Australian Dollar Continues to Gain on its Neighbor

The Australian dollar continues to show strength against its neighbor in New Zealand, as we have now woken above several major resistance barriers. With that in mind, it also makes sense considering that the Royal Bank of New Zealand has recently cut rates by a surprise 50 basis points, showing just how weak the demand for New Zealand export could be. At this point in time, although Australia is going to be very sensitive to a lot of the same external factors involving Asia and the United States, the reality is that Australia is a much stronger economy under most circumstances, so therefore it makes quite a bit of sense that money would favor Australia over New Zealand.

Hard versus soft commodities

Keep in mind that these economies both are major exporters into the Asian region of commodities. However, New Zealand is much more agriculturally based as Australia is a much more a hard commodity producer, including copper, iron, and perhaps even more importantly than any of this, Gold. Gold markets have been on fire so it makes sense that the Australian dollar might be favored a bit over the New Zealand dollar but it should also be apparent that both of these currencies are very weak against most other currencies around the world. This is simply a relative strength play and as gold is one of the influences that make the most noise in the Aussie dollar, it’s something that cannot be ignored.

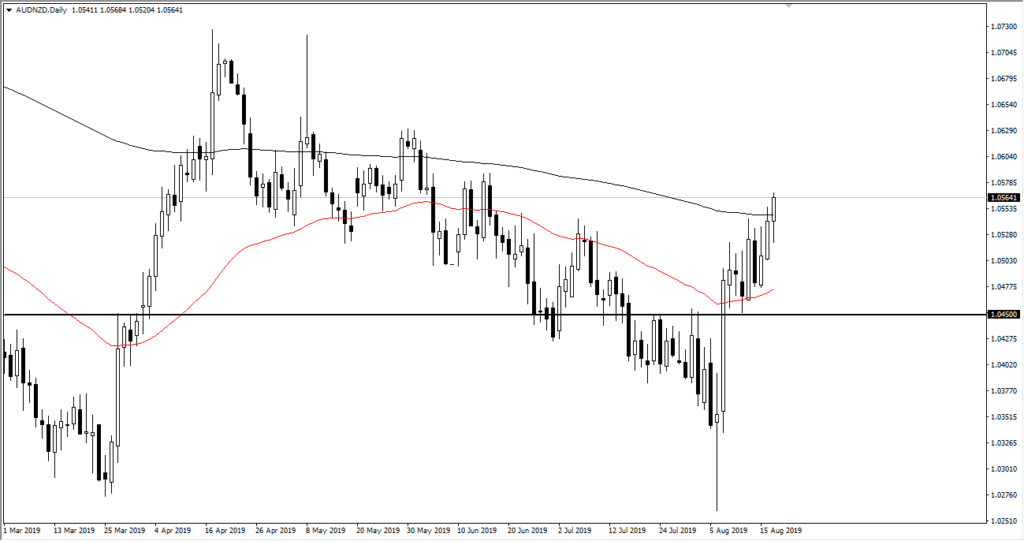

AUDNZD Daily Chart

US/China

Ironically, most of the biggest problems involving this pair have nothing to do with either country. Granted, Australia does have a bit of a housing crisis and New Zealand is a very small economy, so those are two major disadvantages to both of these economic regions, but at the end of the day the biggest problem is going to be coming from both Washington and Beijing. Ultimately, I believe that as long as the US/China trade situation continues to be tenuous at best, it is going to favor the Aussie over the Kiwi simply because of the gold trade if nothing else.

Momentum has shifted

The momentum in this market has deftly shifted to the upside, as we have cleared not only the 50 day EMA, the 1.05 AUD level, and then finally the 200 day EMA. With that in mind, this market looks like it has shifted momentum to the upside and that we should be buying dips.

I don’t have any interest in shorting this market and I now believe that the 50 day EMA which is pictured in red on the chart is going to start offering a massive “floor” in the market. Ultimately, I think that the market will continue to grind higher just simply because of the gold trade more than anything else. Gold has done quite well, but if you are focusing on currencies, going long of this pair may be the way going forward, perhaps grinding its way towards the 1.08 level over the longer-term. If we were to break down below the 1.0450 level, then we may get a bit of a break down.