Aussie Dollar Likely to Find Sellers

- Significant resistance just above

- 50-day EMA crashing towards current pricing

- Longer-term downtrend

- US-China talks set to disappoint

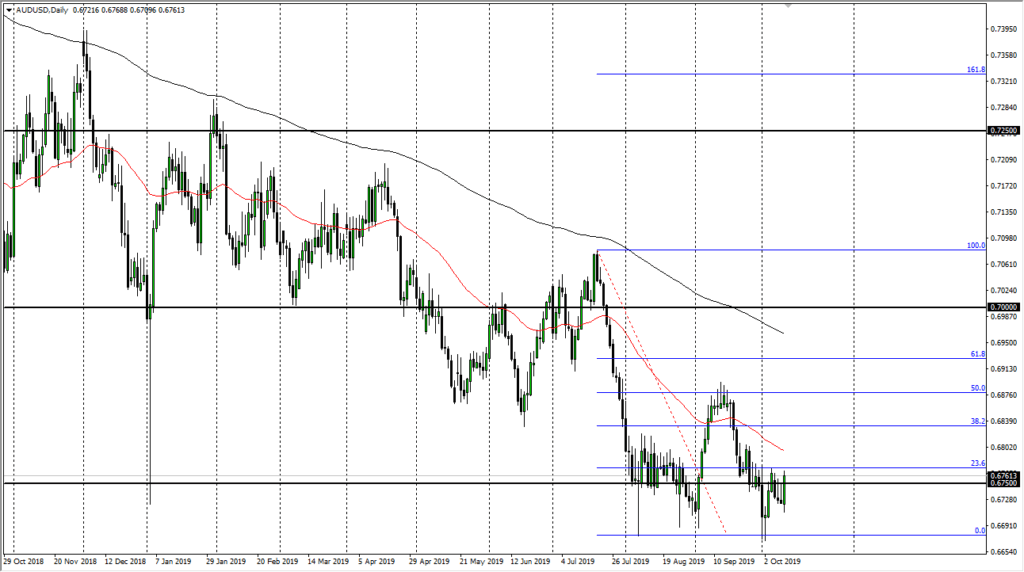

The Australian dollar initially pulled back a bit during the trading session on Thursday, but then rallied to break above the 0.6750 USD level. This is an area that continues to offer resistance, as the market has seen quite a bit of selling in the area just above. Ultimately, this is a currency that is going to be highly influenced by the talks going on between the Americans and the Chinese. The bullish candlestick at this point has to be thought of as a potential short covering movement, as headlines could come out to throw the markets around.

AUD/USD yearly chart

Remember, the Americans and Chinese are speaking

The biggest mover of this market over the next couple of days is going to be the American-Chinese trade talks going on in Washington, D.C. Unfortunately, this lends itself to a lot of rumors and tweets that will agitate algorithmic traders. Machines will come out and buy or sell at the drop of a dime: this can cause a lot of volatility, and could well spike the market in one direction or the other.

Although it’s obviously very resistive just above, you can’t “load the boat” at this point. Therefore, a certain amount of risk management is necessary not only in this pair, but in the markets overall for the next 48 hours.

Don’t expect much

The phrase “don’t expect much” applies not only to the Australian dollar, but also to the US/Chinese trade talks. The American and Chinese negotiators are worlds apart when it comes to the idea of coming together on an agreement. One of the major miscalculations that the Chinese have been making is to assume that President Trump is more worried about his re-election than the deal. This would typically be true with most politicians, but the China issue is particularly unique in the United States, as both the Republicans and the Democrats are behind this issue. Beyond that, Donald Trump is a different kind of president on several fronts, and he has a job to go back to once his dalliance with politics is over.

The trade going forward

The trade going forward is to simply fade signs of strength, as the area near the 0.6775 level has offered quite a bit of resistance. That being said, with the massive amounts of headline risks out there, it makes sense that position size should be much smaller than usual. Perhaps half the usual risk should be taken on a percentage basis. Fading rallies should work out for 20 to 30 pips at a time, but major moves are not to be expected until late Friday, or perhaps even Monday. This is when the markets open again, with talks expected to continue through the close of the week.