Iranian Missile Strike Misses the Mark

- Iran fired over a dozen missiles against US bases

- Oil market showed violent spike before drastic pull back

- No desire from Iran to escalate situation, retaliation could send oil back up

During the early hours of Wednesday, the Iranians launched more than a dozen different missiles over US bases in Iraq. This was in retaliation for the killing of General Soleimani, and an expected move.

The military action has had the market participants very concerned lately, at least as far as the talking heads are concerned. There are several things to glean from the reactions to that underwhelming attack.

The attack and reaction

There were, thankfully, no known casualties as a result of the missile launch. In fact, there was no real significant amount of damage, because the rockets may not have even hit their targets. Nonetheless, the Iranians suggested that the assassination of the general was a “slap in the face of America”.

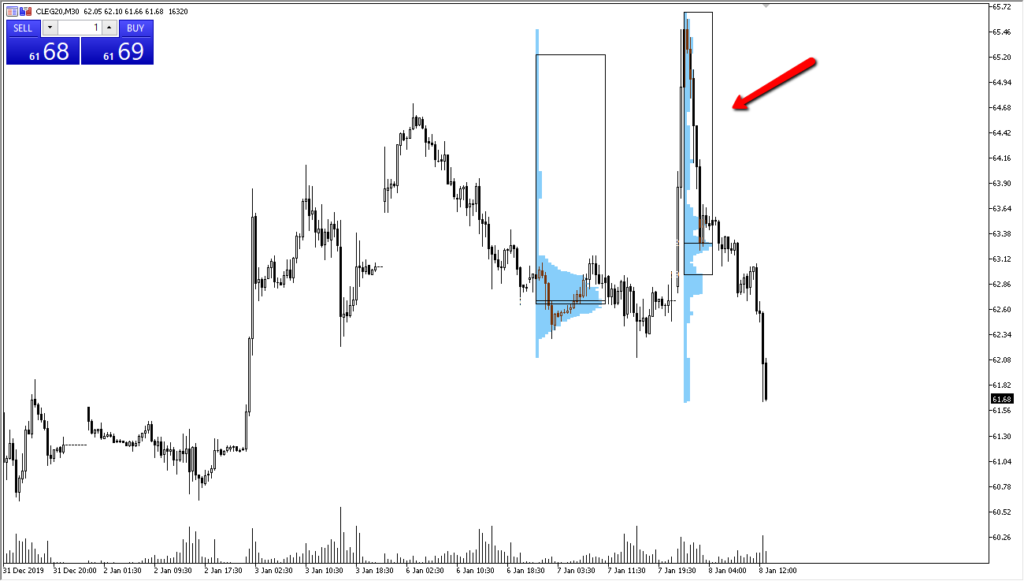

The initial reaction was that the oil markets spiked rather violently. They reached towards the $65.50 level but then pulled back drastically. In fact, the volume profile shows just how thin the volume is above, meaning there is no real demand. This was likely algorithmically driven, and not necessarily sentiment driven.

Not only has the market wiped out the spike from those attacks, but the market has even broken down below the beginning of that spike. In other words, this is a market that simply cannot hang on to gains.

If military actions between the United States and Iran cannot keep the markets afloat, there is possibly very little that will spike the oil markets for a significant move.

WTI futures chart

With the Iranians claiming no desire to escalate the situation, it should also be noted that Donald Trump tweeted “all is well” after the attack. That suggests we could be getting close to the end of all of this rather quickly.

A retaliation could send oil back up

Obviously, if the United States does in fact choose to retaliate in a grand fashion, that will probably send oil straight back up in the air. That being said, the Americans may well feel that this has been a huge victory so far – trading the second most powerful person in Iran for some minor structural damage at best.

Things will likely cool off as these flare-ups have been seen before. That being said, though, if the Americans do retaliate in a strong manner, oil will certainly see a huge push higher, at least initially. Remember, there is a massive oversupply of oil, so it does continue to face a lot of resistance.