Australian dollar falls against the New Zealand dollar

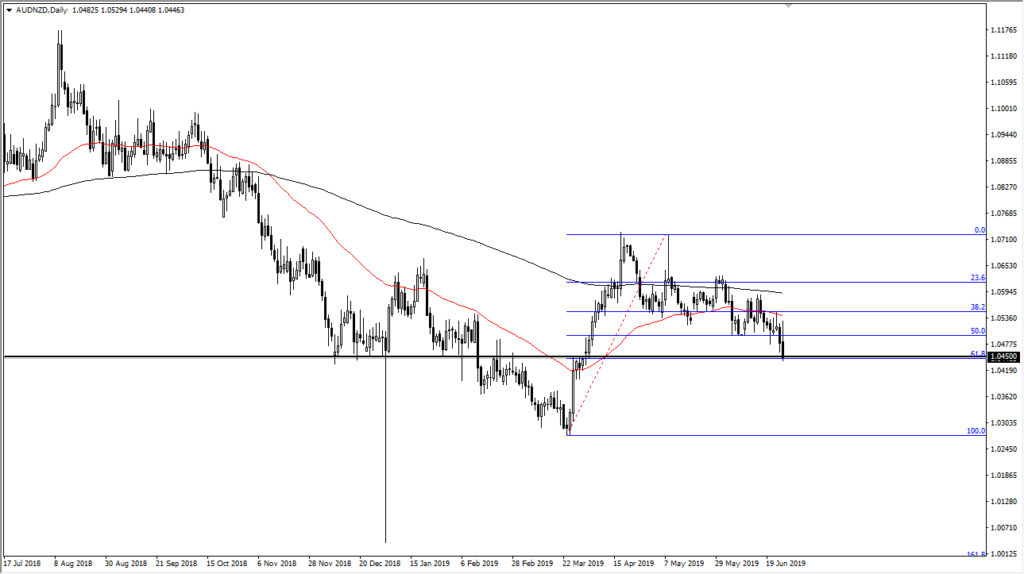

The Australian dollar initially rallied during the trading session on Wednesday, reaching towards the vital 50 day EMA, a technical signal that has held as resistance for some time. However, we have since had an interest rate statement from the Royal Bank of New Zealand, so therefore there was a lot of volatility. We pulled back from there to crash into the 61.8% Fibonacci retracement level.

Bearish candlestick

AUD/NZD chart

The candle stick for the day is very negative, as we initially tried to rally but then broke down rather significantly. Now that we are testing the 1.0450 level, a break down below there could send this market much lower, perhaps down to the 100% Fibonacci retracement level. Quite frankly, most of the time you break the 61.8% Fibonacci retracement level, we tend to wipe out the entire move.

Moving averages

The two most important moving averages that I follow, the 50 day EMA and the 200 day EMA, are both trending lower and therefore it makes sense that we continue to see sellers. Ultimately, to the upside it’s very likely that we would see selling pressure at either one of those levels. We are far below them though, so now when the candle stick formed a bit of an inverted hammer, a breakdown below that signifies even more selling pressure.

Aussie dollar

The Australian dollar is under serious pressure due to the US/China trade relations, and even though New Zealand is also sensitive to that, it’s nowhere near as sensitive as Australia’s. After all, the Australian economy is highly sensitive to that situation due to the fact that Australia export so much copper, gold, and other hard materials that facilitate construction and manufacturing. At this point, it looks very likely that the situation with the US and China isn’t going to get any better and that should continue to put downward pressure on the Aussie in general.

The play going forward

The obvious trade going forward is to short this market on a break of the lows for the Wednesday session. That gives us an opportunity to pick up a couple of handles, and therefore an excellent risk to reward ratio just waiting to happen. However, there is an alternate scenario that could play out as well, but that won’t present itself until the weekend.

If the United States and China come together with some type of positive statement or even a slight agreement, that should be good for the Australian dollar in general, and therefore it should rally from this important level. That being said, it’s hard to believe that people are going to be willing to hold the Australian dollar going into the weekend with any type of size. Beyond that, it seems as if a lot of people thought that the RBNZ was going to cut rates, and of course they didn’t – although they suggest that they will in the future. There may be a bit of rebalancing in favor of the Kiwi dollar, and therefore it provides even more bearish pressure.