Markets suggest 50% chance of Fed rate cut by September

In a stunning turn of events, over the last couple of months we have seen the markets worry about the Federal Reserve raising interest rates far too quick change into a 50% likelihood of a rate hike by September. This would be an extraordinarily quick turnaround, but one would have to point out that the Federal Reserve Chairman has recently given doves a lot to cheer on.

Inverted yield curve

Get used to hearing the phrase “inverted yield curve” a lot. This happens when the short-term treasuries offer more yield than a longer-term treasury. For example, we’ve recently seen the yield on three-month treasuries rise above 10 year treasuries in the United States, for the first time since 2007. That has a lot of investors spooked, because the idea is that if people are willing to park their money for 10 years, that shows a serious lack of faith in the economy.

We are also starting to see inversions all along the curve against various time frames, so of course this is going to continue to cause major issues for traders. The most common one to be monitored by traders is the two month and 10 year treasury yields, which have also struggled.

As a historical measuring stick, recessions typically have occurred roughly one year after an inversion, not necessarily immediately. However, you should keep in mind that the markets are forward-looking mechanism, meaning that of course traders will try to get in front of any recessionary fears. We have seen this play out in the stock markets as of late, and it will of course be crucial to pay attention to.

CME FedWatch Tool

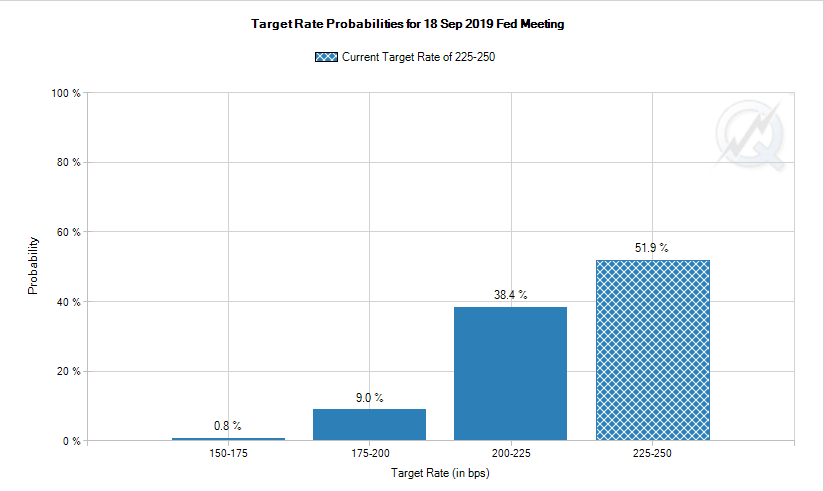

The Chicago Mercantile Exchange has what is known as the “FedWatch Tool” that traders pay attention to give an idea as to where Fed funds rates will be in the future. Currently, there is a slightly more than 50% chance of an interest rate cut in September, something that is a stunning turnaround from what we had seen previously. Because of this, traders will be paying quite a bit of attention to the Federal Reserve and any hints of hawkish in this between now and then. If they do sound a bit more hawkish, that will more than likely ripple through the stock markets and cause big sell offs.

September FedWatch graph

It’s not just the US story

We’ve recently seen a lot of concerns around the world when it comes to economic growth. The most concerning lack of bullish and hawkish numbers have come out of Germany, which of course has a major effect on the entire European Union. If the European Union continues to struggle, then it is going to be a scenario where the rest of the world is going to be affected. That of course will affect US companies as they will not be able to sell as much in the European Union, and therefore could bring down earnings.

The Federal Reserve has recently stepped away from being so hawkish, as they have explicitly stated that they were going to “remain data dependent” and “patient” when it came to interest rate hikes, as they are concerned about global growth. As the Federal Reserve has suggested all of this and of course the numbers are getting any better out there, it leads traders to believe that the Federal Reserve will have to bail the markets out eventually.