Australian dollar gaining against Swiss franc

Understanding what currencies represent can quite often make a huge difference in your Forex trading results. In the AUD/CHF pair we have a bit of a “barometer for risk.” This is because the Australian dollar is highly levered to the Chinese economy, as well as many other Asian developing economies that produce goods for the rest of the world. This is because the Australian dollar represents Australia, which of course supplies most of Asia with its raw materials.

On the other side of the equation, you have the Swiss franc. Long thought of as strong, stable, and safe. Money flows into Switzerland when there are economic issues, and therefore it’s considered to be a “safety currency.” In other words, the great thing about this pair as it will tell you how the market “feels.” Not just this market, but the overall global markets.

Understand what you are looking at

The AUD/CHF pair represents how the markets overall are feeling about risk appetite. As the pair rises, that means that money is moving away from safety, and towards risk appetite based assets such as gold, copper, and of course the Australian dollar. If we fall in this pair, then that means that for the most part money is flowing into safety and away from those riskier assets.

As the market has been going back and forth for some time, this shows the attitude of global markets, which shouldn’t be much of a surprise. Although the US stock markets are doing well, we’ve seen a lot of mixed emotions when it comes to other parts of the world. That being said, we are in a nice range and that is something that should not be ignored.

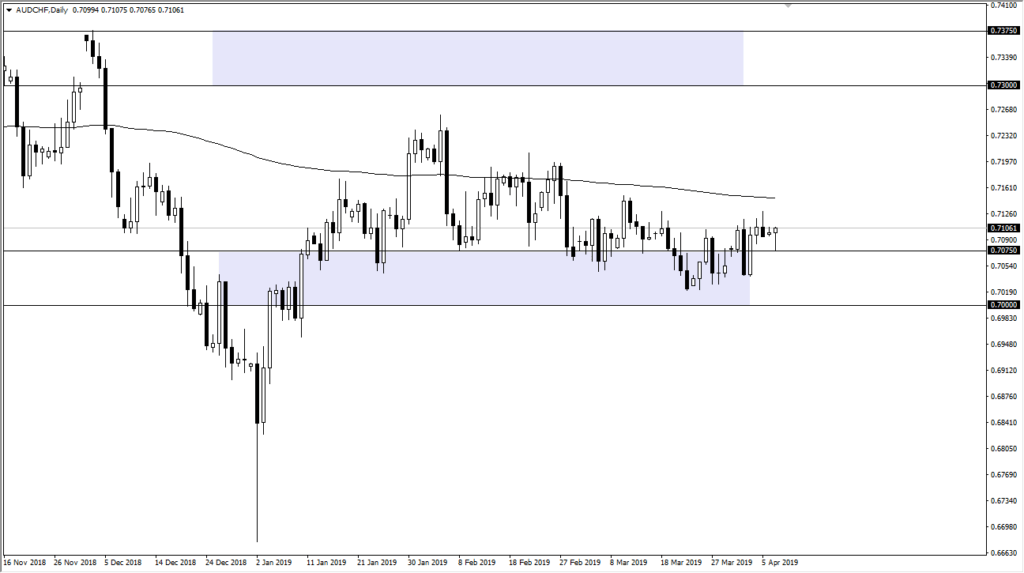

AUD/CHF daily

Bottom of the range

We are currently testing the bottom of the range, which is drawn as 0.70 on this chart, extending support all the way to the 0.75 handle. At the top of the range, we have the 0.73 level that extends to the 0.7375 level. As we are close to the bottom of the range, it makes sense the buyers would come back into the market and try to pick up a bit of value. As I write this article, we are forming a bit of a hammer, based upon the massive support level so it makes sense that perhaps other risk appetite markets are rising.

For example, gold markets have picked up a bit, just as silver has. Copper is doing fairly well, and perhaps this is either based upon some type of optimism, right around the US/China trade relations, or perhaps it’s just simply people trying to get some type of return in what is a low return environment when it comes to safety assets.

The main take away

As traders, we simply play the percentages. Looking at this chart, there’s much more room to go to the upside then there is the downside, so it makes sense that the odds favor a bounce. The 200 day EMA is just above, but if we can break above there it’s likely that the market will then go to the 0.73 handle over the longer-term. On the other hand, if we were to break down below the 0.70 level then obviously this market suddenly becomes one that you should sell.