Aussie looking supported against Kiwi

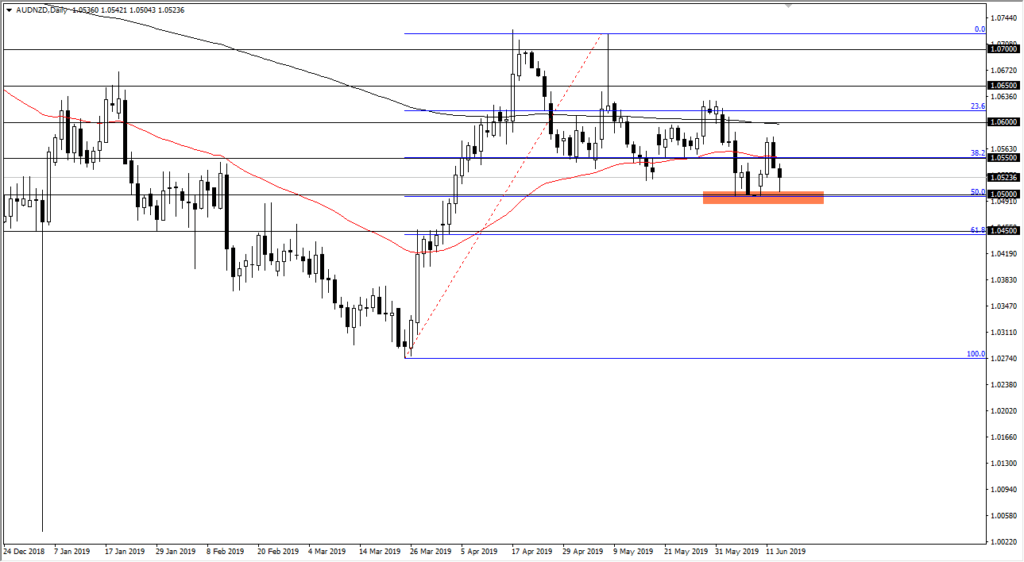

The Australian dollar initially fell during trading on Thursday, reaching down to the 1.05 handle before bouncing a bit. There is an area that show signs of support, as we have seen over the last couple of weeks. At this point in time, it’s very likely that we have entered a bit of a consolidation area, which at this point would probably be bullish for the Australian dollar.

Short-term floor?

AUD/NZD

The market looks as if it is trying to show signs of support in this region, as we are starting to form a bit of a hammer close to the level, so I think at this point we probably get a bit of a short-term floor showing up yet again. I don’t know that this is necessarily a stray dollar strength rather than the New Zealand dollar weakness. Overall, these are both commodity currencies so it’s difficult to imagine a scenario where we break down or for that matter rally significantly anytime soon. With the issues between the United States and China, it’s very difficult to imagine a scenario where one of these currencies does better than the other.

Targets

I have a couple of targets right now, that are easily reached in my estimation. In the first scenario, I believe that we continue to rally and go looking towards the 200 day EMA above at the 1.06 level. That would simply consolidate more of the market, which is what we continue to see overall. For that matter, this pair tends to do that a lot anyway. If we break above that level, then it’s an entirely different conversation.

The second scenario is a bit different though, as a break down below the 1.05 level could open up the door down to the 61.8% Fibonacci retracement level underneath at the 1.0450 level. That is obviously an area that would attract a lot of attention, but if we get past that, it’s very likely that we could drop down to the 1.03 handle which is closer to the 100% Fibonacci retracement level.

The commodities

There are couple of different commodities that you should be paying attention to, but the first and most important one would be the gold market, as it could give us a bit of a lift to the Australian dollar as it is a major exporter. However, New Zealand favors commodities in general. The fact that the gold market has rallied significantly over the last couple weeks should continue to put a little bit of a floor underneath the Aussie.

The main take away

The main take away is that although we have a couple of different scenarios, I am tilting towards the upside based upon the daily action. It’s more likely that we simply go sideways in general and therefore it makes sense that we rally towards the 1.06 handle. However, if we do get the breakout below the 1.05 level, it opens up doors to lower levels, but right now I suspect the upside is probably about a 70% probability.