Aussie dollar trying to recover

The Australian dollar has been trying to recover over the last couple of weeks, and therefore it’s likely that the Aussie could bounce. Having said that, you probably need to pick the correct currency to trade against, as there is such a mixed situation around the world right now. In this particular article, I’m taking a look at the Australian dollar against the Swiss franc, which has a significant “risk barometer” attitude to it, which makes it a particularly interesting currency pair to trade in this geopolitical and global economic environment that we find ourselves in.

Bottoming pattern?

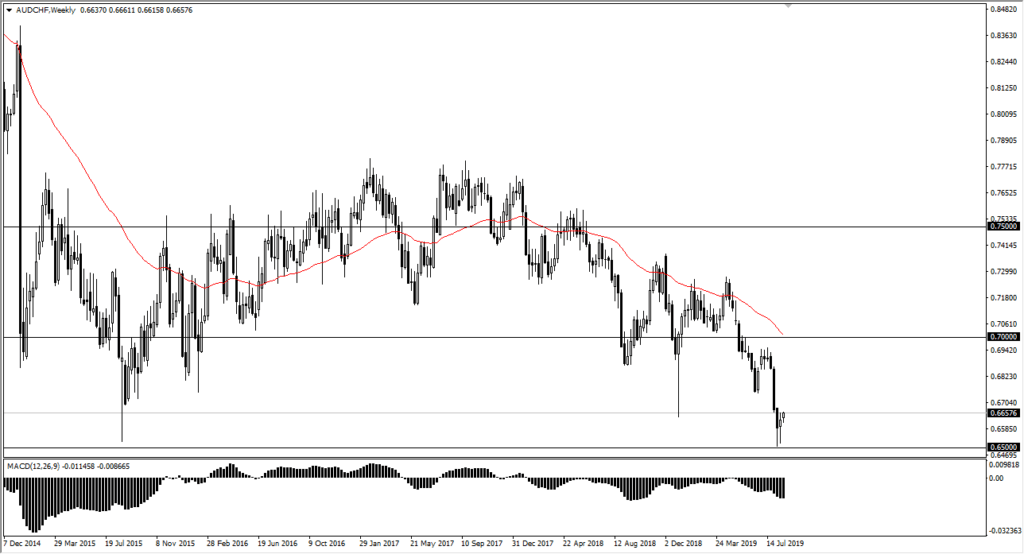

AUD/CHF Weekly

The last couple of candlesticks look as if they are trying to form some type of bottoming pattern, as we have broken above a hammer from the previous week. Now that we are rallying from here and it’s likely that we are owing to try to bounce from here. Overall, the market is oversold, so it’s possible that we get a nice bounce from here. However, the question is whether or not it’s going to end up being a bottoming pattern. We don’t know that it’s going to be, but certainly it looks as if a bounce is coming, which could be a sign that we have more of a “positive bounce” in general.

Major support underneath

The 0.65 level underneath is massive support, not only from the recent trading, but from a longer-term perspective as well. That being said, it makes sense that we have gotten a bit of a bounce as markets are starting to calm down. Keep in mind that stock markets have rallied a bit over the last couple of days, or at the very least stabilize. Beyond that, interest rate differential still favors the Australian dollar, so if there’s any hint of positivity out there, this pair should rally.

Resistance above

Having said all of that, there is a significant amount of resistance above, as seen on the weekly chart attached to this article. With this, I think that we will get a bit of a bounce, but the negative breakdown candle from three weeks previous should offer a lot of resistance, extending towards the 0.70 level above. Beyond that, we have the 50 week moving average starting to cross the 0.70 level, so there are a couple of different reasons to think that the sellers are going to come in and push lower. Ultimately, I think that this pair is going to offer a nice selling opportunity at higher levels, so it comes down to your timeframe as to whether or not you will be trading in one direction or the other.

The trade going forward

The trade going forward for me is to start buying this pair on a short-term chart but recognize that the 0.6850 level is about as high as this pair can go. It’s much safer to simply wait for signs of exhaustion on a daily candle stick above near the 0.70 level or the top of that candle mentioned previously, which would be a continuation of the negativity and perhaps even the more important aspect here: global uncertainty.