AUD/NZD on the Verge of a Bigger Move

- Aussie forming bullish flag against New Zealand dollar

- Moving averages reaching towards price

- Continuation of longer-term trend?

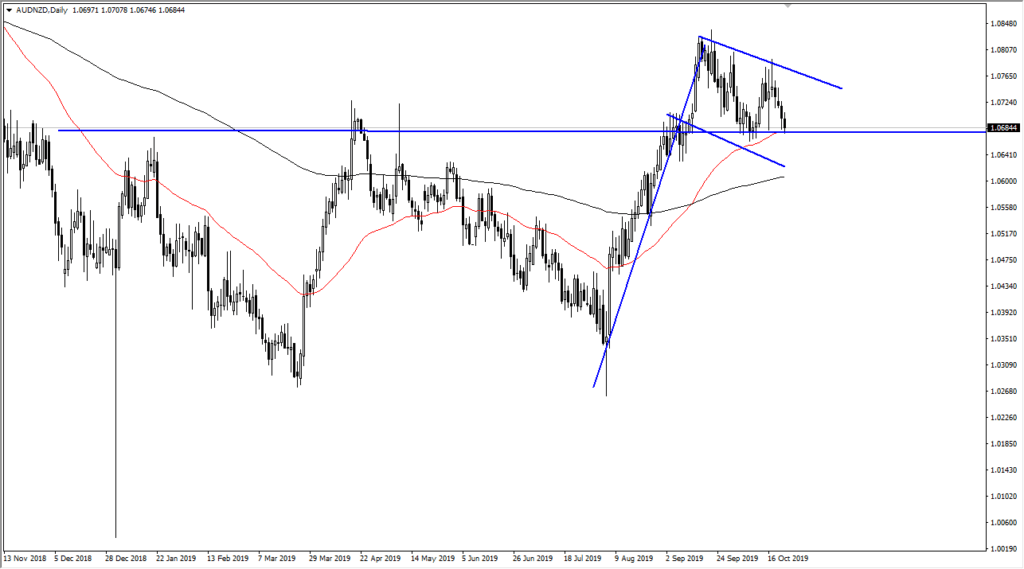

The Australian dollar has pulled back slightly during the trading session on Wednesday, reaching towards the 50-day EMA underneath. Ultimately, this is a sign that perhaps the market is going to continue to see a lot of pressure underneath, as the 50-day EMA is a common technical indicator for trend followers. Beyond that, there is a significant amount of support near the 1.0675 handle that has caused the market to bounce previously.

The Australian dollar/New Zealand dollar currency pair is one that is quite choppy in general. However, the fact that the Australian dollar has rallied so much against the New Zealand dollar during the last couple of months is quite telling as to who has strength and who doesn’t. It is not uncommon for this pair to simply grind sideways and go nowhere. The fact that it hasn’t behaved like that is quite crucial and interesting to pay attention to.

Technical analysis

AUD/NZD chart

The technical analysis for the pair is a bit of a mixed bag, but it shows bullish pressure all the way around. As marked on the chart, it’s easy to see that there is a bullish flag forming, which is one of the more bullish currency patterns. The measured move for a breakout to the upside opens up the door for 500-point gains. This means that the pair could reach towards the 1.12 level.

The 50-day EMA of course has reached its price, and it has also crossed above the 200-EMA as well. This is a very bullish sign and sends a lot of longer-term “buy-and-hold” type of trading. As long as that’s the case, it’s very likely that a certain amount of money will be flowing into this market and trying to pick up the Aussie every time it dips. As long as this pair stays above the 200 EMA, it’s likely that we will remain in a longer-term uptrend.

The trade going forward

The trade going forward is to simply look for buying opportunities based on value. In the general vicinity that that price is trading right now, there is an argument to be made for support extending down to the 1.06 handle. On short-term bounces, there should be buyers coming back into the market to take advantage of those moves. Alternately, a break above the top of the flag pattern is a strong buying opportunity as well.

This is a very bullish-looking market and will more than likely continue to be so, based on external factors such as the US-China trade situation, which has given a bit of a boost for gold until recently. Quite often, currency traders use the Australian dollar as a proxy for that market.