trying to re-enter the overall consolidation that is seen between roughly $50 level on the bottom and $60 on the top. As can be seen on the chart, there are several hammers leading the way higher from the lows.

With that being the case, it shows there are quite a few buyers underneath trying to lift this market. Beyond that, you can see the value area of volume from the last 30 days, as shown on the right-hand side of the chart. As the market is at the bottom of that range, it suggests that the market could reach towards the $60 level, which is the top of that range.

Longer-term trend

WTI crude chart

The longer-term trend in this market has certainly been in consolidation, even though the market has been rather volatile lately, and possibly forming some type of bearish flag. At this point, it’s very obvious that the market will more than likely attract value hunters in this general vicinity. That being said, it doesn’t mean it would necessarily be easy to go higher. Certainly, however, there would be more people interested in buying than selling, as the sell-off has been so overdone.

Remember, it wasn’t that long ago that the market shot higher based on a drone strike in Saudi Arabia. However, we have filled that gap and fallen even further to the downside.

Technical analysis

The technical analysis for this market beyond the obvious range can be found in the volume profile of the last 30 days. The POC, or point of control, is where the most volume has been traded over the last 30 days. It currently sits near the $53.50 level. This means there will be a certain amount of interest in this market that should increase volume. Once we get to that area, a break above there would show several short-sellers as being under water, which should continue to thrust this market higher.

Special attention should be paid to the outer ranges of this consolidation, and the point of control. A break above the point of control could lead to a flesh higher, as volume suddenly drops off until roughly reaching $54.50. The first $1.00 level could be rather quick to give way to buying pressure. As far as selling is concerned, it’s not until the market closes below the $50 level on a daily chart that it would make for prudent trading.