Australian Dollar Falls Against Japanese Yen

- Aussie dollar sensitive to global growth

- Japanese yen considered safety currency

- Continuation of longer-term downtrend

- Fibonacci levels holding at present

The Australian dollar has fallen a bit during the trading session on Thursday, as it is considered to be a “risk on” currency. Ultimately, as the Australian dollar is so highly levered to China, it makes sense that as long as the US/China trade relations sour, the Australian dollar will have a negative attitude towards it.

Beyond that, the Chinese economic numbers have been very poor lately. So, as Australia’s largest customer suffers, so does Australia.

Pullback

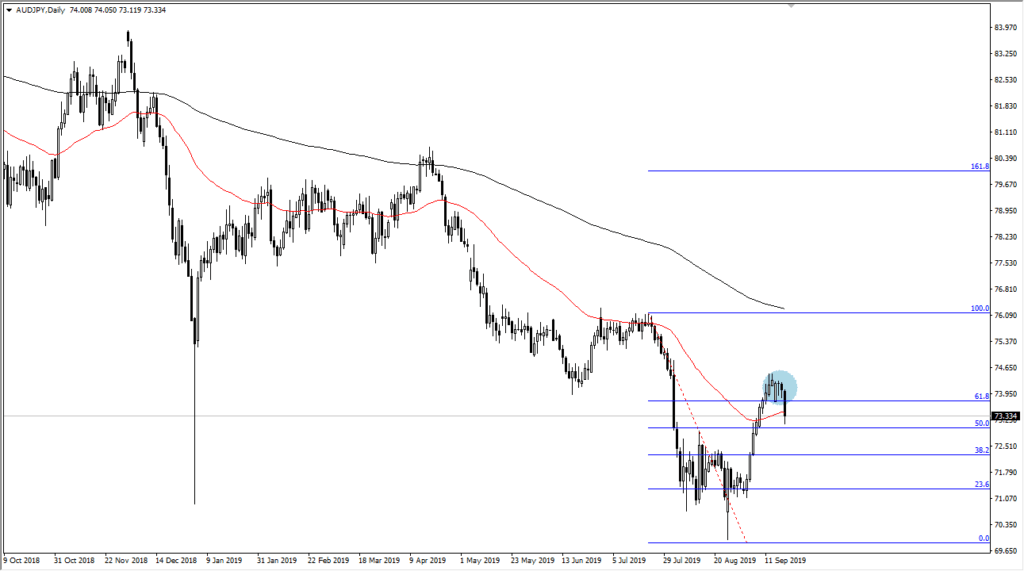

The AUD/JPY pair has bounced significantly, but it also was quite parabolic. That obviously is a major issue, so with that being the case, gravity had to take effect sooner or later. At this point, the market has broken below the 50-day EMA. That suggests that perhaps the shorter-term momentum is starting to pick up to the downside as well.

The 61.8% Fibonacci retracement level has held as resistance on the rally. This is a very commonplace area for traders to get involved. To the downside, this does suggest that perhaps the market could try to go towards the lows again. One would have to think that it is only one headline away from breaking down rather significantly.

While we have had a massive short-covering rally, there has been no real push towards the Aussie dollar. Beyond that, the Australian economy has shown a significant amount of negative pressure. There are several reasons to think that this market should continue to suffer.

Trading this pair

AUD/JPY chart

The pair is rather volatile at times, and will certainly have sudden bursts based on what’s going on around the world. However, the market has been in a downtrend for some time.

Even with the recent pop to the upside, it is still just a blip on the radar, and it certainly looks bearish from the higher time frames. In fact, it’s not unless the United States and China come to some type of major agreement at the next meeting that this pair will turn around completely. The Japanese yen will continue to attract a lot of flow as people are looking to protect their wealth.

To the downside, the market will more than likely go looking towards the lows again.

It is near the ¥70 level underneath, which has a certain amount of psychological as well as structural importance from a longer-term standpoint. To the upside, if the market were to crack above the 200-day EMA, it could change the entire look.

That being said, it seems to be all but impossible until we get that agreement between the Americans and the Chinese, as Australia is essentially “held hostage” to that external situation. There is a lot of volatility just waiting to happen, which will more than likely be in a negative manner.